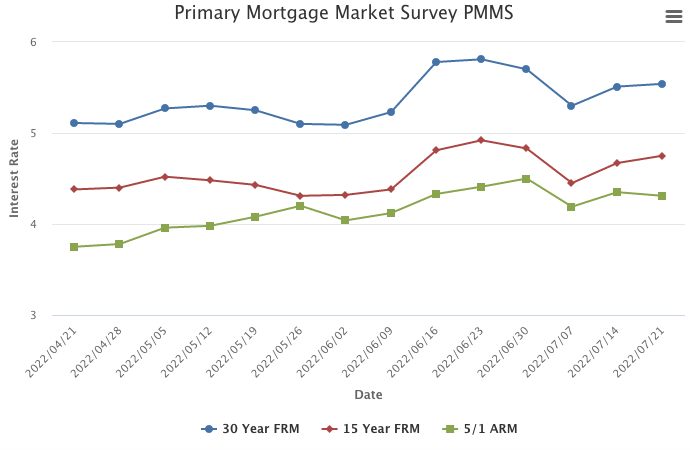

Mortgage Rates Continue to Fluctuate

July 28, 2022

Purchase demand continues to tumble as the cumulative impact of higher rates, elevated home prices, increased recession risk, and declining consumer confidence take a toll on homebuyers. It’s clear that over the past two years, the combination of the pandemic, record low mortgage rates, and the opportunity to work remotely spurred greater demand. Now, as the market adjusts to a higher rate environment, we are seeing a period of deflated sales activity until the market normalizes.

Information provided by Freddie Mac.

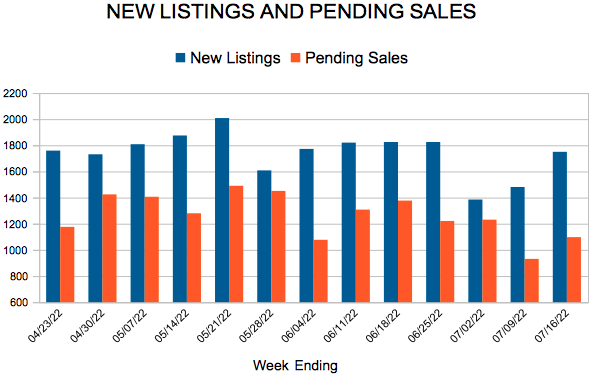

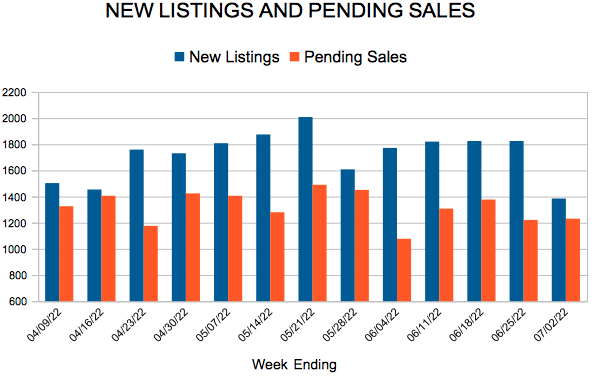

New Listings and Pending Sales

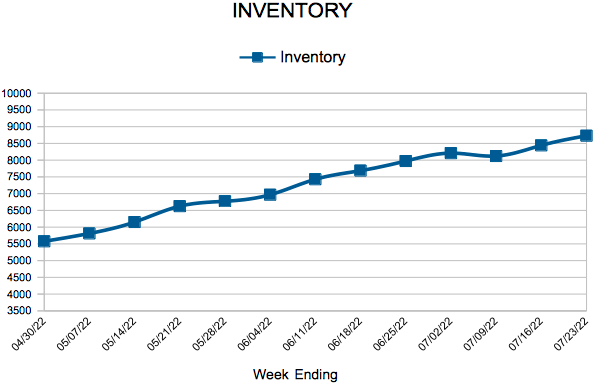

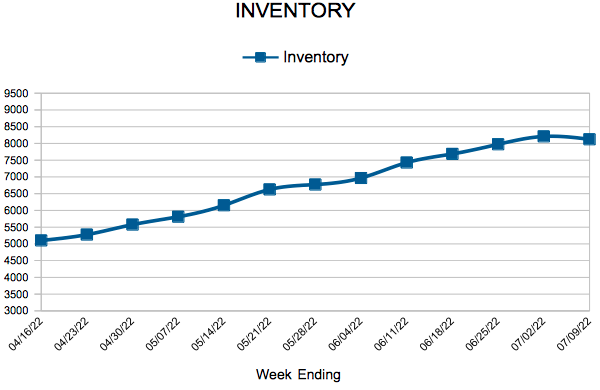

Inventory

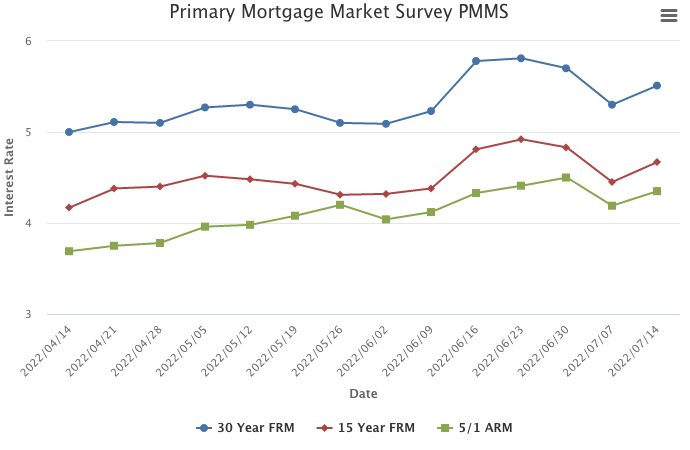

Mortgage Rates Continue to Inch Up

July 21, 2022

The housing market remains sluggish as mortgage rates inch up for a second consecutive week. Consumer concerns about rising rates, inflation and a potential recession are manifesting in softening demand. As a result of these factors, we expect house price appreciation to moderate noticeably.

Information provided by Freddie Mac.

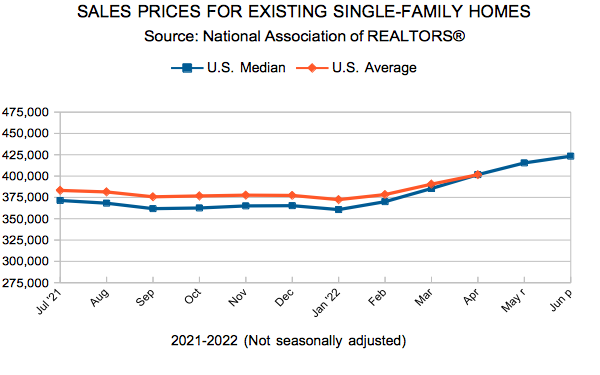

Existing Home Sales

New Listings and Pending Sales

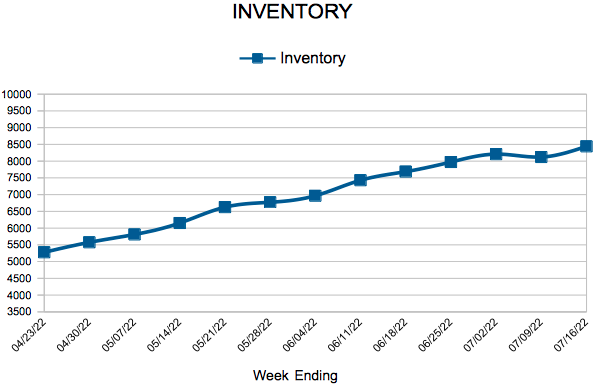

Inventory

Mortgage Rates Shift Upward

July 14, 2022

Mortgage rates are volatile as economic growth slows due to fiscal and monetary drags. With rates the highest in over a decade, home prices at escalated levels, and inflation continuing to impact consumers, affordability remains the main obstacle to homeownership for many Americans.

Information provided by Freddie Mac.