April 30, 2020

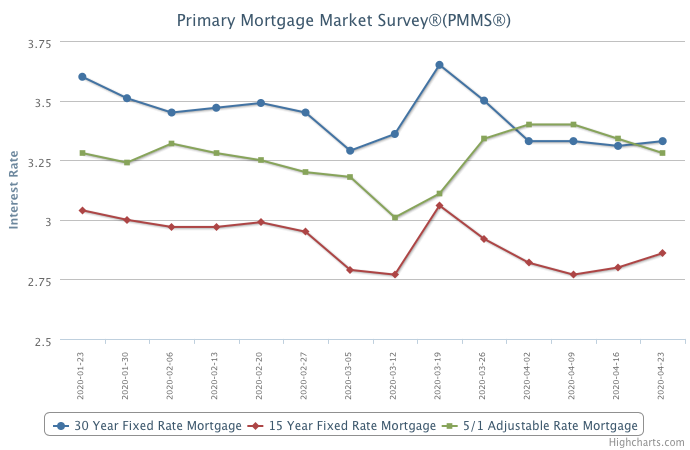

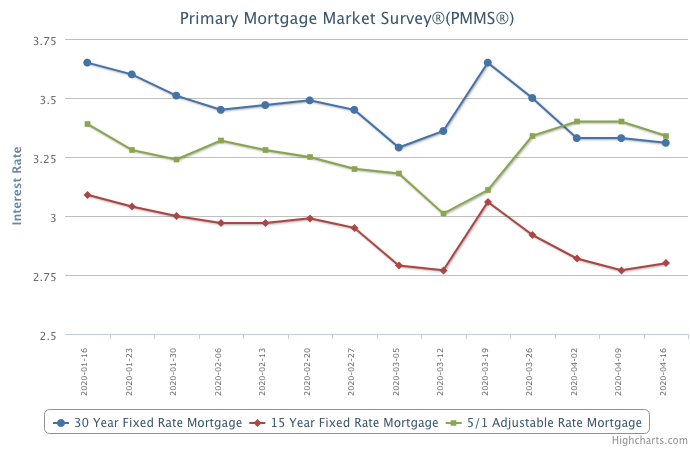

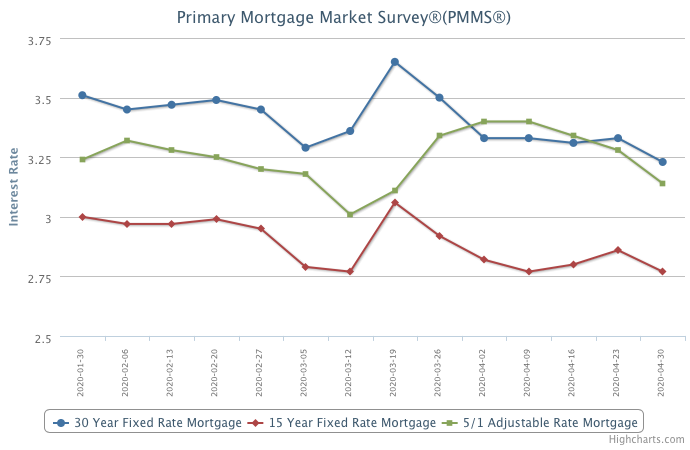

The size and depth of the secondary mortgage market is helping to keep rates at record lows. These low rates are driving higher refinance activity and have modestly helped improve purchase demand from their extremely low levels in mid-April. While many people are benefitting from low mortgage rates, it’s important to remember that not all people are able to take advantage of them given the current pandemic.

Information provided by Freddie Mac.