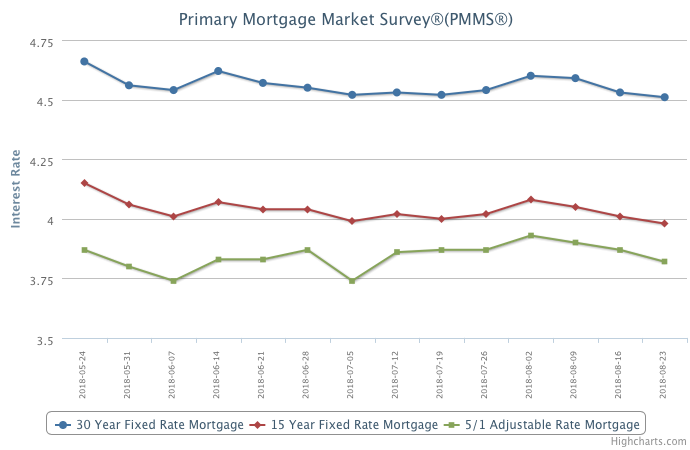

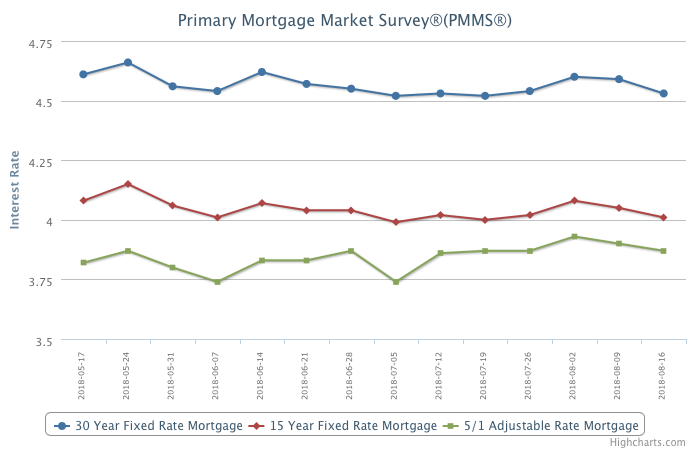

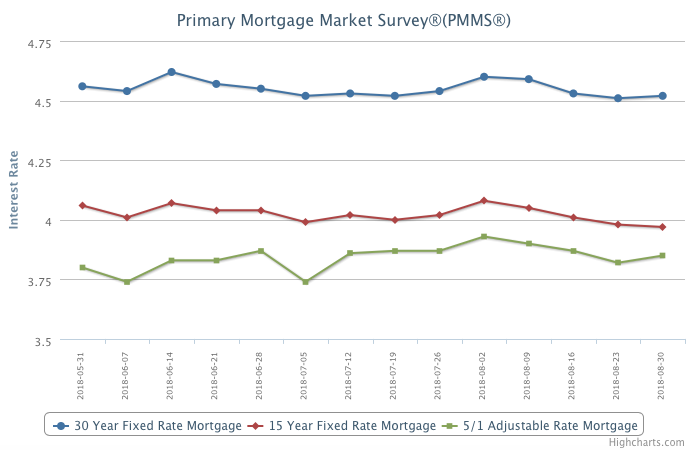

The 30-year fixed-rate mortgage barely inched up this week, continuing the summer trend of essentially being flat.

While sales and price growth have softened these last few months, this leveling of rates may be helping more buyers reach the market. Purchase mortgage applications this week were once again modestly above year ago levels.

Information provided by Freddie Mac.