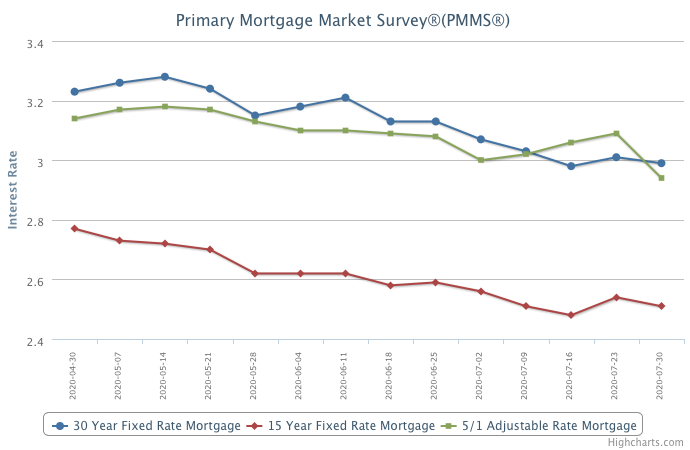

July 30, 2020

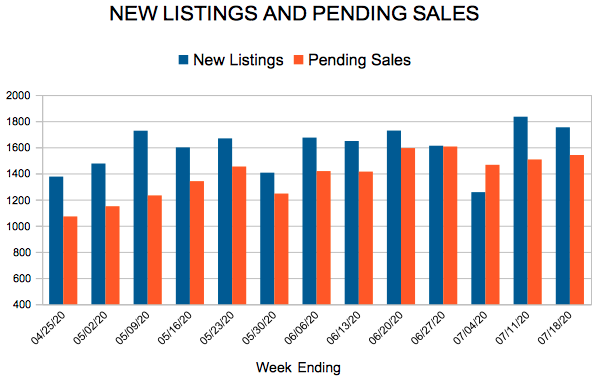

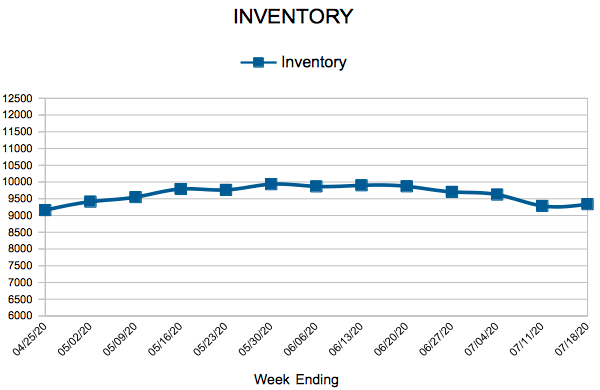

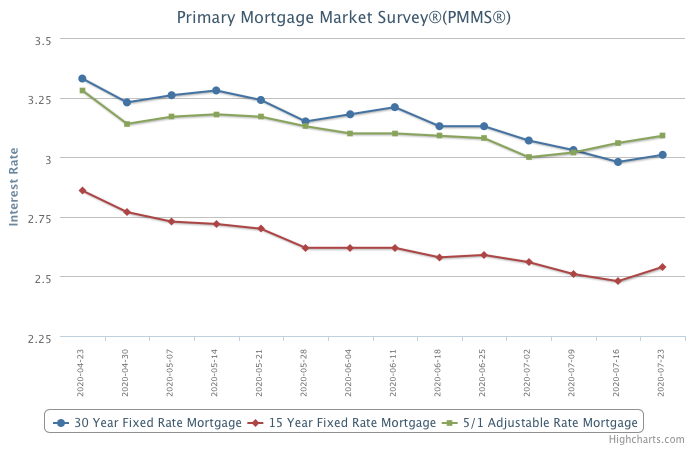

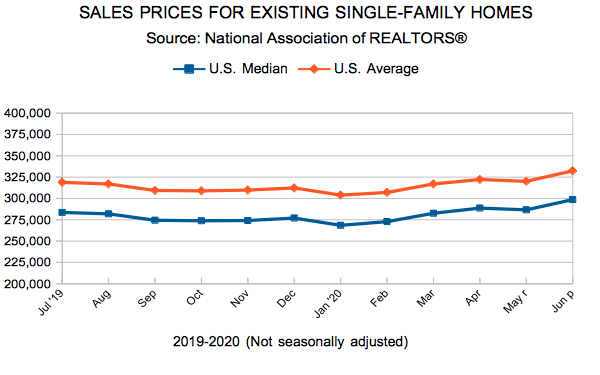

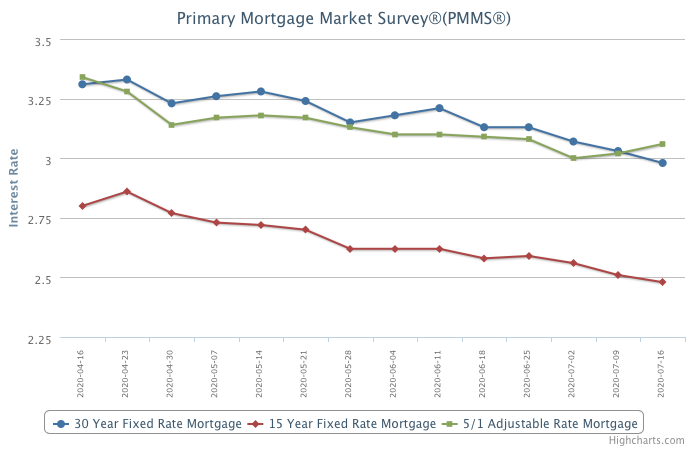

Rates continue to remain near historic lows, driving purchase demand over 20 percent above a year ago. Real estate is one of the bright spots in the economy, with strong demand and modest slowdown in home prices heading into the late summer. Home sales should remain strong the next few months into the early fall.

Information provided by Freddie Mac.