August 31, 2023

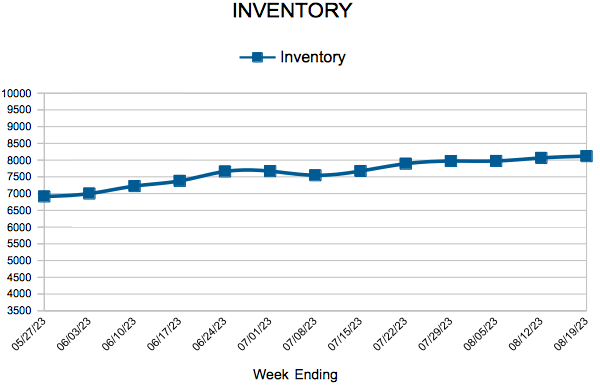

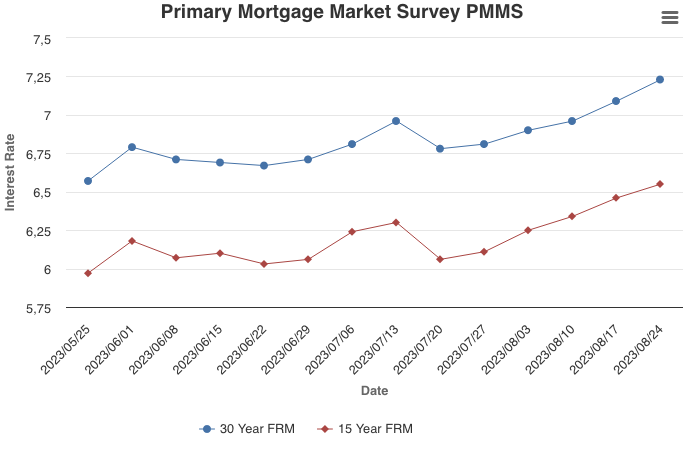

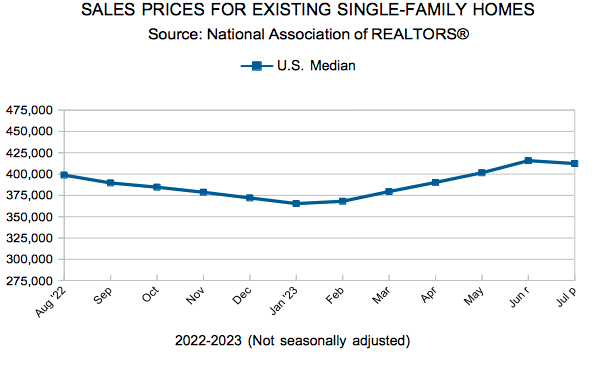

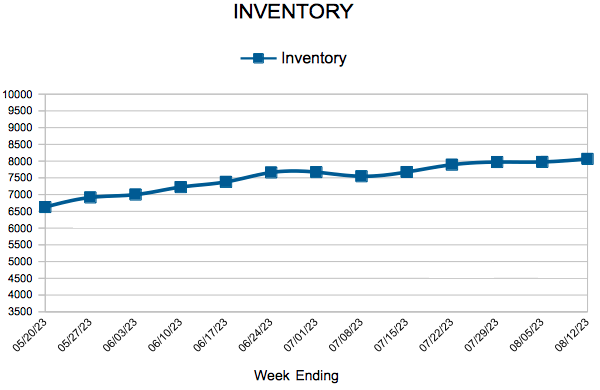

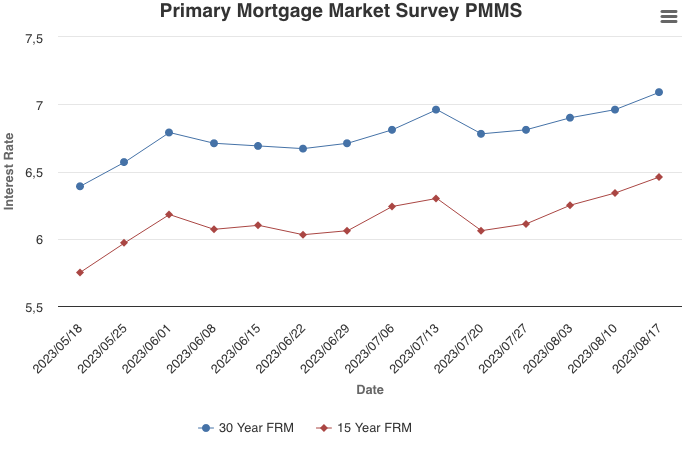

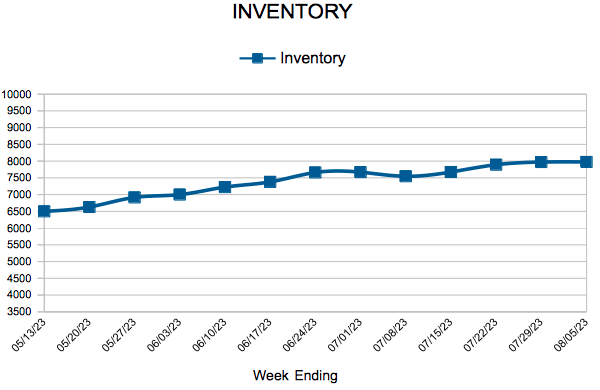

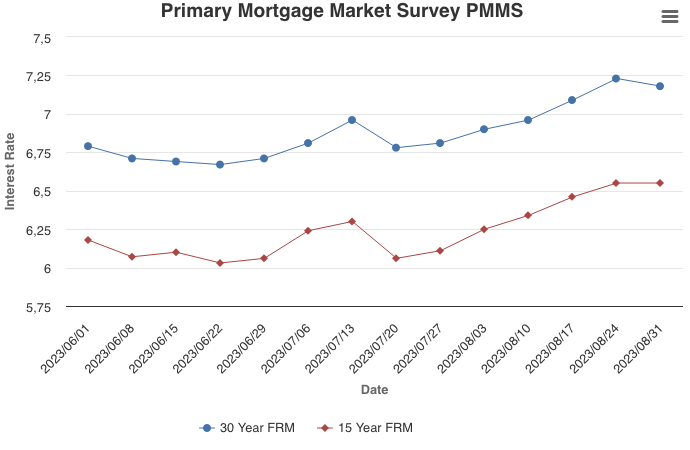

Mortgage rates leveled off this week but remain elevated. Despite continued high rates, low inventory is keeping house prices steady. Recent volatility makes it difficult to forecast where rates will go next, but it might be easier to gauge as the Federal Reserve determines their next steps regarding interest rate hikes in September.

Information provided by Freddie Mac.