Monthly Archives: December 2019

Inventory

Mortgage Rates, The Housing Bright Spot in 2019

December 26, 2019

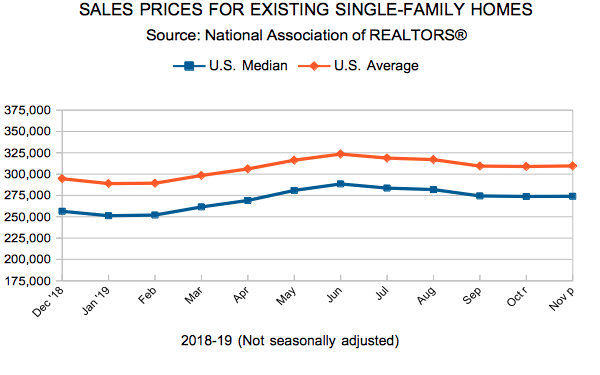

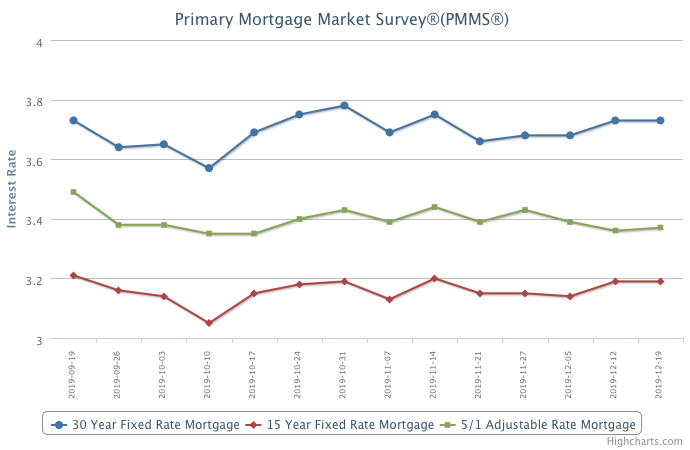

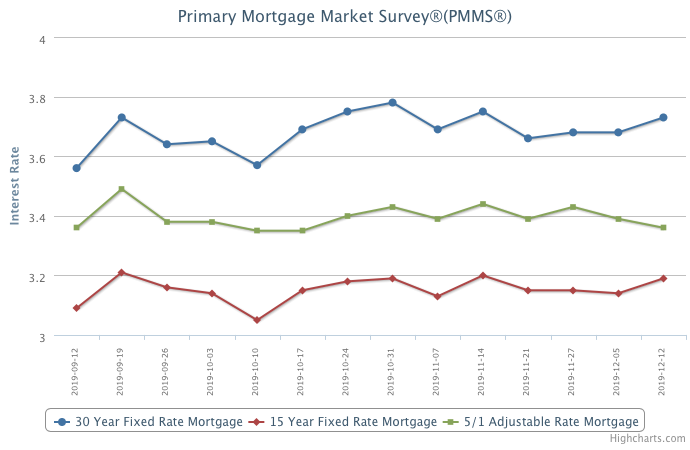

The 30-year fixed-rate mortgage rate saw little change again this week and averaged just 3.9% during 2019, the fourth lowest annual average since 1971 when Freddie Mac started its weekly survey.

Heading into 2020, low mortgage rates and the improving economy will be the major drivers of the housing market with steady increases in home sales, construction and home prices. While the outlook for the housing market is bright, worsening housing affordability is no longer a coastal phenomenon and is spreading to many interior markets and it is a threat to the continued recovery in housing and the economy.

Information provided by Freddie Mac.

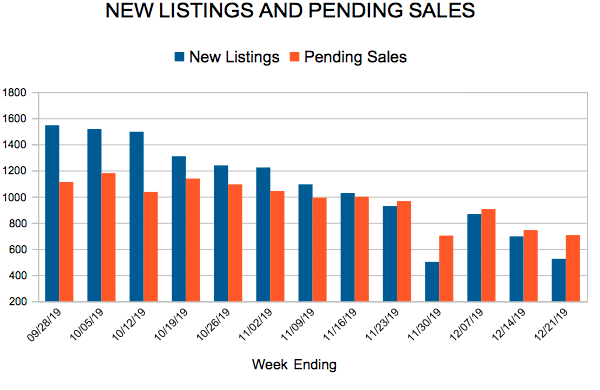

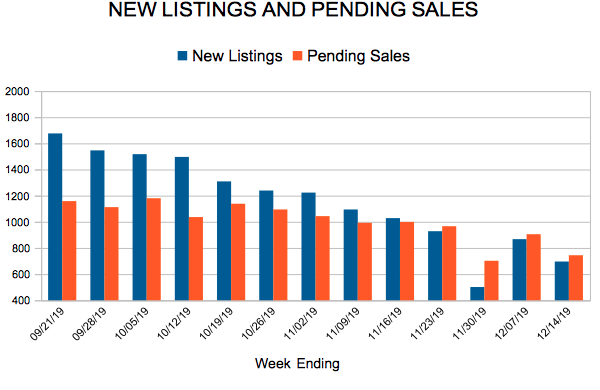

New Listings and Pending Sales

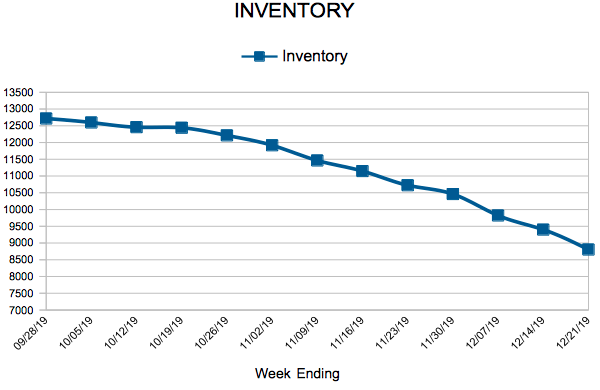

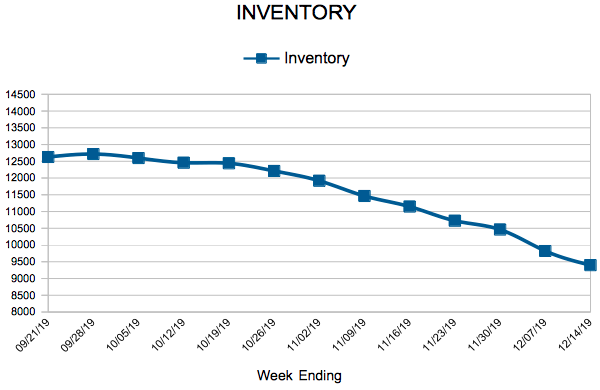

Inventory

Existing Home Sales

Mortgage Rates Remain Flat

December 19, 2019

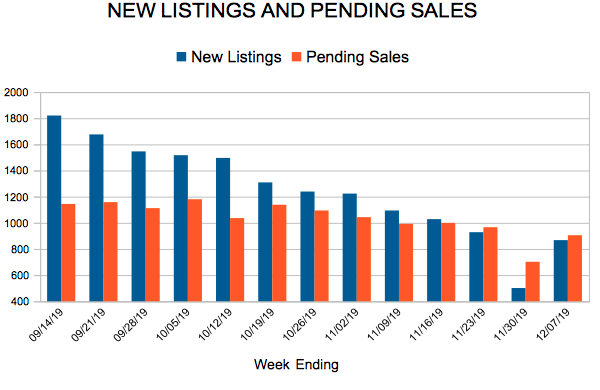

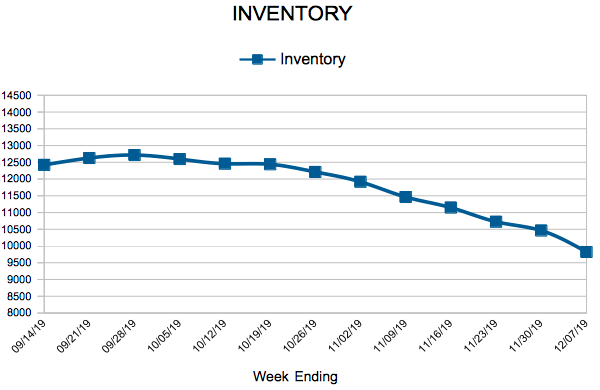

The economy continued to pick up momentum with a solid increase in residential construction, improvement in industrial output in our nation’s factories and a rise in job openings. While the economy is in a sweet spot, improvements in housing market sales volumes will be modest heading into next year simply due to the lack of available inventory. The demand is clearly not being met for entry-level Millennials and trade-up Generation X home buyers. If there was more inventory of unsold homes for buyers to choose from, home sales would be rising at a faster rate.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Mortgage Rates Tick Up

December 12, 2019

With Federal Reserve policy on cruise control and the economy continuing to grow at a steady pace, mortgage rates have stabilized as the market searches for direction. The risk of an economic downturn has receded and, combined with the very strong job market, it should lead to a slightly higher rate environment. Since early September, when mortgage rates posted the year low of 3.49 percent, rates have moved up to 3.73 percent this week. Often, while higher mortgage rates are deleterious, improved economic sentiment is the reason that these higher rates have not impacted mortgage demand so far.

Information provided by Freddie Mac.