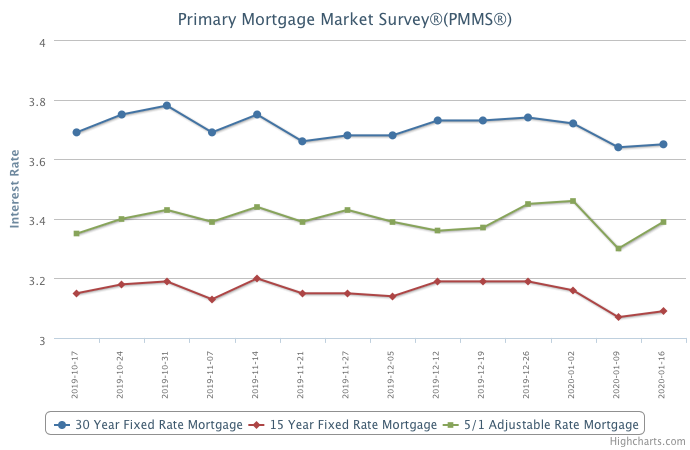

January 16, 2020

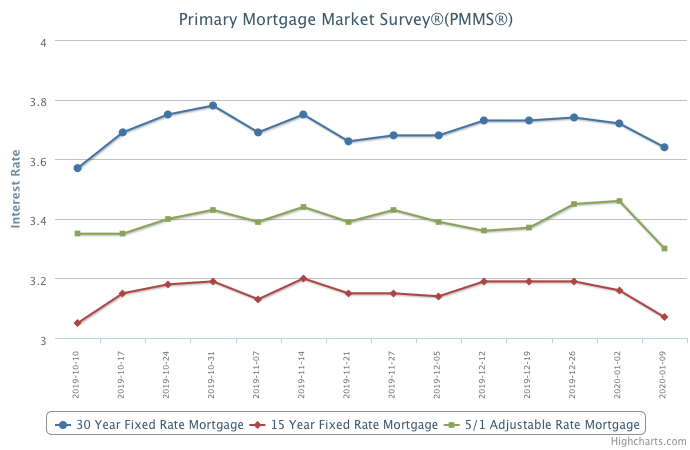

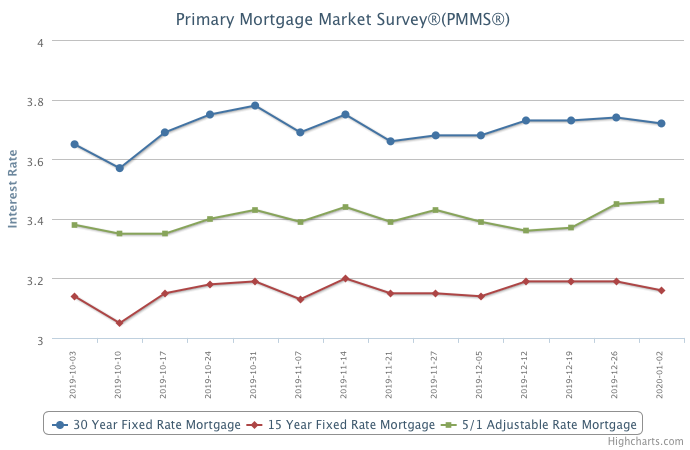

Mortgage rates inched up by one basis point this week with the 30-year fixed-rate mortgage averaging 3.65 percent. By all accounts, mortgage rates remain low and, along with a strong job market, are fueling the consumer-driven economy by boosting purchasing power, which will certainly support housing market activity in the coming months. While the outlook for the housing market is positive, worsening homeowner and rental affordability due to the lack of housing supply continue to be hurdles, and they are spreading to many interior markets that have traditionally been affordable.

Information provided by Freddie Mac.