Category Archives: Interest Rates

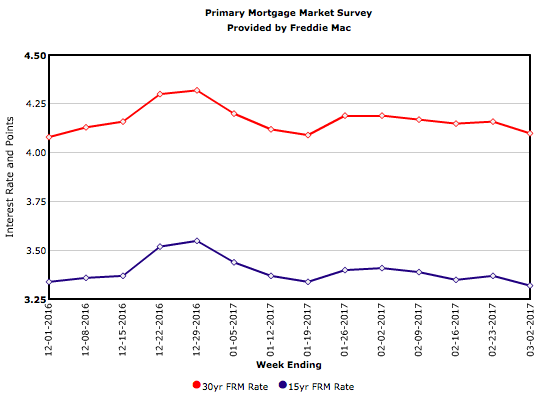

Uncertainty Causes Mortgage Rates to Hold

Mortgage Rates Continue Holding Pattern

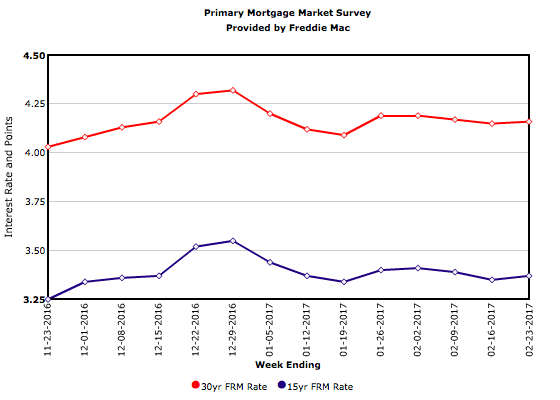

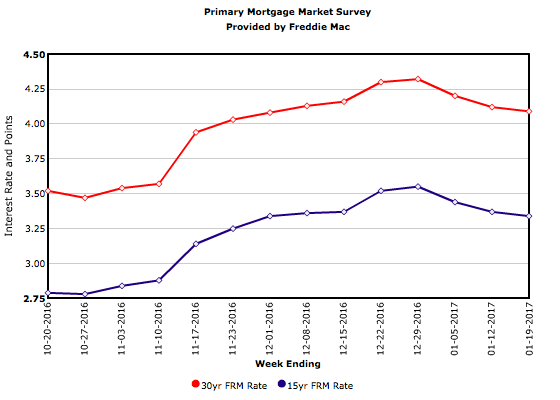

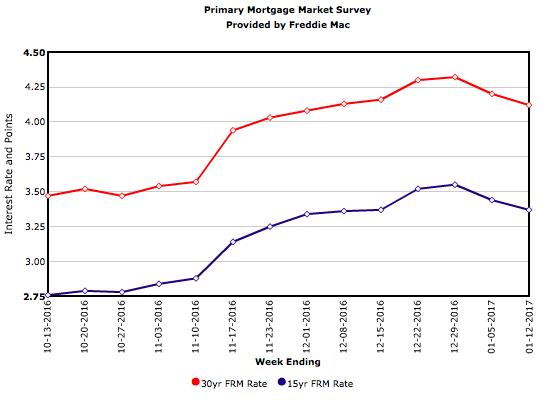

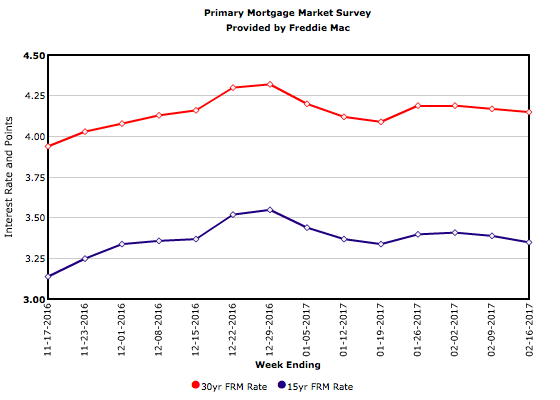

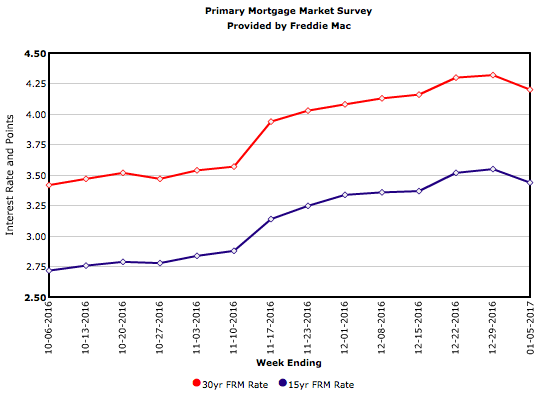

For the last 46 years, the 30-year mortgage rate has been almost perfectly correlated with the yield on the 10-year Treasury, but not this year. From Dec. 29, 2016, through today, the 30-year mortgage rate fell 17 basis points to this week’s reading of 4.15 percent. In contrast, the 10-year Treasury yield began and ended the same period at 2.49 percent. A year ago at this time, the 30-year FRM averaged 3.65 percent.

Mortgage Rates in Holding Pattern

The 30-year fixed mortgage fell two basis points to 4.17 percent this week. Rates are at about the same level at which they started the year and have stayed within a two basis point range over the past three weeks. Mixed economic releases such as Friday’s jobs report and uncertainty about the Administration’s fiscal policies have contributed to the holding pattern in rates.

Mortgage Rates Steady

Mortgage Rates Rise for First Time in 2017

Mortgage Rates Lower for Third Consecutive Week

Mortgage Rates Lower Again

Mortgage Rates Start the Year Lower

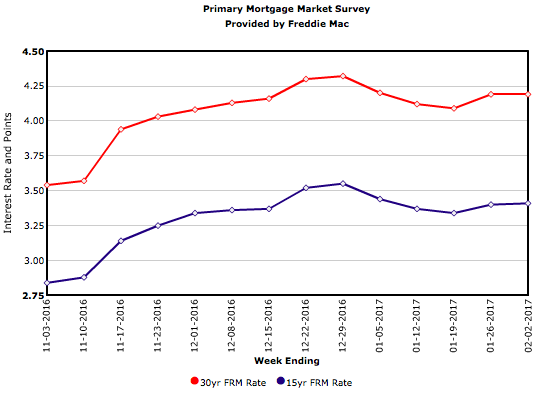

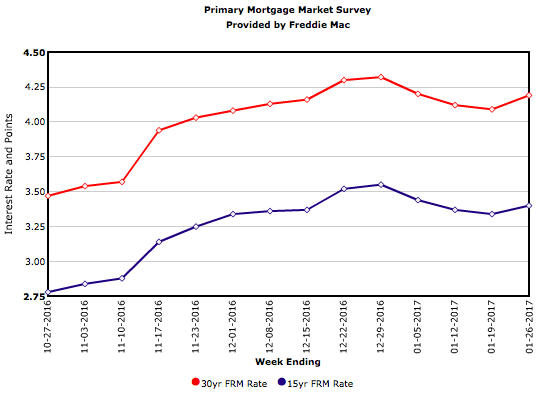

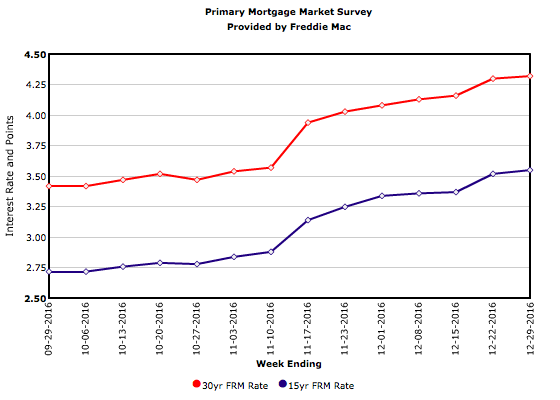

The 30-year mortgage rate fell this week for the first time since the presidential election, dropping 12 basis points to 4.20 percent. This marks the first time since 2014 that mortgage rates opened the year above 4 percent. Despite this week’s breather, the 66-basis point increase in the mortgage rate since November 3, is taking its toll–the MBA’s refinance index plunged 22 percent this week.