November 21, 2018

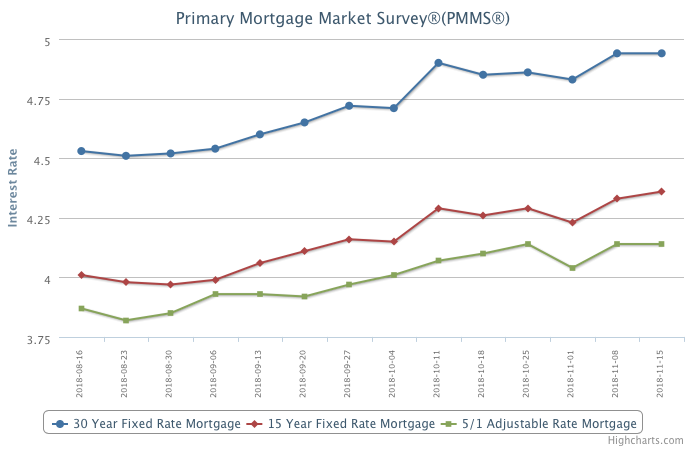

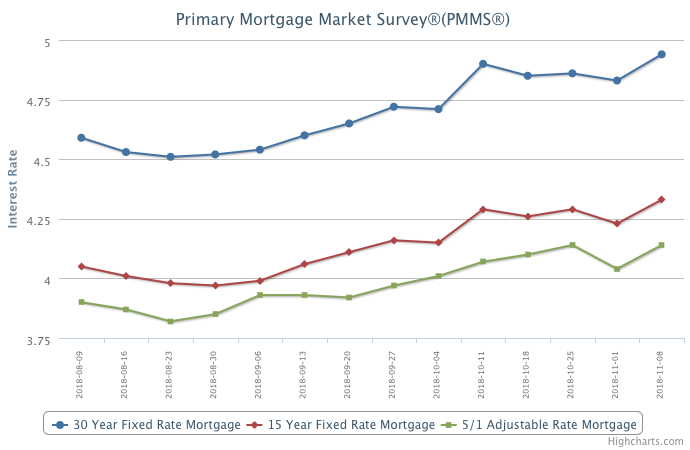

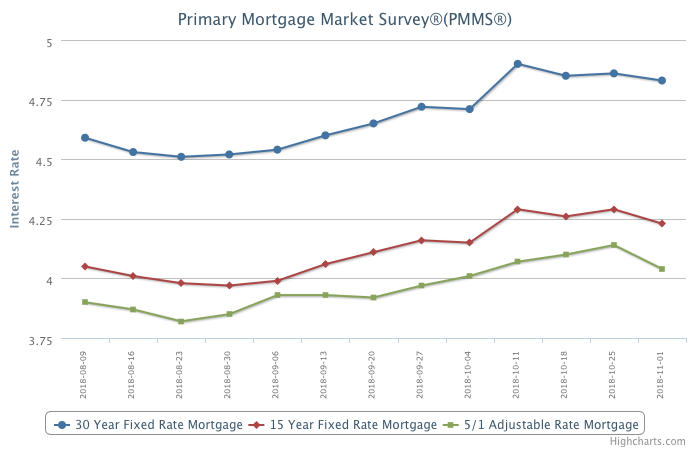

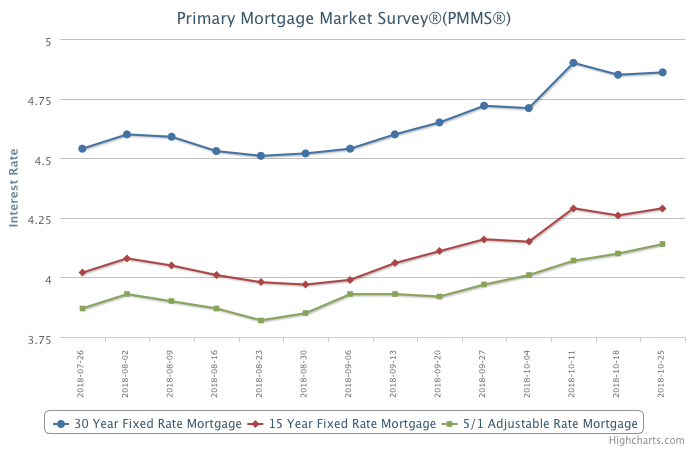

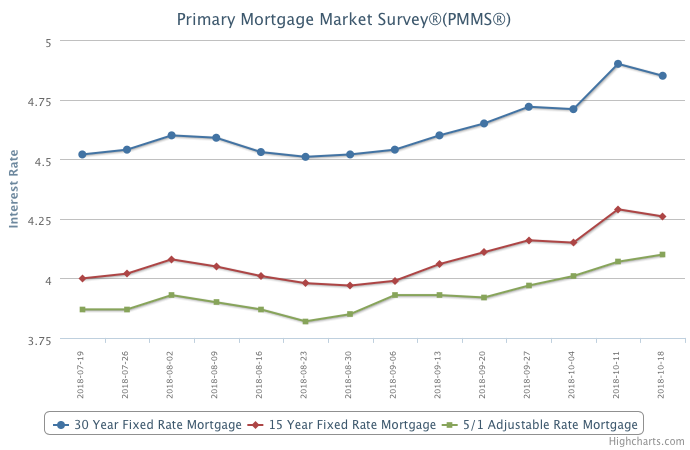

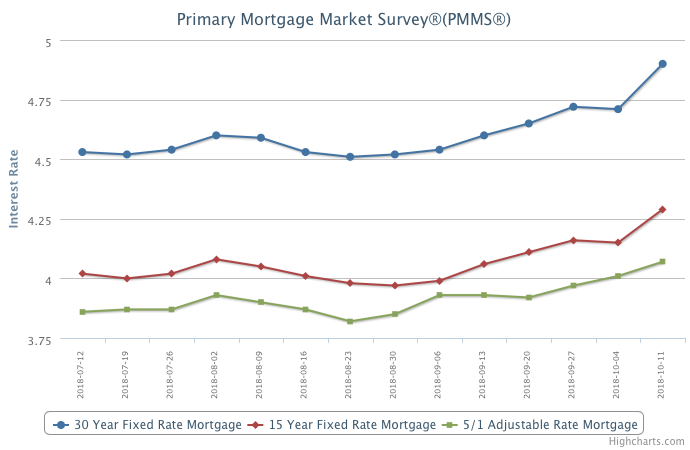

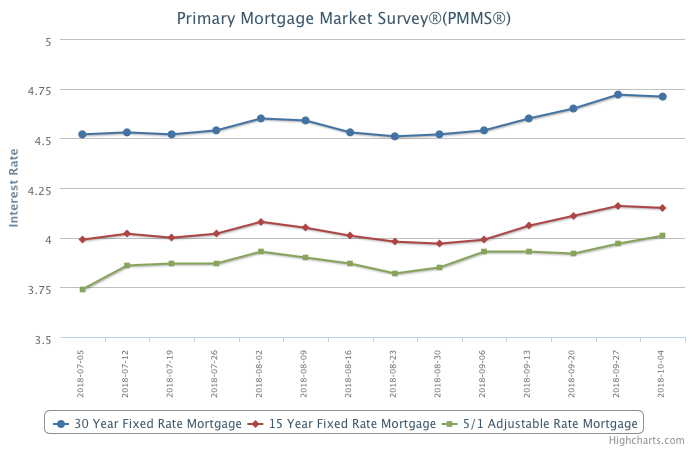

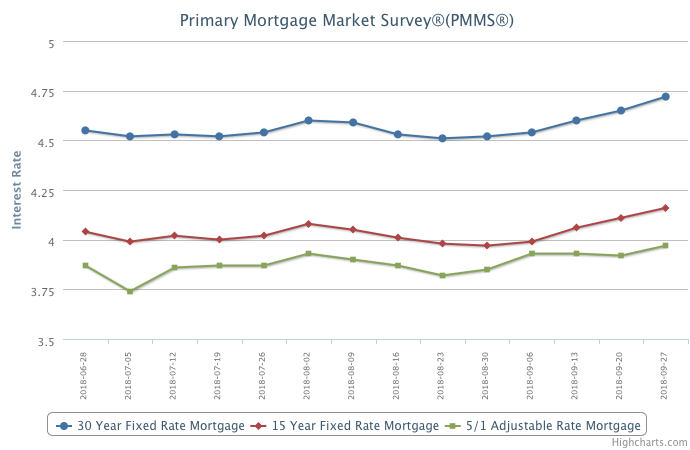

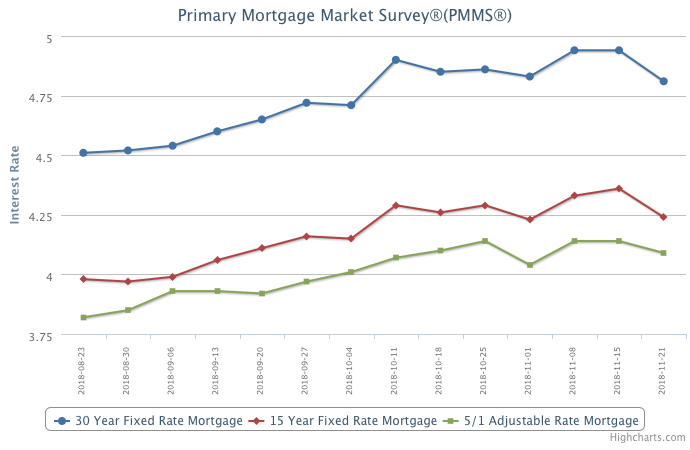

The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81 percent, the largest weekly drop since January 2015. Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.

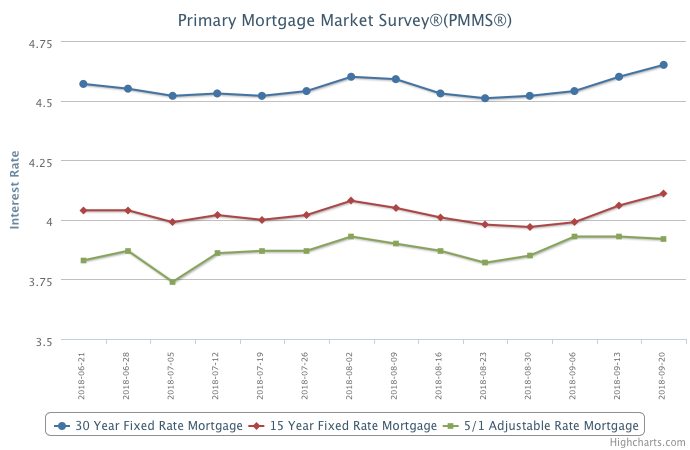

Information provided by Freddie Mac.