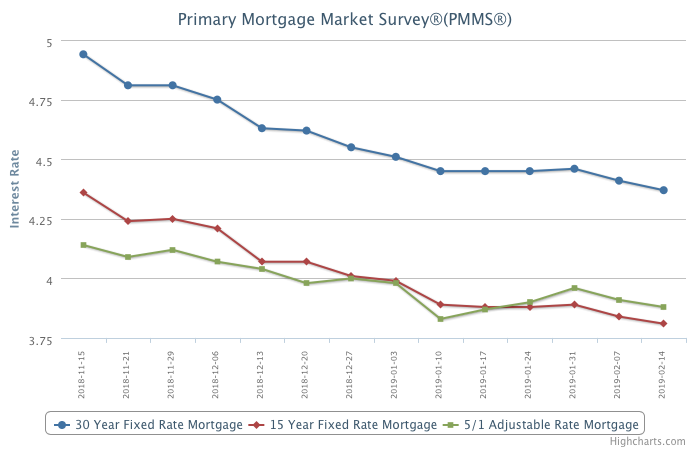

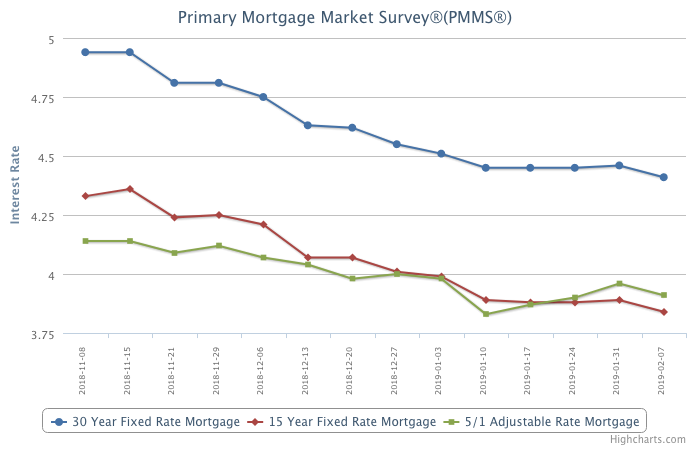

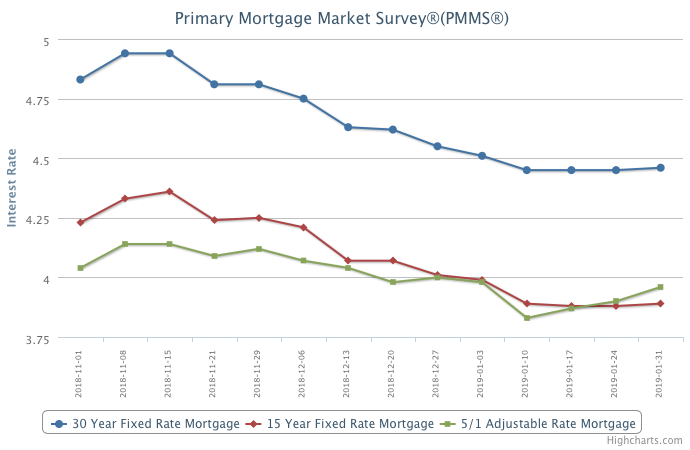

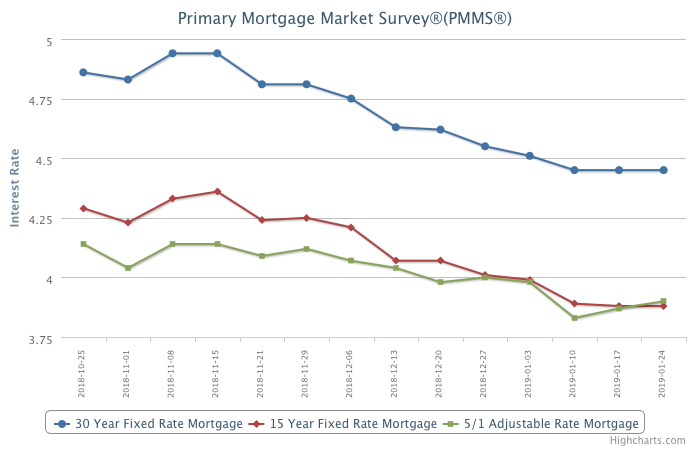

February 21, 2019

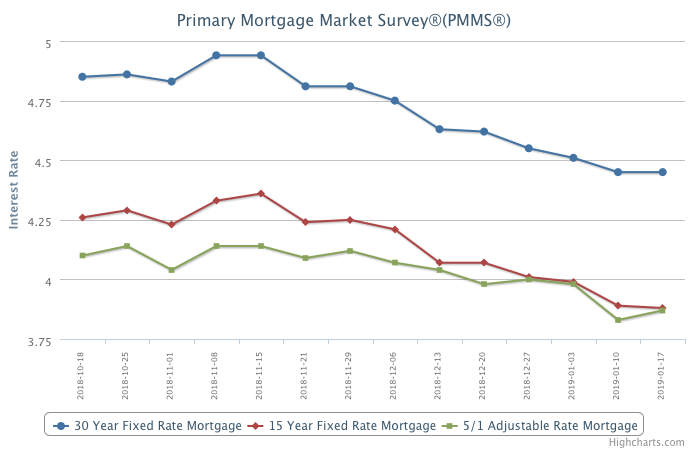

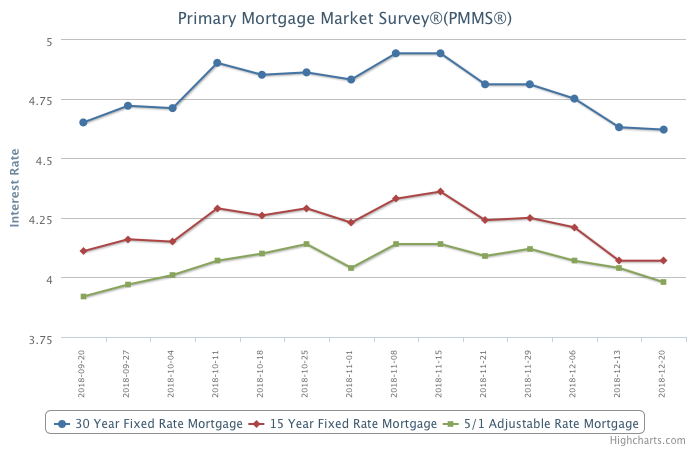

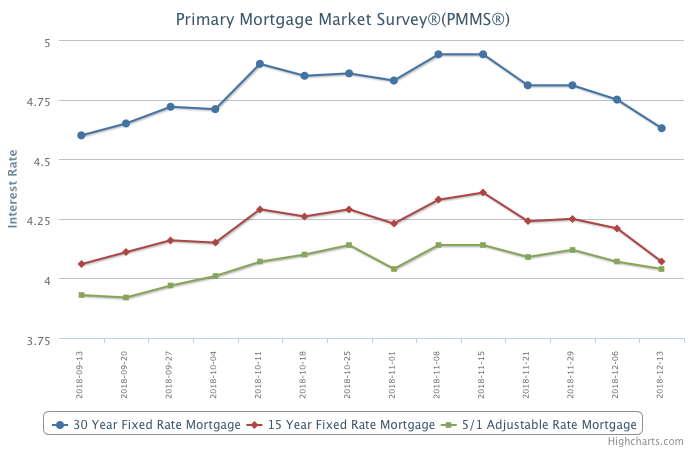

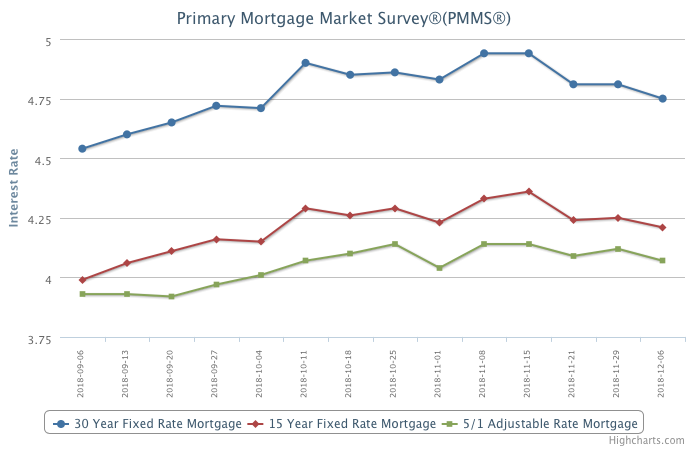

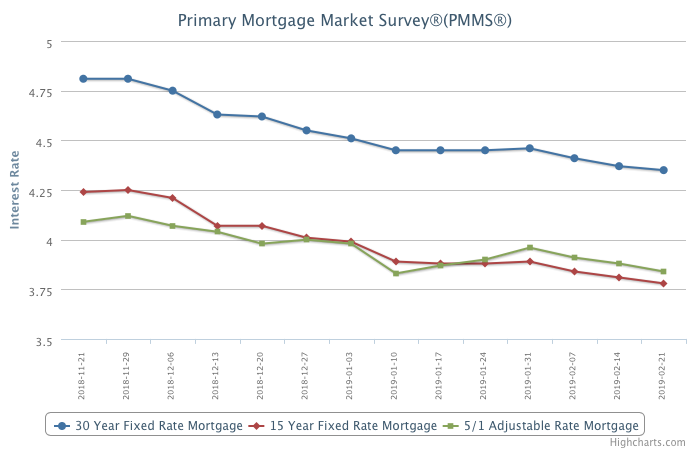

Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year. Wages are growing on par with home prices for the first time in years, and with more inventory available, spring home sales should help the market begin to recover from the malaise of the last few months.

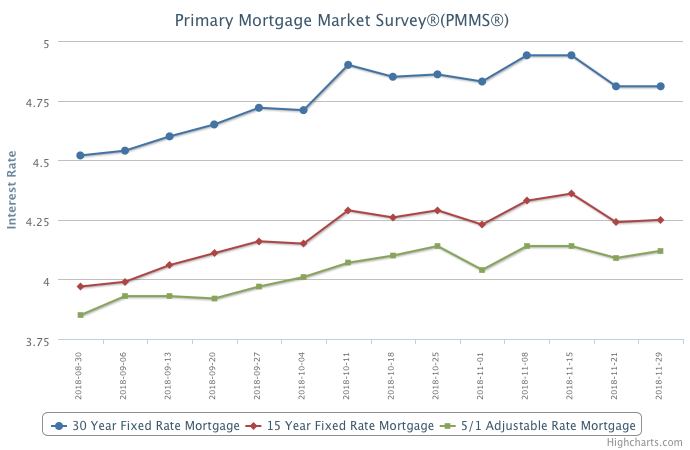

Information provided by Freddie Mac.