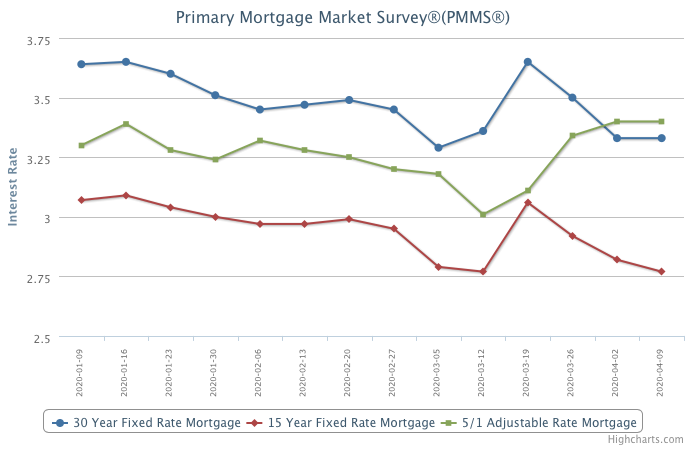

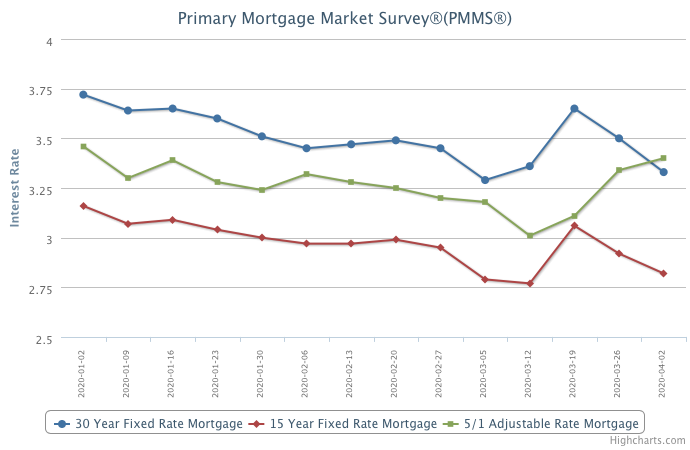

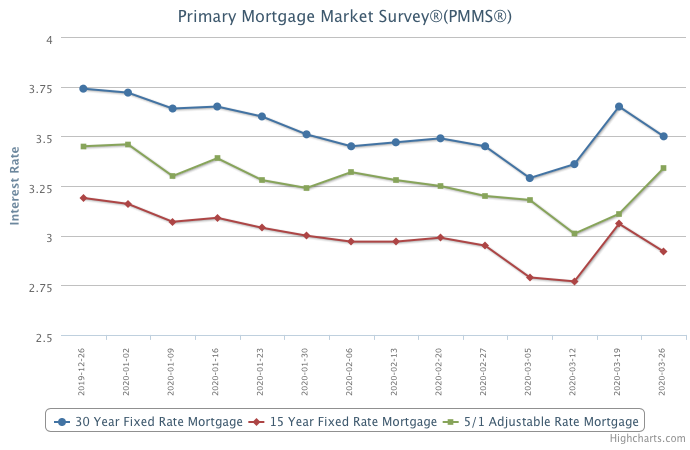

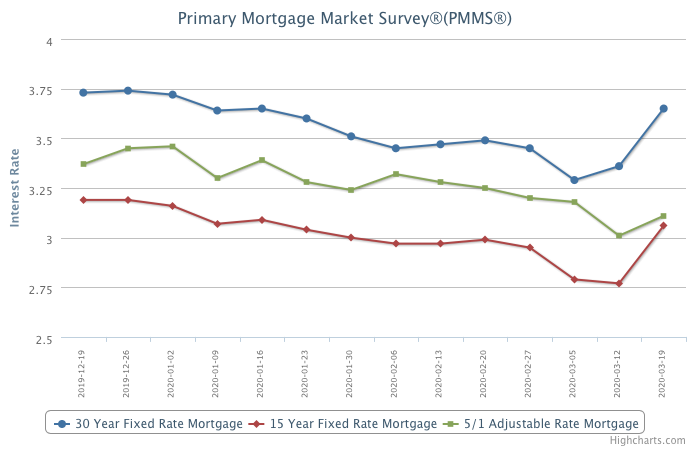

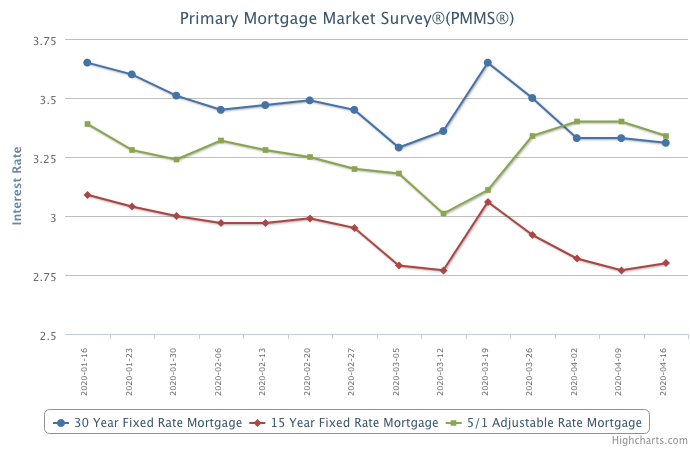

April 16, 2020

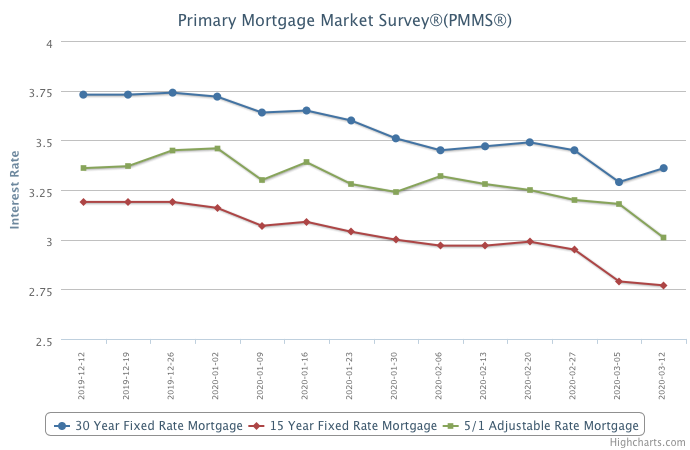

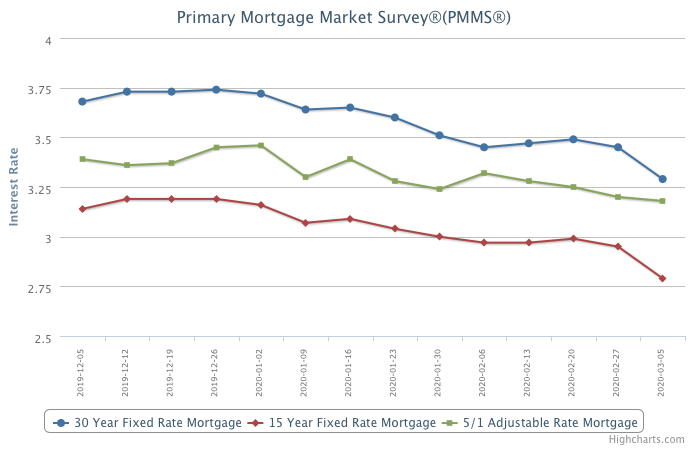

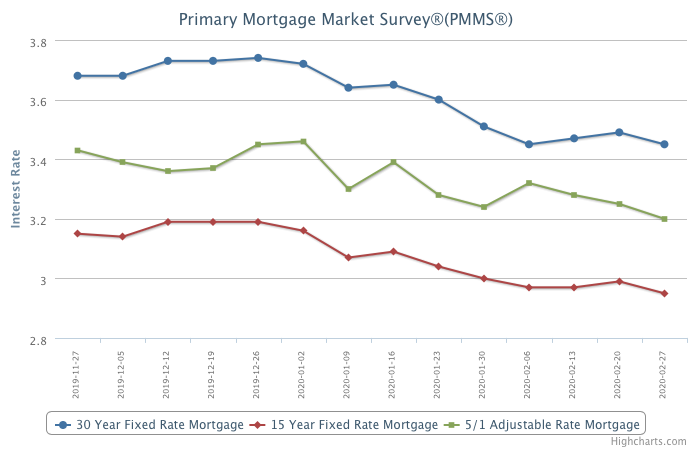

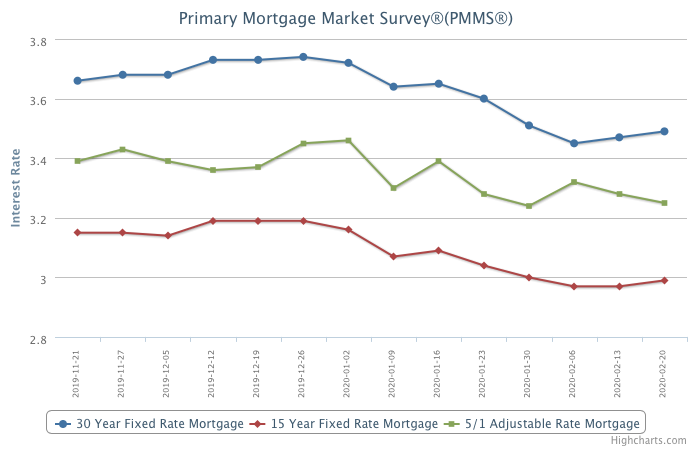

Mortgage rates continue to hover near all-time lows for the third straight week. As a result, refinance activity remains high, but home purchase demand is weak due to economic tightening. While new monthly economic data are driving markets lower this week, they are a lagging indicator and should be priced in already. Real time daily economic activity metrics suggest that the economy will likely not decline much further. Going forward, the key question is no longer the depth of the economic contraction, but the duration.

Information provided by Freddie Mac.