Author Archives: admin

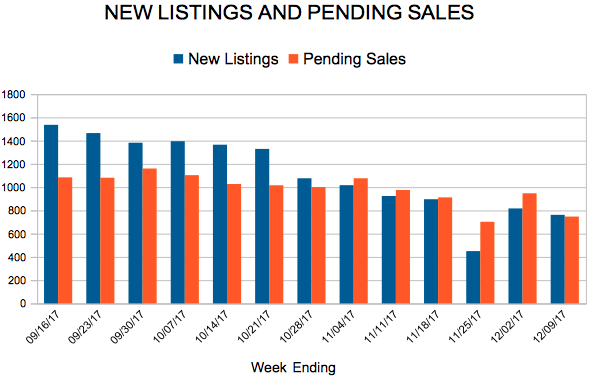

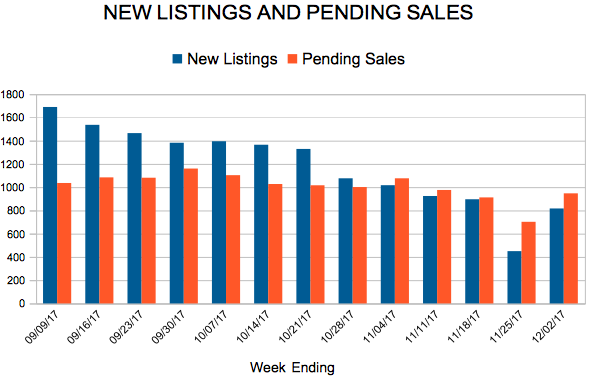

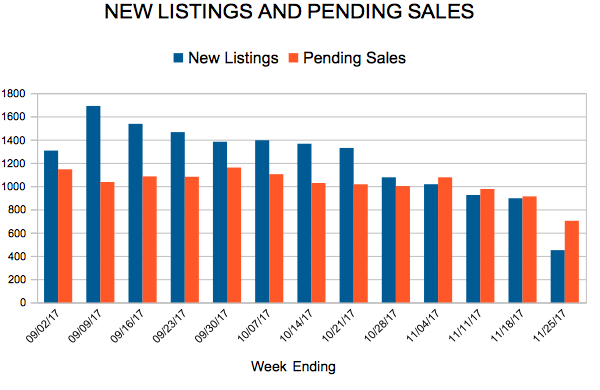

New Listings and Pending Sales

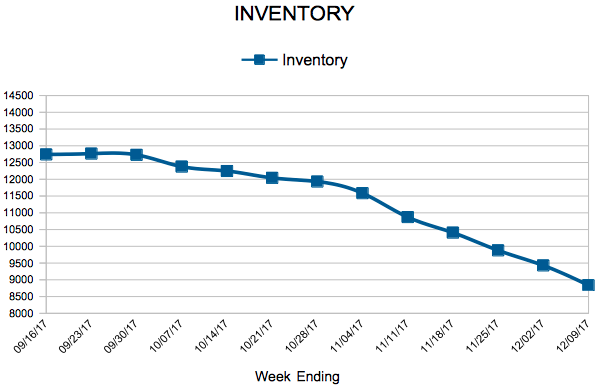

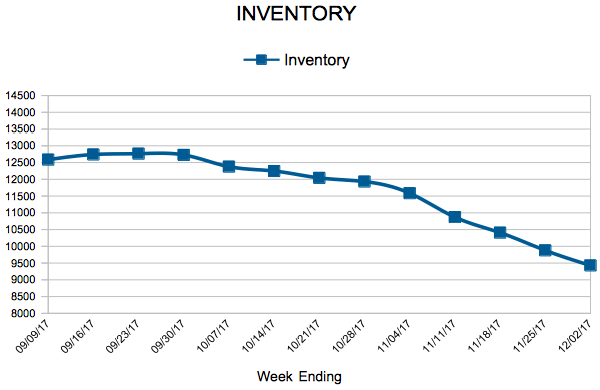

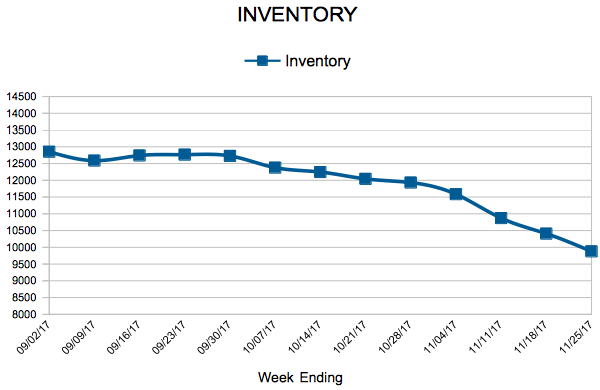

Inventory

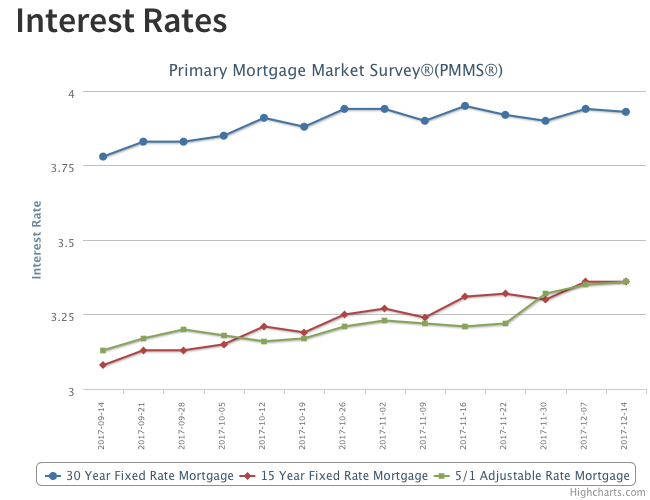

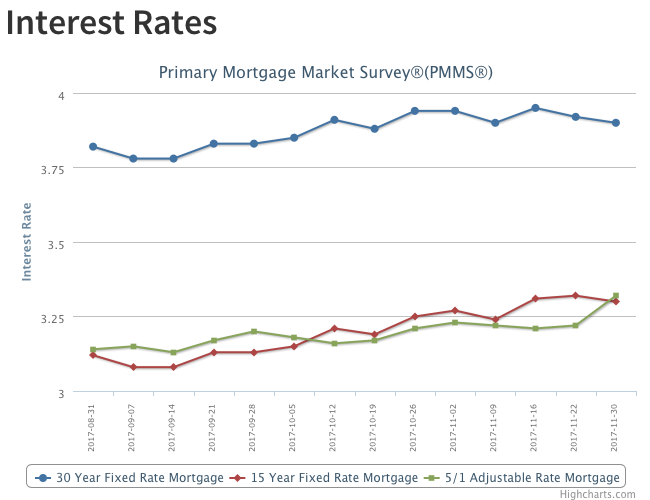

Mortgage Rates Little Changed

As widely expected, the Fed increased the federal funds target rate this week for the third time in 2017. The market had already priced in the rate hike so long-term interest rates, including mortgage rates, hardly moved. Mortgage rates have been in a holding pattern for the fourth quarter, remaining within a 10 basis point range since October.

New Listings and Pending Sales

Inventory

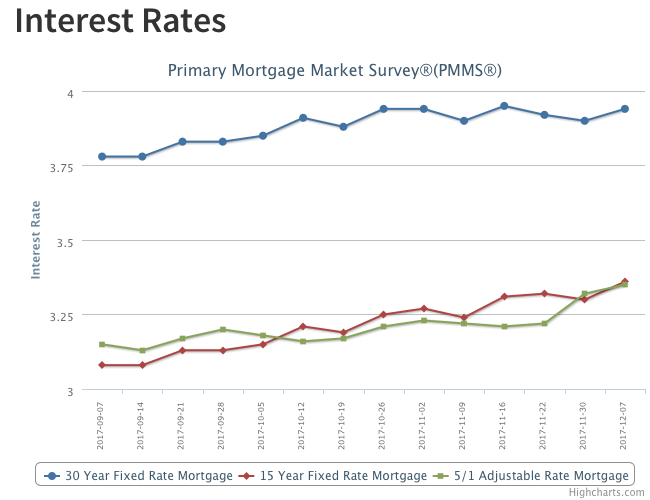

Rates Rise Across the Board

This week’s survey reflects last week’s uptick in long-term interest rates, with the 30-year fixed mortgage rate up 4 basis points to 3.94 percent. The 30-year mortgage rate has been bouncing around in a 10 basis point range since September.

While long-term rates have been relatively steady week-to-week, shorter term interest rates have been on the rise. The spread between the 30-year fixed mortgage and the 5/1 Hybrid ARM rate was 59 basis points this week, down 43 basis points from earlier this year. With a narrower spread between fixed and adjustable mortgage rates, more borrowers are opting for a fixed product.

New Listings and Pending Sales

Inventory

Mortgage Rates Inch Lower

The market implied probability of a Fed rate hike in December neared 100 percent, helping to drive short term interest rates higher. The 5/1 Hybrid ARM, which is more sensitive to short-term rates than the 30-year fixed mortgage, increased 10 basis points to 3.32 percent in this week’s survey. The spread between the 30-year fixed mortgage and 5/1 Hybrid ARM is just 58 basis points this week, the lowest spread since November of 2012.