Author Archives: admin

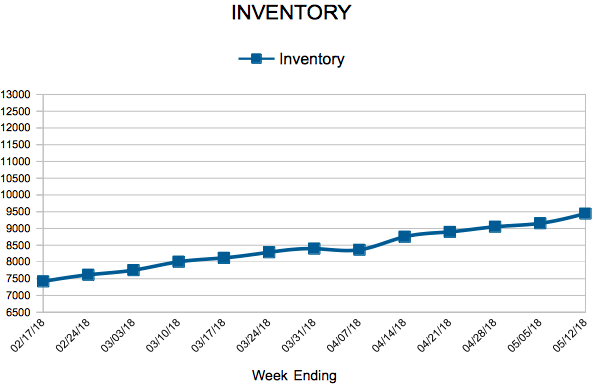

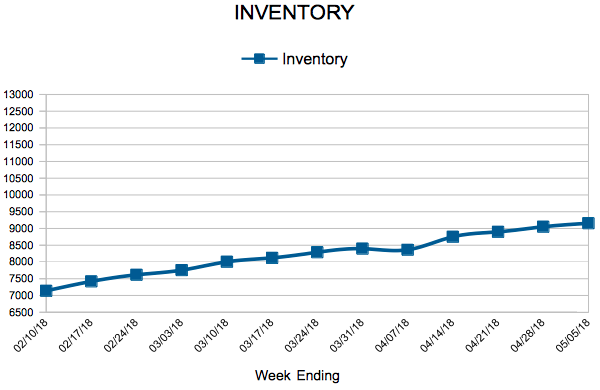

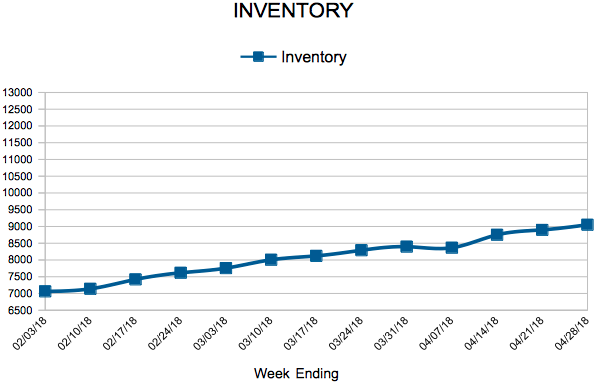

Inventory

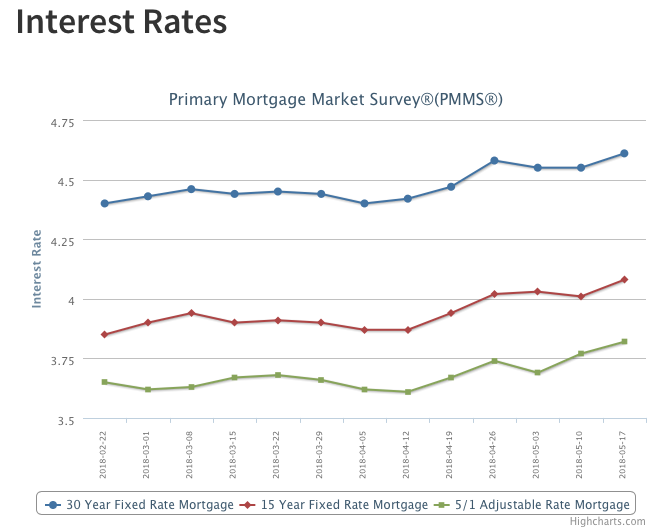

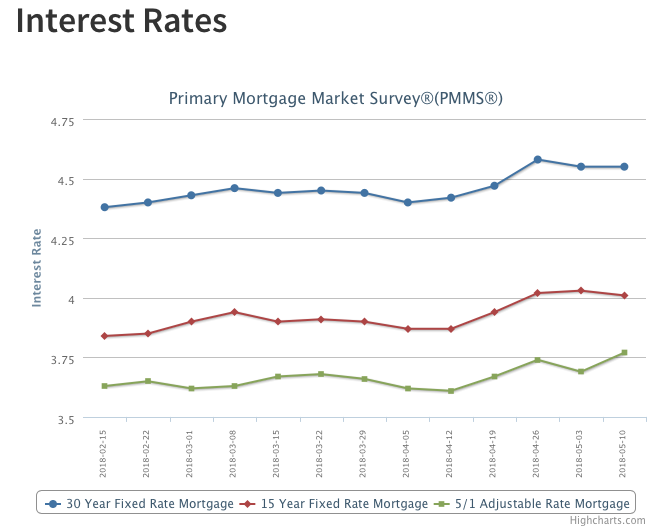

Mortgage Rates Move Up to Highest Level in Seven Years

After plateauing in recent weeks, mortgage rates reversed course and reached a new high last seen eight years ago. The 30-year fixed mortgage rate edged up to 4.61 percent, which matches the highest level since May 19, 2011. Healthy consumer spending and higher commodity prices spooked the bond markets and led to higher mortgage rates over the past week. Not only are buyers facing higher borrowing costs, gas prices are currently at four-year highs just as we enter the important peak home sales season.

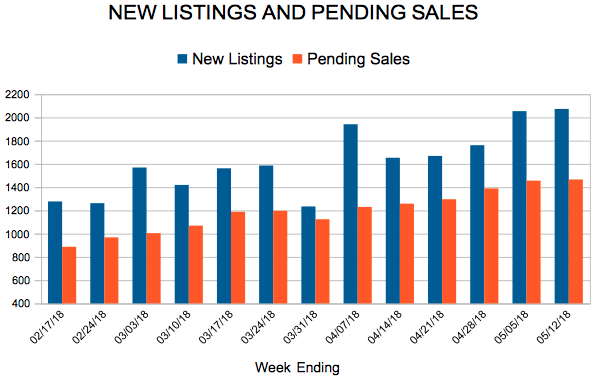

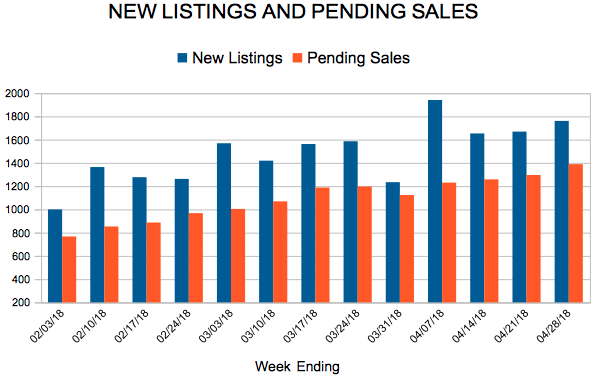

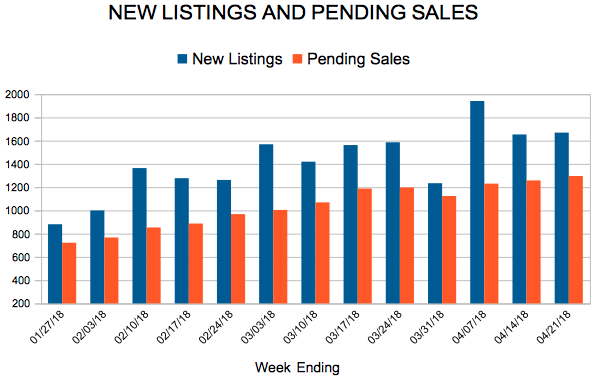

New Listings and Pending Sales

Inventory

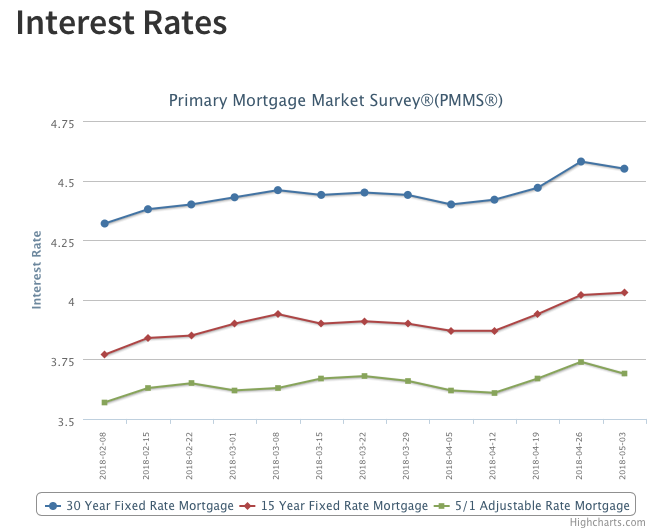

Mortgage Rates Level Out

The 30-year fixed mortgage rate remained at 4.55 percent over the past week. The minimal movement of mortgage rates in these last three weeks reflects the current economic nirvana of a tight labor market, solid economic growth and restrained inflation. While this year’s higher rates – up 50 basis points from a year ago – have put pressure on the budgets of some home shoppers, weak inventory levels are what’s keeping the housing market from a stronger sales pace.

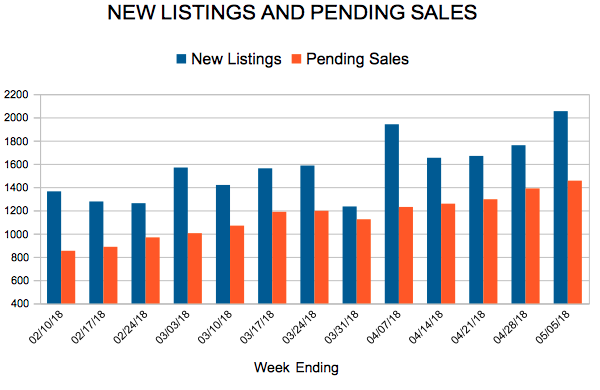

New Listings and Pending Sales

Inventory

Mortgage Rates See Modest Decline

After steadily rising in most of April, average mortgage rates dipped slightly over the past week. The 30-year fixed mortgage rate declined three basis points to 4.55 percent in this week’s survey. While mortgage rates have increased by one-half of a percentage point so far this year, it has not impacted home purchase demand, which continues to grow this spring. The observed buyer resiliency in the face of higher rates reflects the healthy economy and strong consumer confidence, which are important drivers of home sales activity.