Author Archives: admin

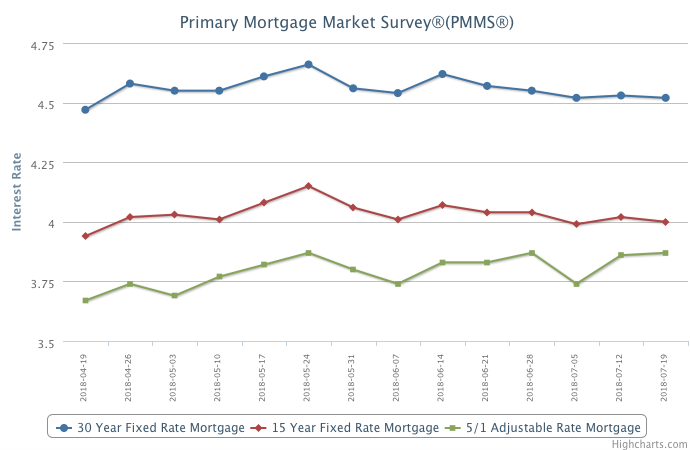

Mortgage Rates Barely Move

Mortgage rates were once again mostly flat over the past week, inching backward slightly.

Manufacturing output and consumer spending showed improvements, but construction activity was a disappointment. This meant there was no driving force to move mortgage rates in any meaningful way, which has been the theme in the last two months. That’s good news for price sensitive home shoppers, given that this stability in borrowing costs allows them a little extra time to find the right home.

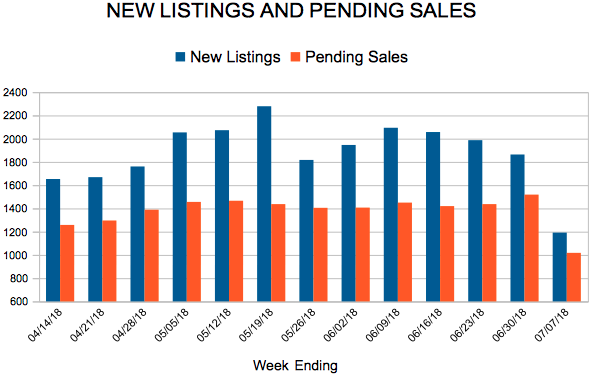

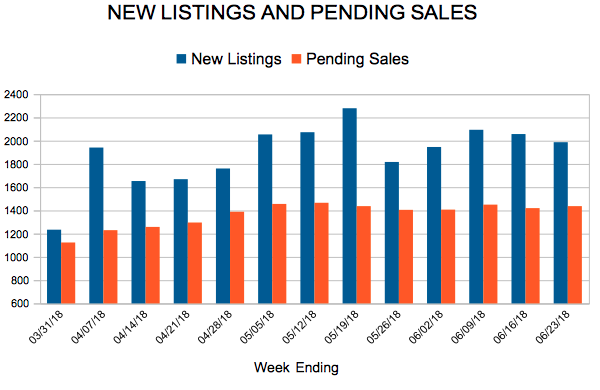

New Listings and Pending Sales

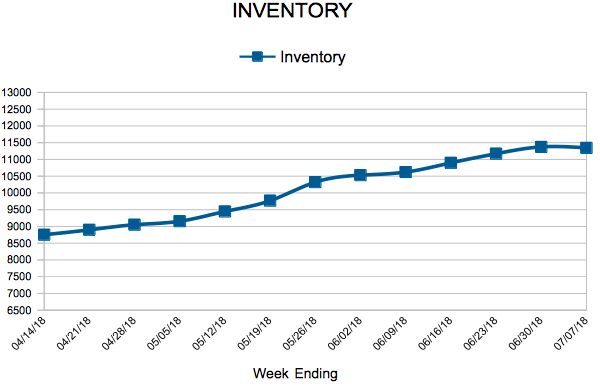

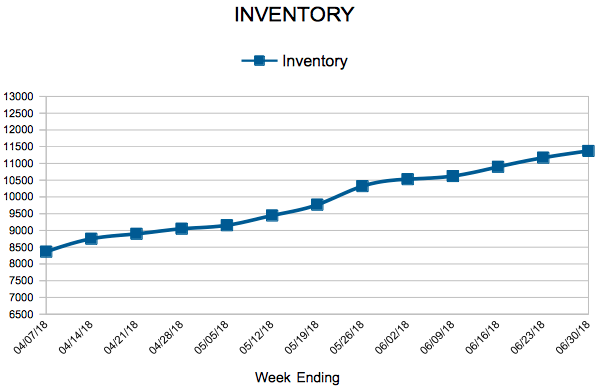

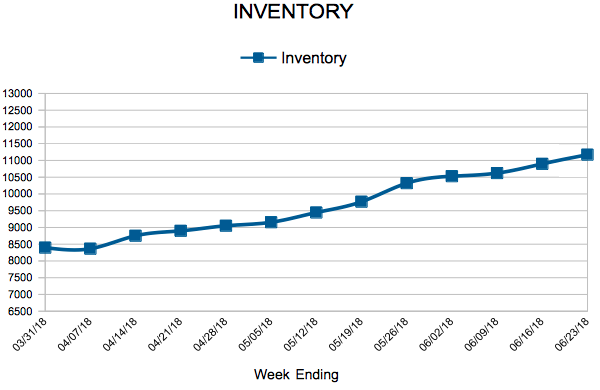

Inventory

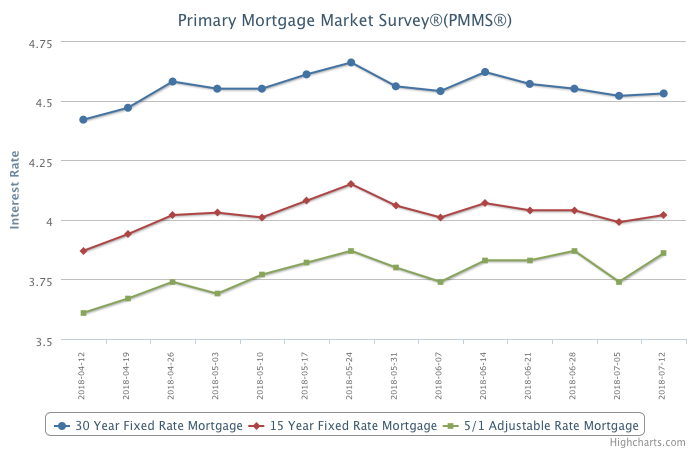

Mortgage Rates Inch Higher

Mortgage rates were mostly unchanged, but did tick up for the first time since early June.

The 10-year Treasury yield continues to hover along the same narrow range, as increased global trade tensions are causing investors to take a cautious approach. This in turn has kept borrowing costs at bay, which is certainly welcoming news for those looking to buy a home before the summer ends.

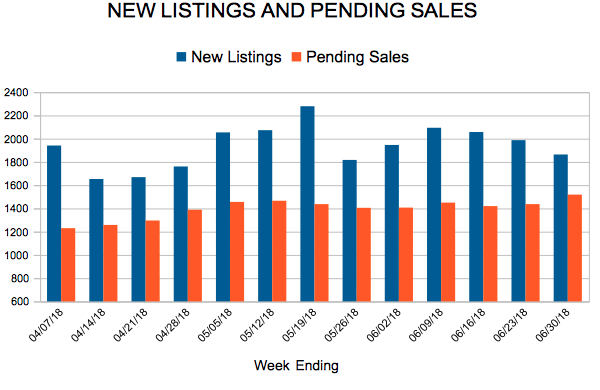

New Listings and Pending Sales

Inventory

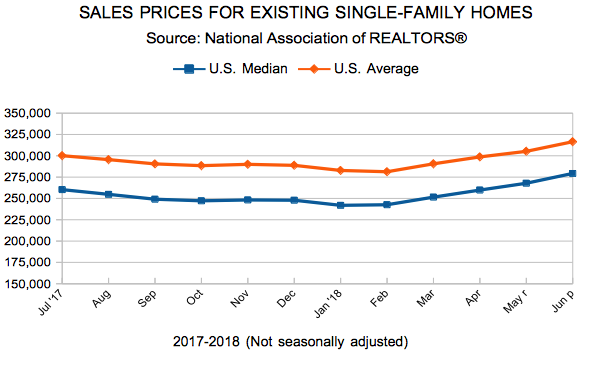

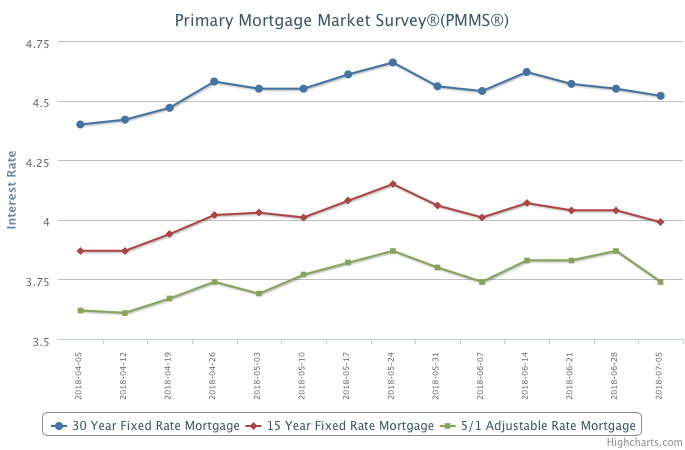

Mortgage Rates Continue Recent Decline

After a rapid increase throughout most of the spring, mortgage rates have now declined in five of the past six weeks.

The run-up in mortgage rates earlier this year represented not just a rise in risk-free borrowing costs, but for investors, the mortgage spread also rose back to more normal levels by about 20 basis points. What that means for buyers is good news. Mortgage rates may have a little more room to decline over the very short term.