Author Archives: admin

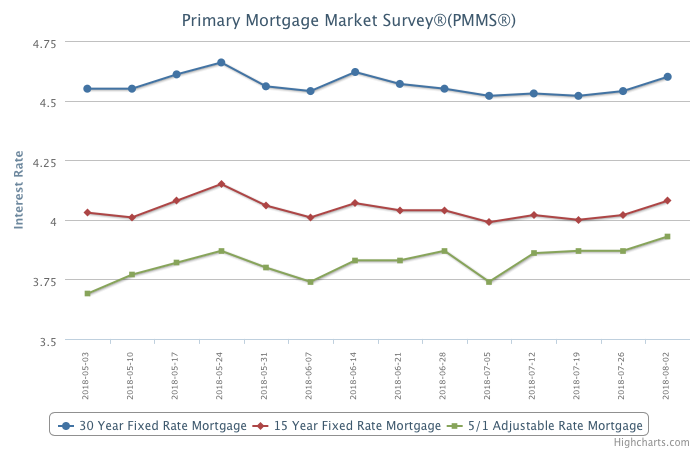

Mortgage Rates Inch Backward

Mortgage rates have mostly drifted sideways this summer. This stability is much needed for home sales, which have crested because of the multi-year run up in prices, tight affordable inventory and this year’s higher rates. Going forward, the strong economy will support the housing market, but with affordability pressures mounting, further spikes in mortgage rates will lead to continued softening in home price growth.

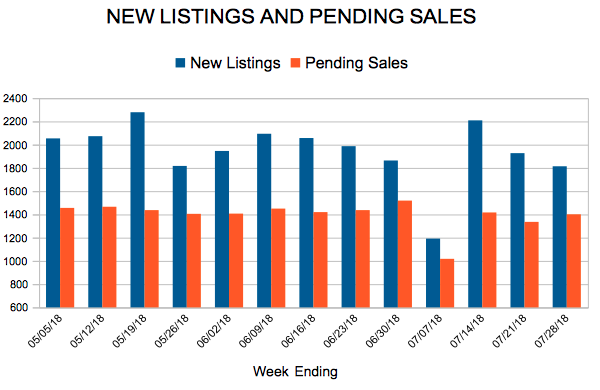

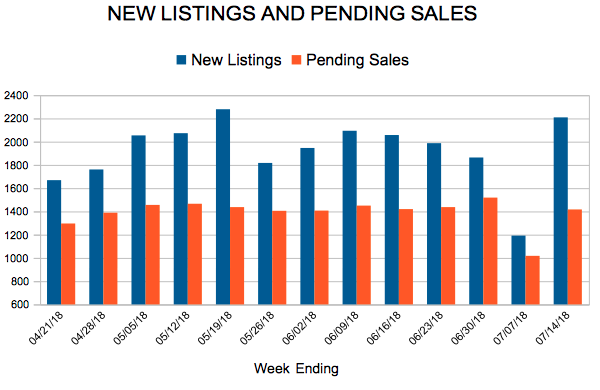

New Listings and Pending Sales

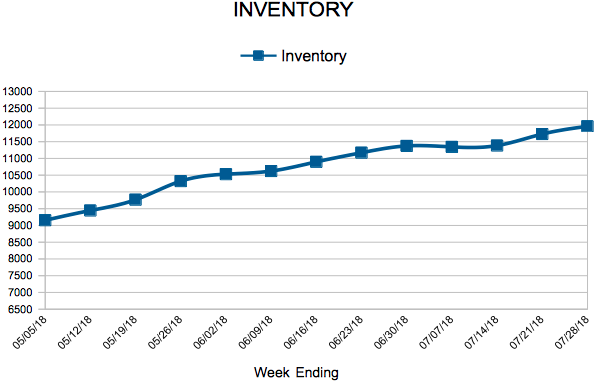

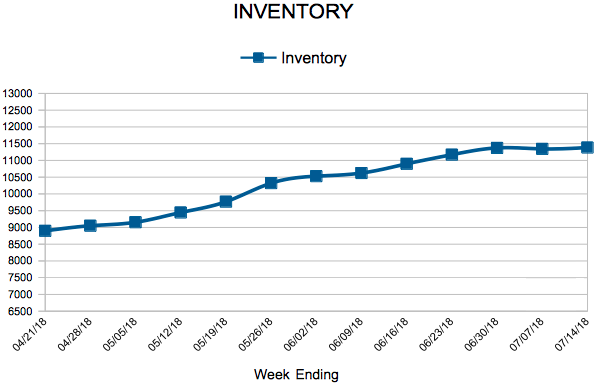

Inventory

Mortgage Rates on the Upswing

The 30-year fixed-rate mortgage drifted up for the second consecutive week to 4.60 percent.

The higher rate environment, coupled with the ongoing lack of affordable inventory, has led to a drag on existing-home sales in the last few months. Yesterday, the Federal Reserve passed on raising short-term rates, but with the embers of a strong economy potentially stoking higher inflation, borrowing costs will likely modestly rise in coming months.

Even with home price growth easing slightly in some markets, mortgage rates hovering near a seven-year high will certainly create affordability challenges for some prospective buyers looking to close.

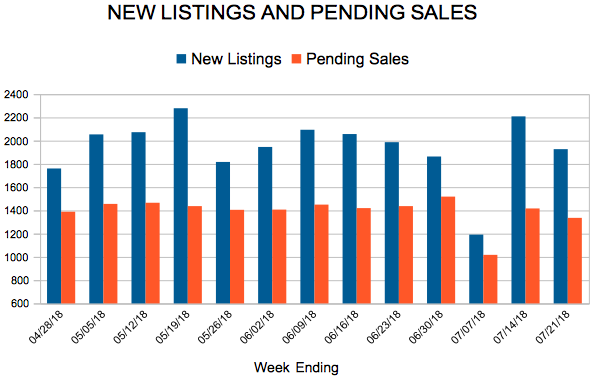

New Listings and Pending Sales

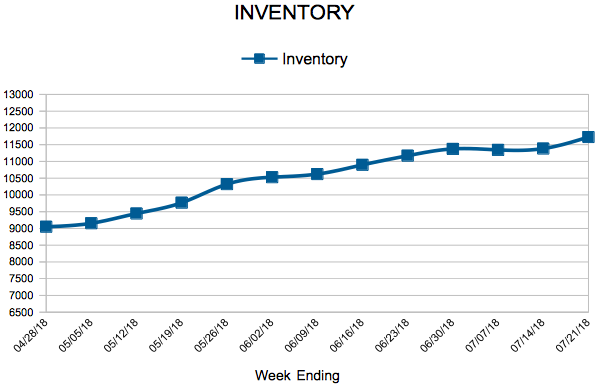

Inventory

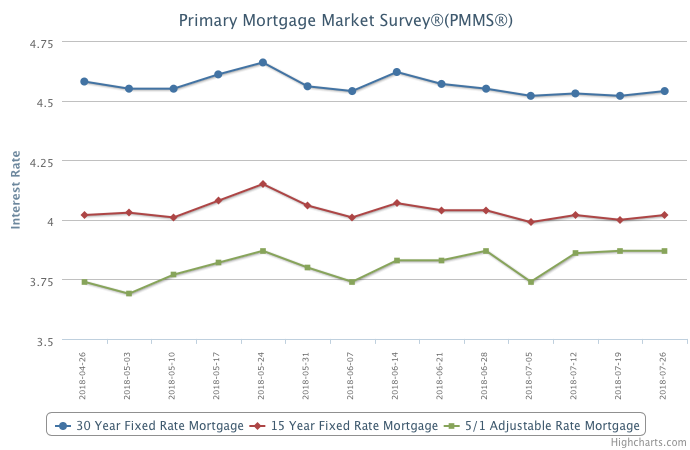

Mortgage Rates Shift Slightly Higher

Mortgage rates moved up slightly over the past week to their highest level since late June.

The next few months will be key for gauging the health of the housing market. Existing sales appear to have peaked, sales of newly built homes are slowing and unsold inventory is rising for the first time in three years.