Author Archives: admin

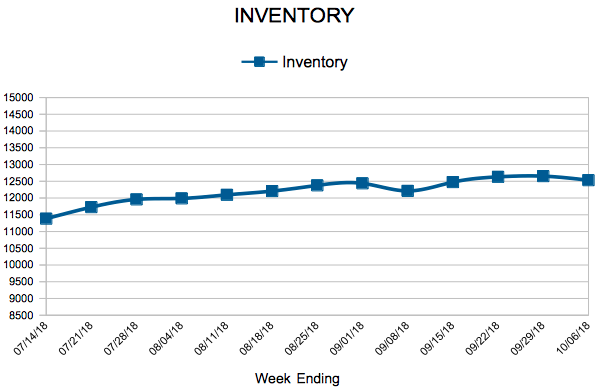

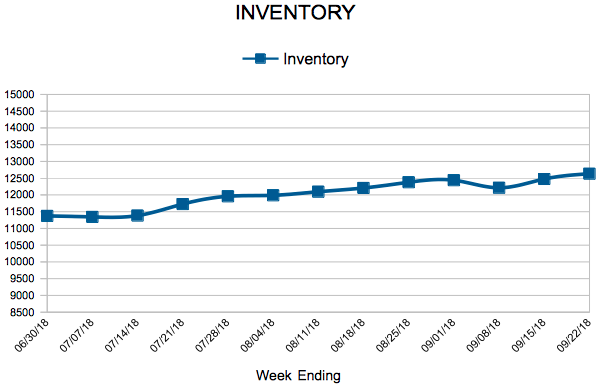

Inventory

Mortgage Rates Jump

October 11, 2018

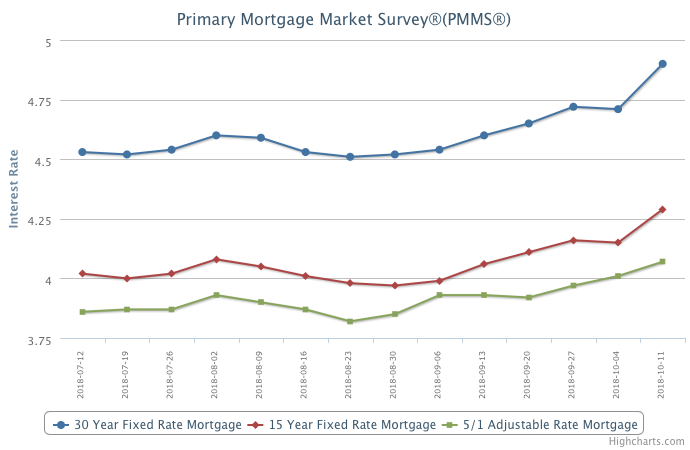

In this week’s survey, the 30-year fixed-rate mortgage jumped 19 basis points to 4.90 percent. Rates are now at their highest level since the week of April 14, 2011.

Rising rates paired with high and escalating home prices is putting downward pressure on purchase demand. While the monthly payment remains affordable due to the still low mortgage rate environment, the primary hurdle for many borrowers today is the down payment and that is the reason home sales have decreased in many high-priced markets.

Information provided by Freddie Mac.

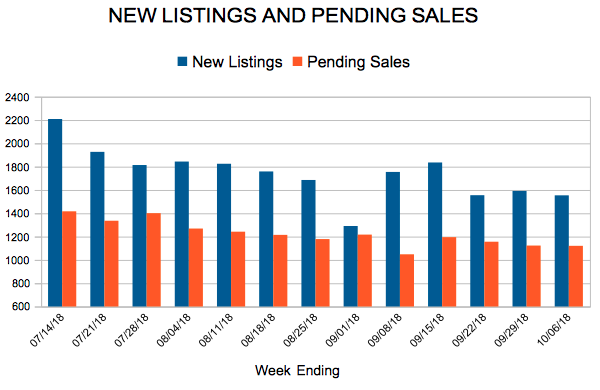

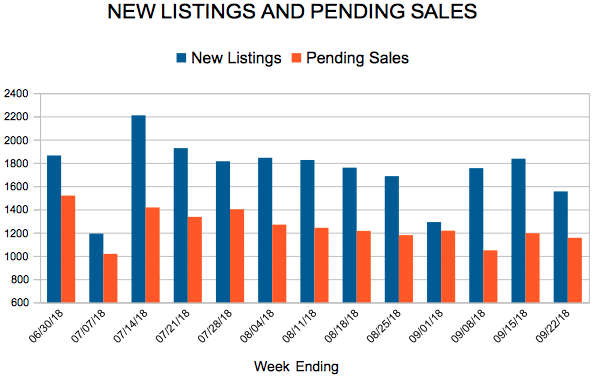

New Listings and Pending Sales

Inventory

Mortgage Rates Largely Hold Steady

October 4, 2018

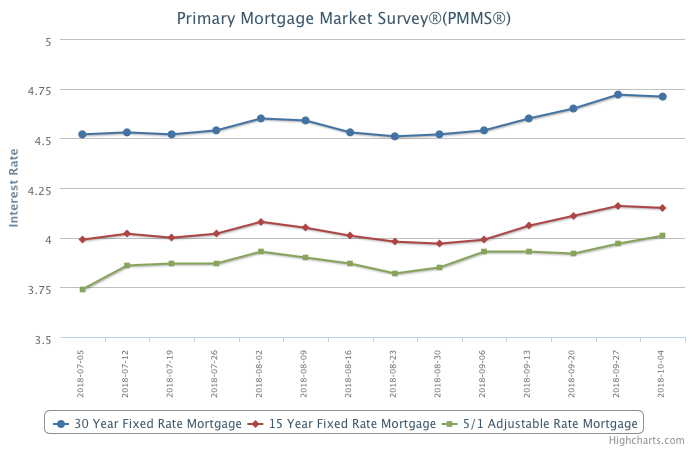

Mortgage rates inched back a little in this week’s survey, easing 1 basis point to 4.71 percent after hitting a seven year high last week. There is upside risk to mortgage rates as the economy remains very robust and this is reflected in the very recent strength in the fixed income and equities markets.

However, the strength in the economy has failed to translate to gains in the housing market as higher mortgage rates have contributed to the decrease in home purchase applications, which are down from a year ago. With mortgage rates expected to track higher, it’s going to be a challenge for the housing market to regain momentum.

Information provided by Freddie Mac.

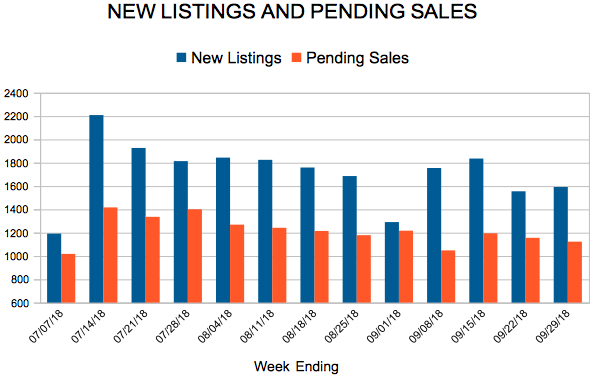

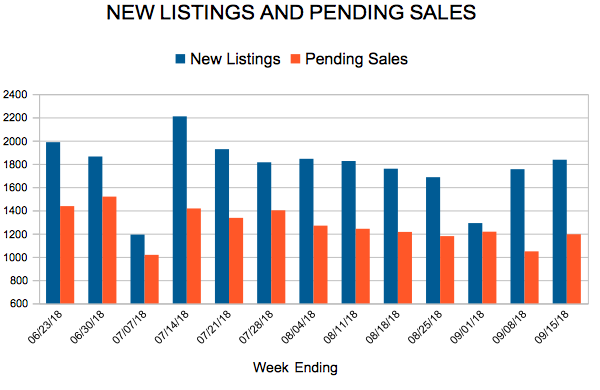

New Listings and Pending Sales

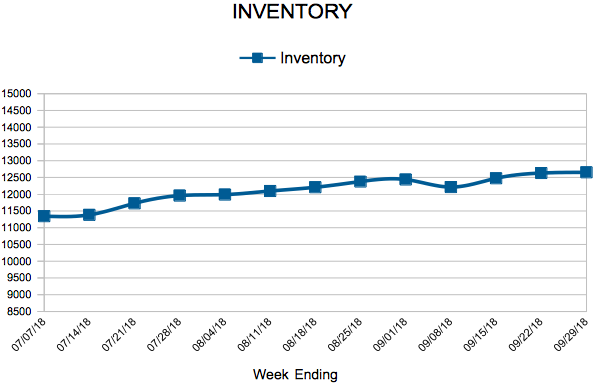

Inventory

Mortgage Rates Jump for the Fifth Straight Week

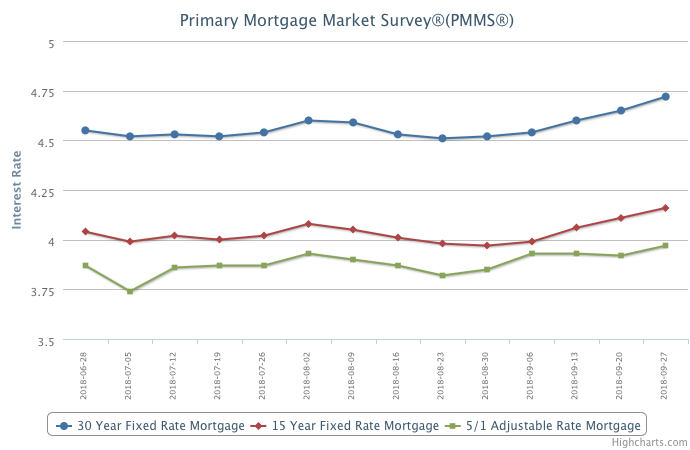

The 30-year fixed-rate mortgage rose for the fifth consecutive week to 4.72 percent – a high not seen since April 28, 2011 (4.78 percent).

The robust economy, rising Treasury yields and the anticipation of more short-term rate hikes caused mortgage rates to move up.

Even with these higher borrowing costs, it’s encouraging to see that prospective buyers appear to be having a little more success. With inventory constraints and home prices starting to ease, purchase applications have now trended higher on an annual basis for six straight weeks.

Consumer confidence is at an 18-year high, and job gains are holding steady. These two factors should keep demand up in coming months, but at the same time, home shoppers will likely deal with even higher mortgage rates.

Information provided by Freddie Mac.