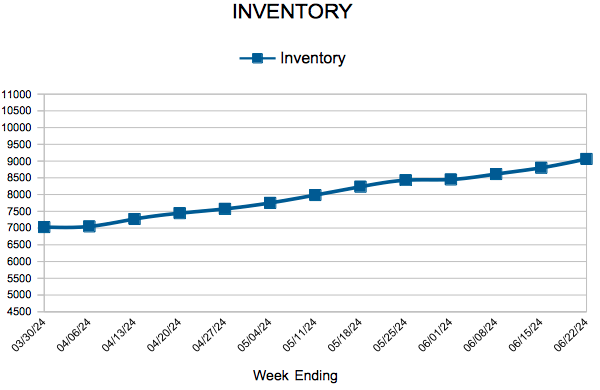

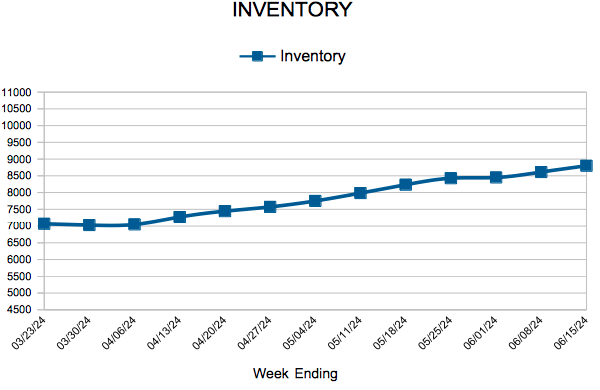

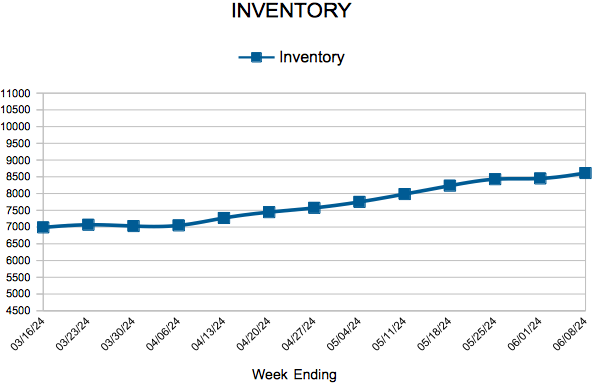

Inventory

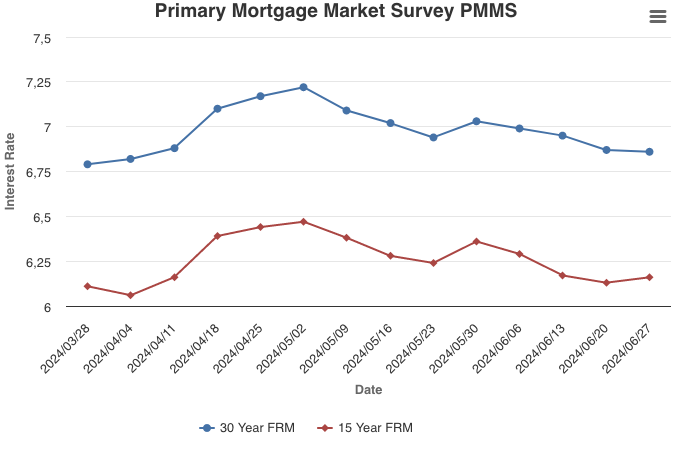

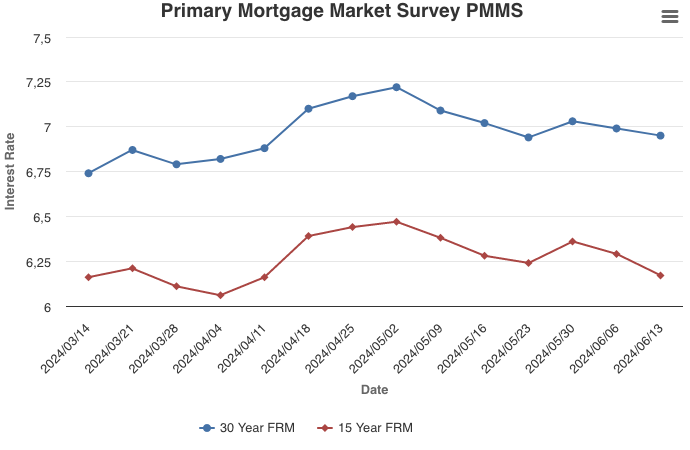

The 30-Year Fixed-Rate Mortgage Continues its Downward Trend

June 27, 2024

The 30-year fixed-rate mortgage continues to trend down, hitting the lowest level in almost three months. By historical standards, the economy is in good shape, and we expect rates to continue to come down over the summer months, bringing additional homebuyers back into the market.

Information provided by Freddie Mac.

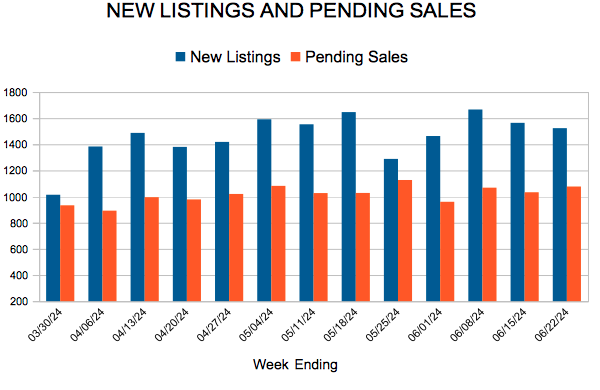

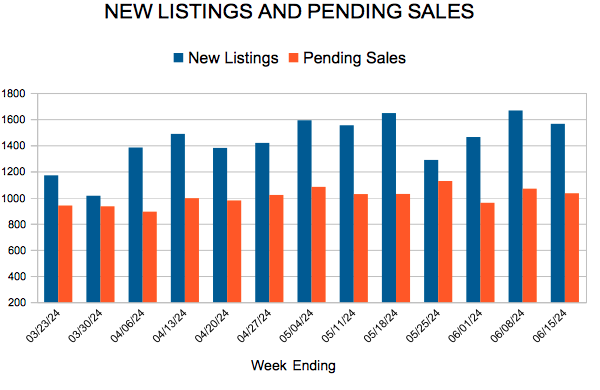

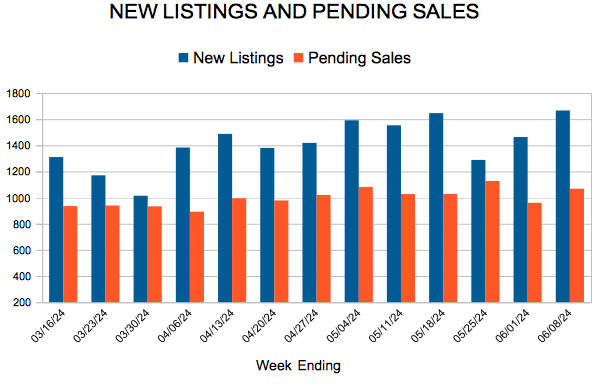

New Listings and Pending Sales

Inventory

Existing Home Sales

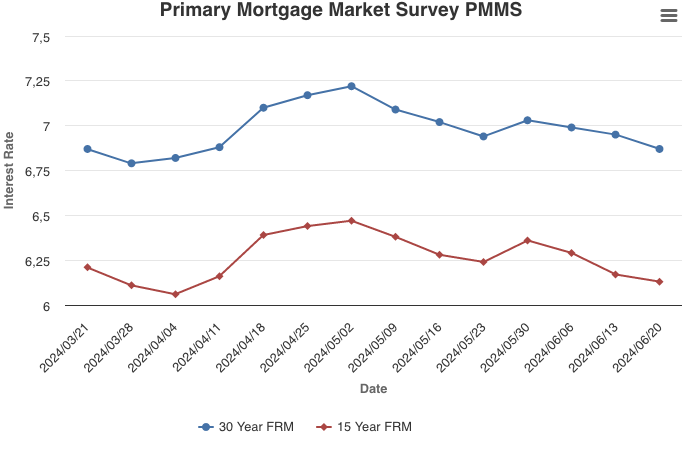

Mortgage Rates Move Lower

June 20, 2024

Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut. These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market. Aspiring homeowners should remember it’s important to shop around for the best mortgage rate as they can vary widely between lenders.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Mortgage Rates Continue to Move Down

June 13, 2024

Mortgage rates continued to fall back this week as incoming data suggests the economy is cooling to a more sustainable level of growth. Top-line inflation numbers were flat but shelter inflation, which measures rent and homeownership costs, increased showing that housing affordability continues to be an ongoing impediment for buyers on the house hunt.

Information provided by Freddie Mac.