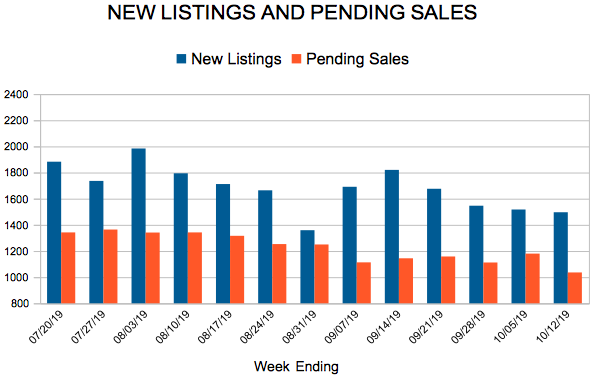

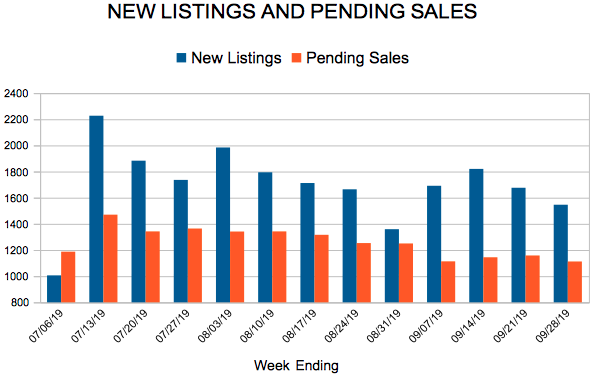

New Listings and Pending Sales

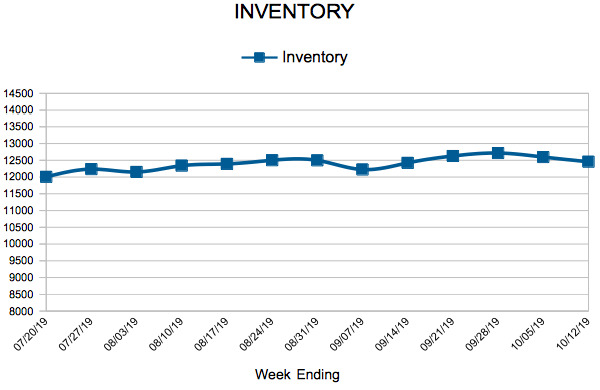

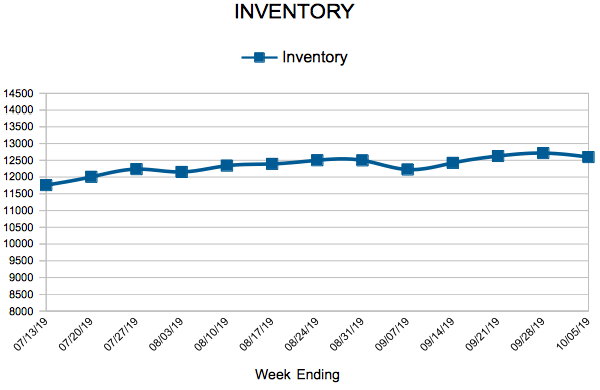

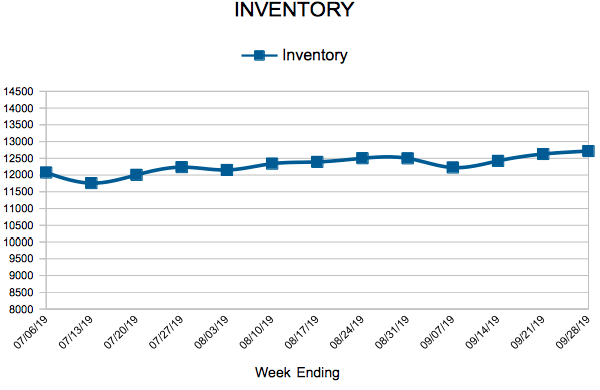

Inventory

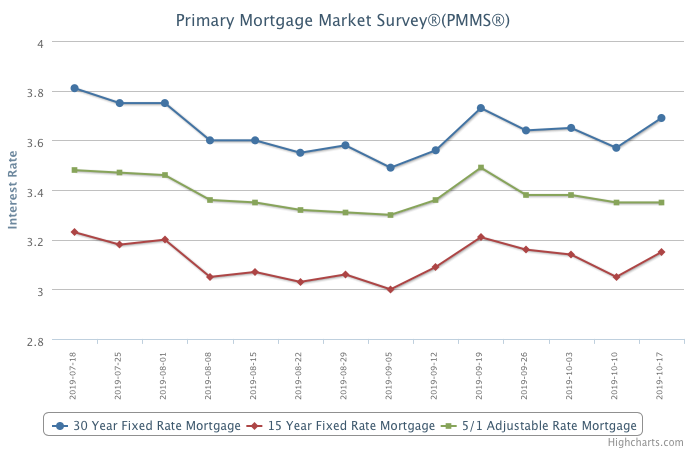

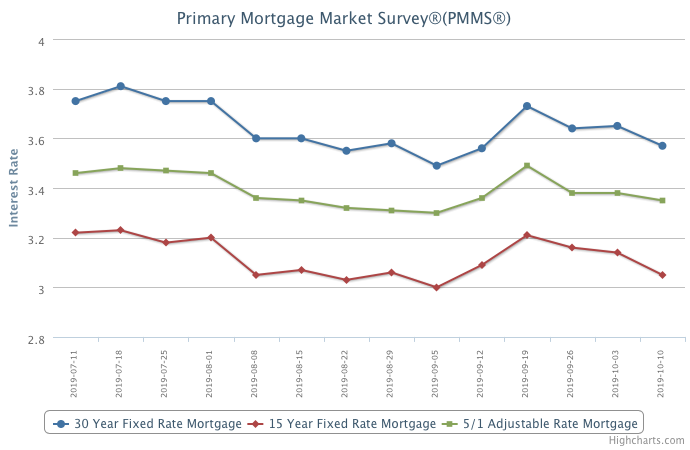

Mortgage Rates Jump

October 17, 2019

Despite this week’s uptick in mortgage rates, the housing market remains on the upswing with improvement in construction and home sales. While there has been a material weakness in manufacturing and consistent trade uncertainty, other economic trends like employment and homebuilder sentiment are encouraging.

Information provided by Freddie Mac.

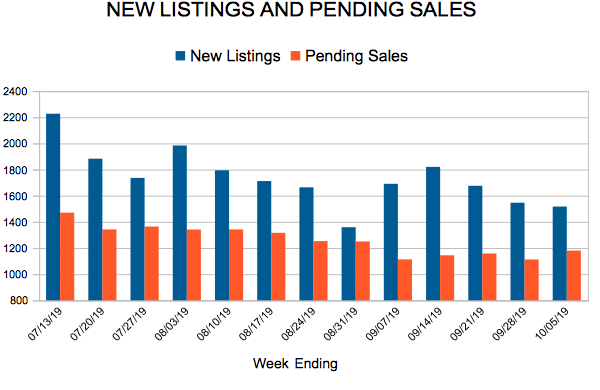

New Listings and Pending Sales

Inventory

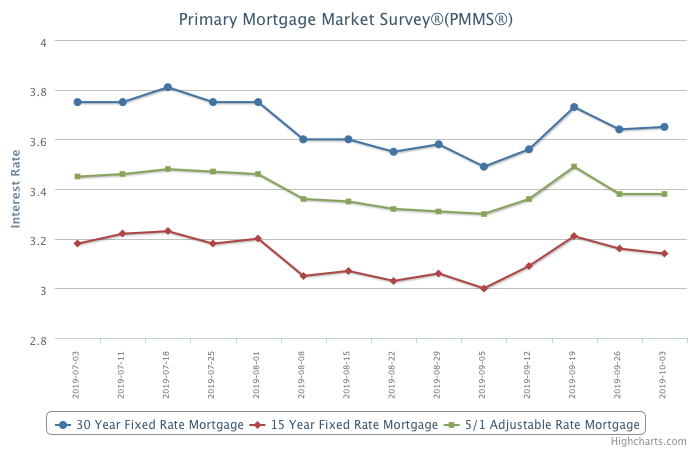

Mortgage Rates Decrease

October 10, 2019

Despite the economic slowdown due to weakening manufacturing and corporate investment, the consumer side of the economy remains on solid ground. The fifty-year low in the unemployment rate combined with low mortgage rates has led to increased homebuyer demand this year. Much of this strength is coming from entry-level buyers – the first-time homebuyer share of the loans Freddie Mac purchased in 2019 is forty-six percent, a two-decade high.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Mortgage Rates Hold Steady

October 3, 2019

While mortgage rates generally held steady this week, overall mortgage demand remained very strong, rising over fifty percent from a year ago thanks to increases in both refinance and purchase mortgage applications. As economic growth decelerates, it is clear that low mortgage rates will continue to support the mortgage market and we expect that to persist for the remainder of the year.

Information provided by Freddie Mac.