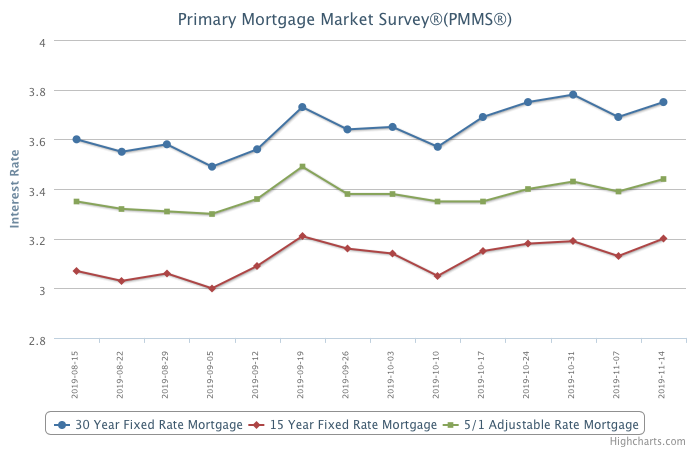

November 14, 2019

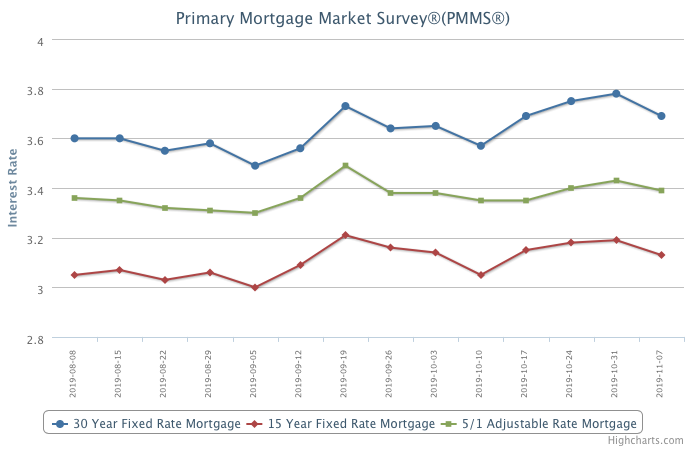

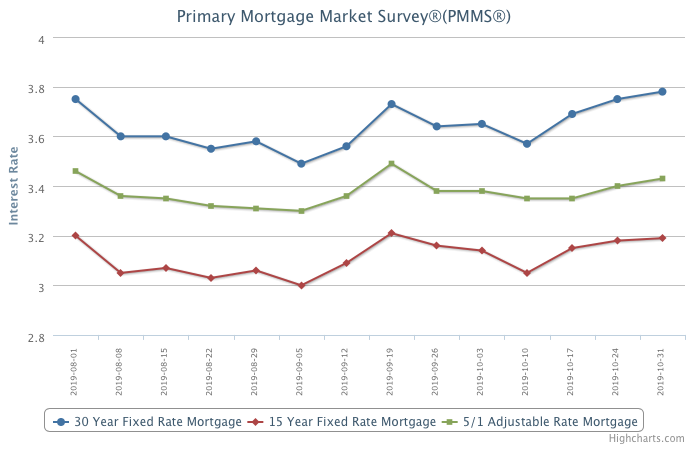

The modest uptick in mortgage rates over the last two months reflects declining recession fears and a more sanguine outlook for the global economy. Due to the improved economic outlook, purchase mortgage applications rose fifteen percent over the same week a year ago, the second highest weekly increase in the last two years. Given the important role residential real estate plays in the economy, the steady improvement of the housing market is a reassuring sign that the economy is on solid ground heading into next year.

Information provided by Freddie Mac.