December 5, 2019

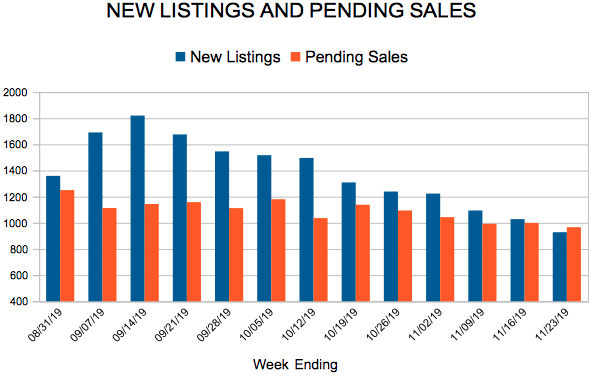

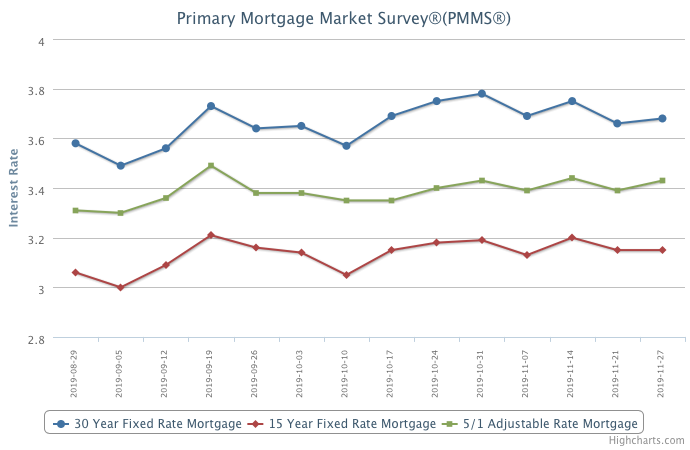

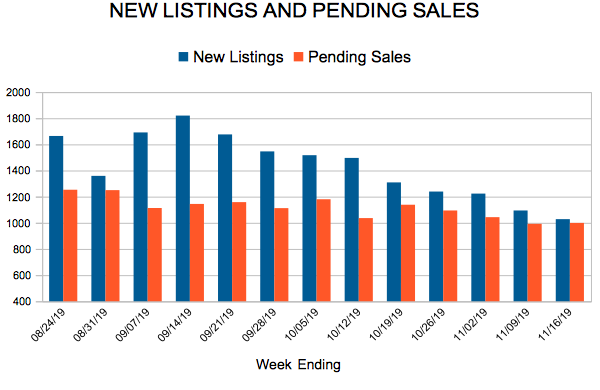

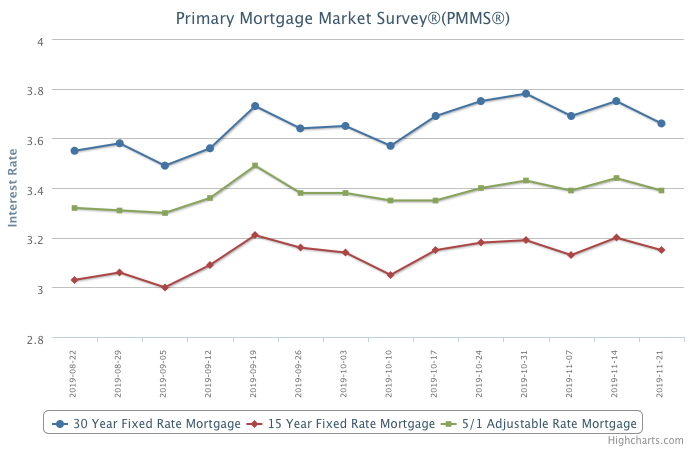

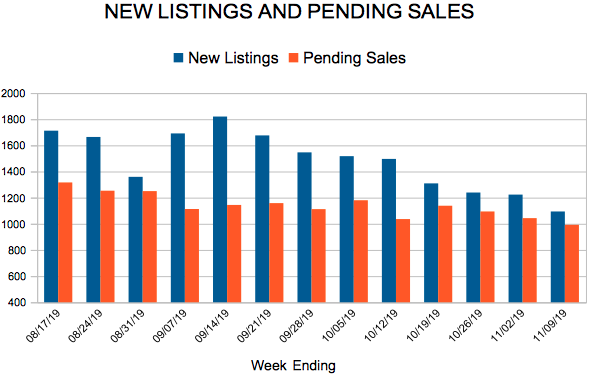

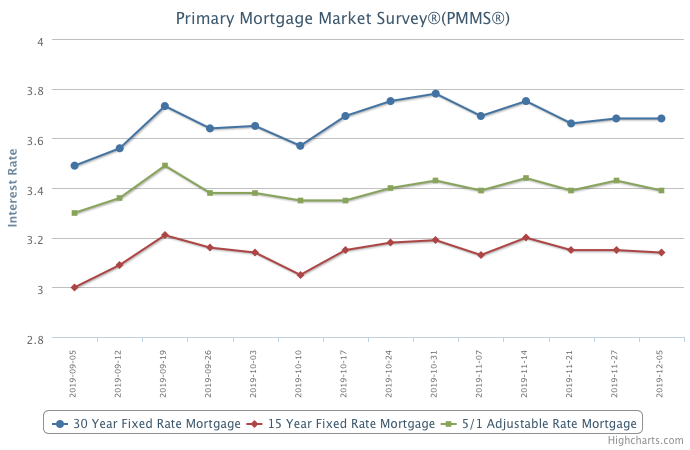

This week the economy sent mixed signals, leaving mortgage rates unchanged. Survey data for manufacturing and service industries varied while construction spending fell modestly. However, homebuyer demand continued to improve, rising eight percent. Clearly homebuyers remain bullish on the real estate market.

Information provided by Freddie Mac.