Existing Home Sales

Reply

January 28, 2021

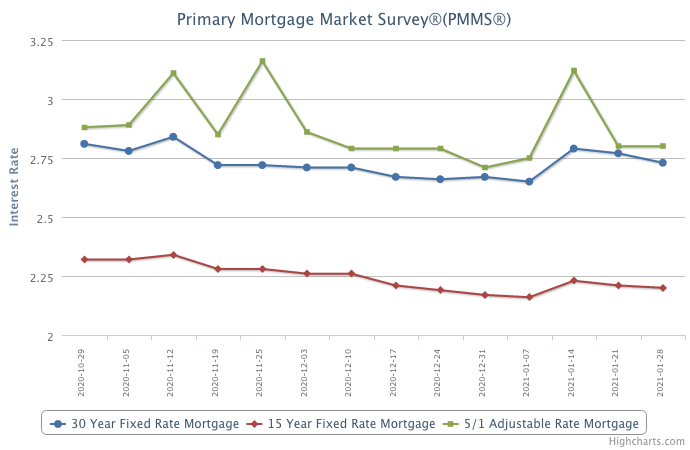

As the market reacts to a new administration in Washington and COVID-19 driven economic malaise, mortgage rates continued to decrease this week, just slightly. Even as house prices increase at the fastest rate we’ve seen in years, competition to buy is strong given the low inventory that exists across the country. The fact that there are not enough homes to meet demand is going to be an ongoing issue for the foreseeable future.

Information provided by Freddie Mac.