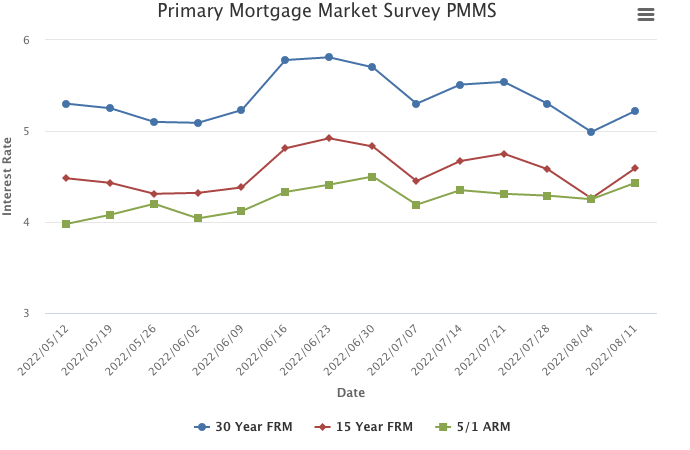

August 11, 2022

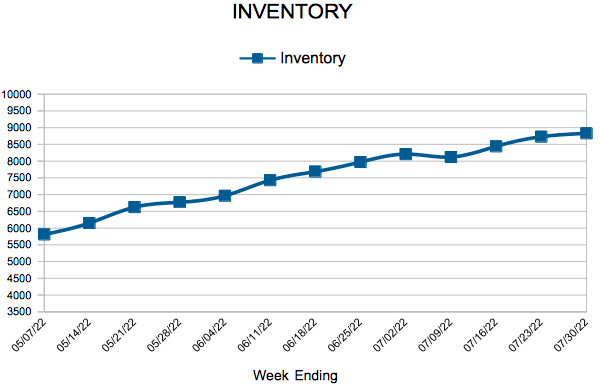

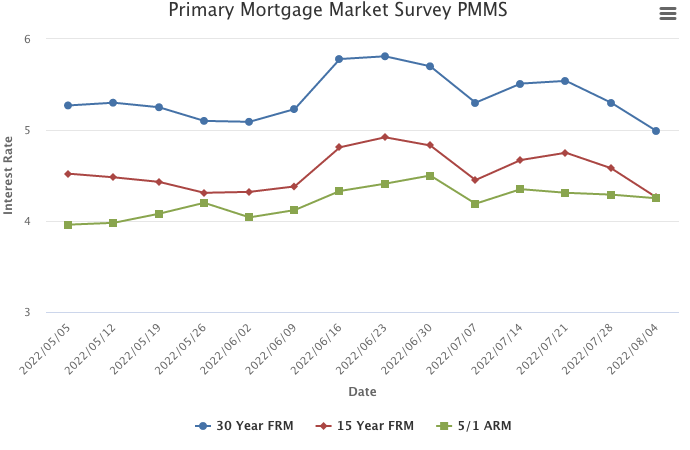

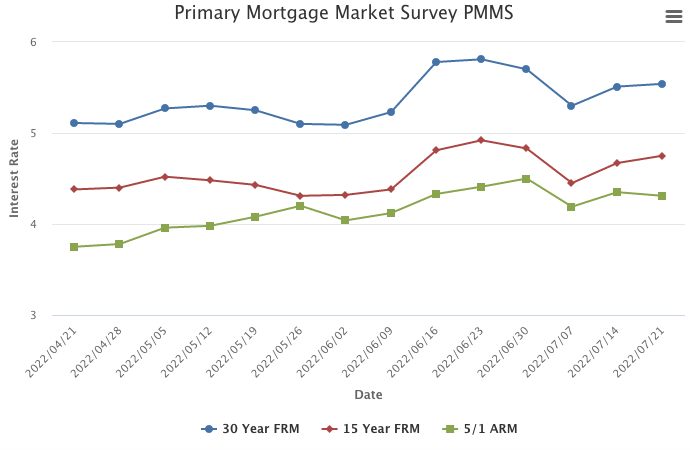

The 30-year fixed-rate went back up to well over five percent this week, a reminder that recent volatility remains persistent. Although rates continue to fluctuate, recent data suggest that the housing market is stabilizing as it transitions from the surge of activity during the pandemic to a more balanced market. Declines in purchase demand continue to diminish while supply remains fairly tight across most markets. The consequence is that house prices likely will continue to rise, but at a slower pace for the rest of the summer.

Information provided by Freddie Mac.