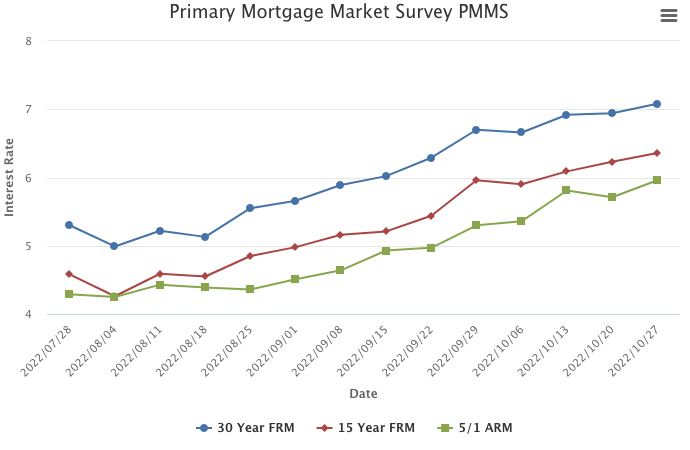

Mortgage Rates Surpass Seven Percent

October 27, 2022

The 30-year fixed-rate mortgage broke seven percent for the first time since April 2002, leading to greater stagnation in the housing market. As inflation endures, consumers are seeing higher costs at every turn, causing further declines in consumer confidence this month. In fact, many potential homebuyers are choosing to wait and see where the housing market will end up, pushing demand and home prices further downward.

Information provided by Freddie Mac.

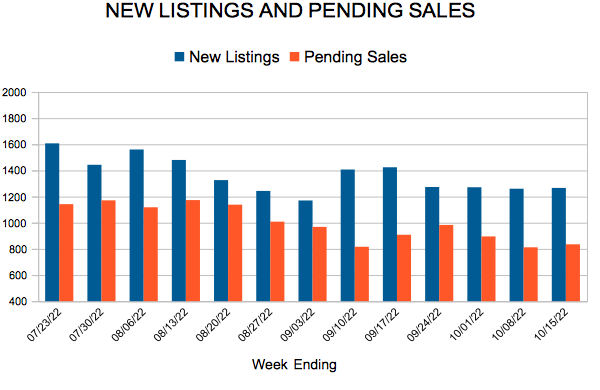

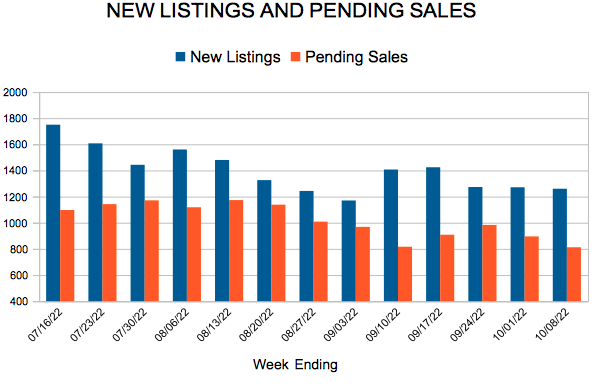

New Listings and Pending Sales

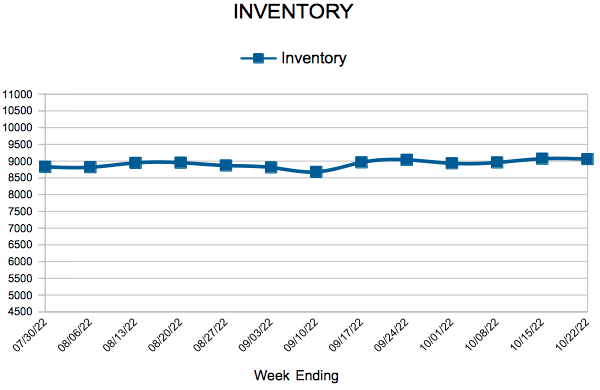

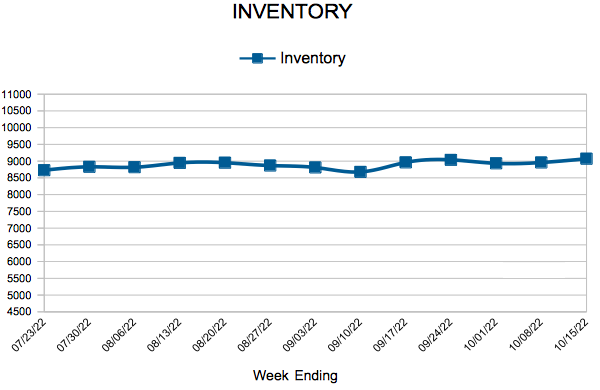

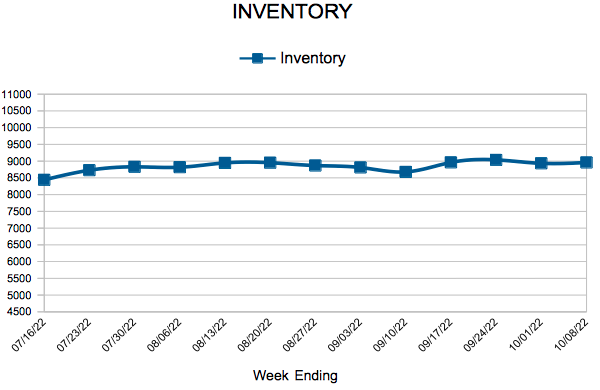

Inventory

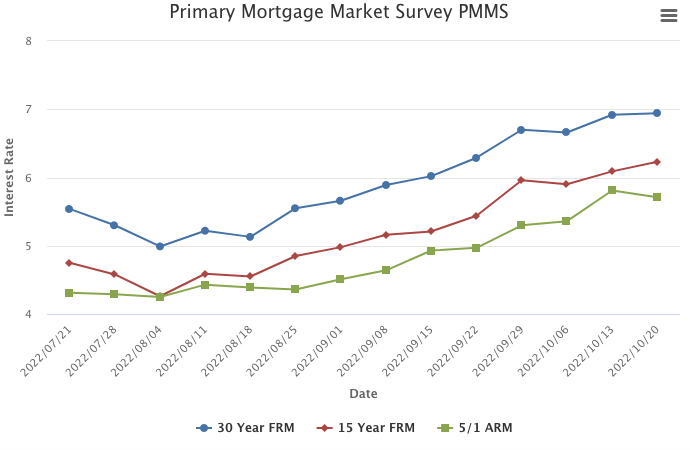

Mortgage Rates Slow Their Upward Trajectory

October 20, 2022

The 30-year fixed-rate mortgage continues to remain just shy of seven percent and is adversely impacting the housing market in the form of declining demand. Additionally, homebuilder confidence has dropped to half what it was just six months ago and construction, particularly single-family residential construction, continues to slow down.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

Inventory

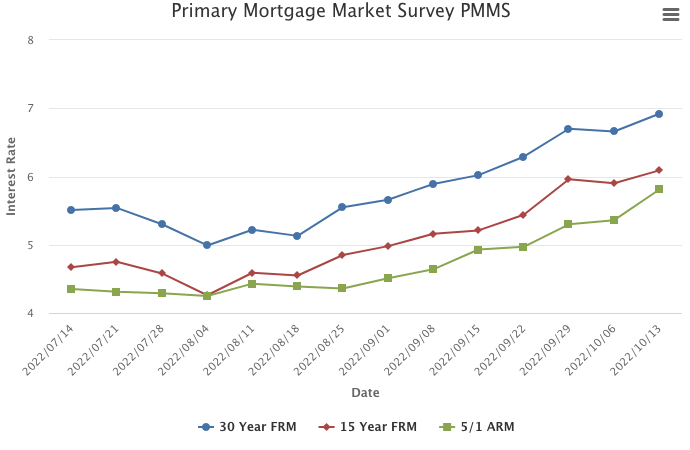

Mortgage Rates Resume Their Climb

October 13, 2022

Rates resumed their record-setting climb this week, with the 30-year fixed-rate mortgage reaching its highest level since April of 2002. We continue to see a tale of two economies in the data: strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving housing demand down precipitously. The next several months will undoubtedly be important for the economy and the housing market.

Information provided by Freddie Mac.