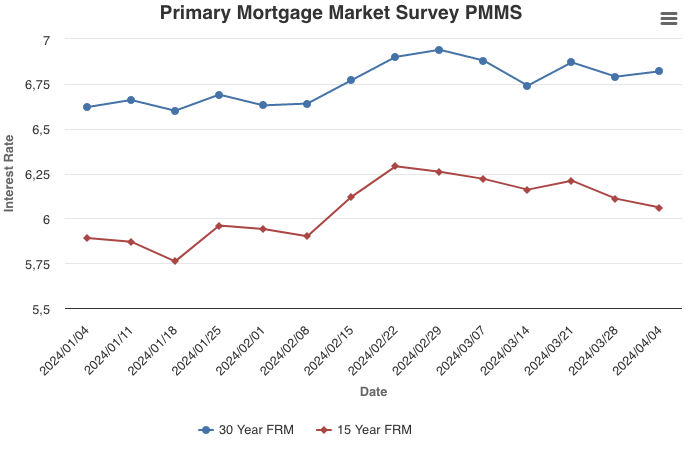

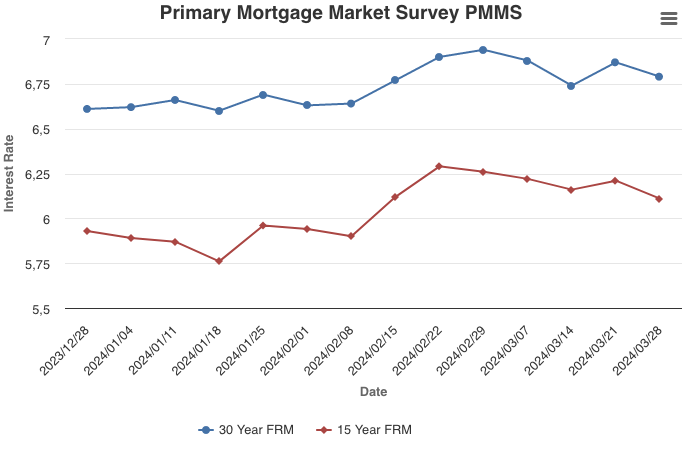

Mortgage Rates Continue to Show Little Movement

April 4, 2024

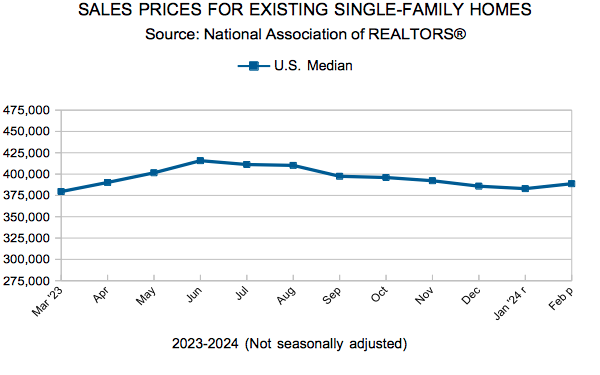

Mortgage rates showed little movement again this week, hovering around 6.8 percent. Since the start of 2024, the 30-year fixed-rate mortgage has not reached seven percent but has not dropped below 6.6 percent either. While incoming economic signals indicate lower rates of inflation, we do not expect rates will decrease meaningfully in the near-term. On the plus side, inventory is improving somewhat, which should help temper home price growth.

Information provided by Freddie Mac.

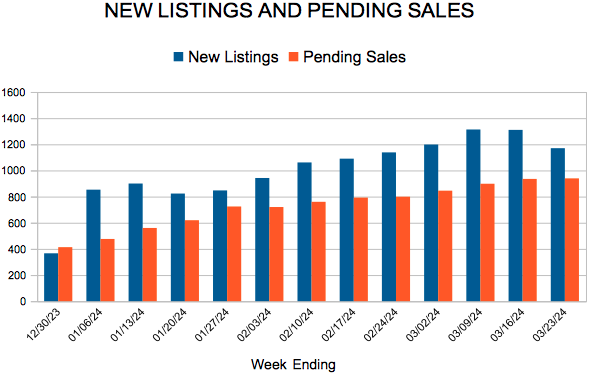

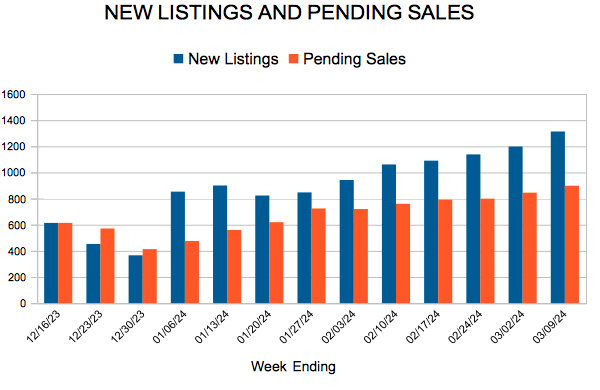

New Listings and Pending Sales

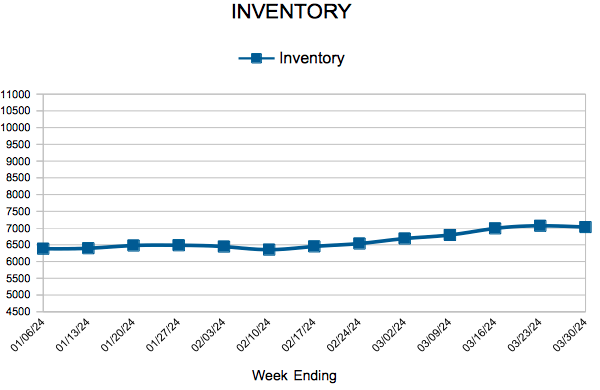

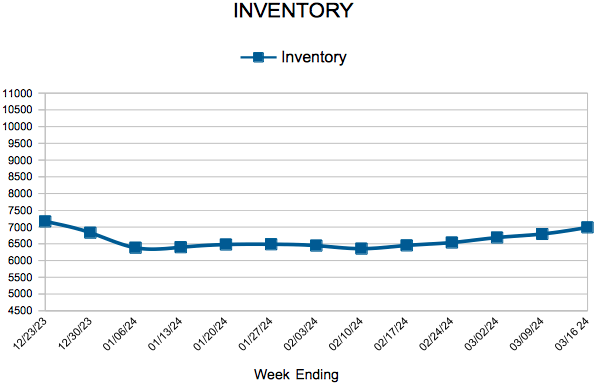

Inventory

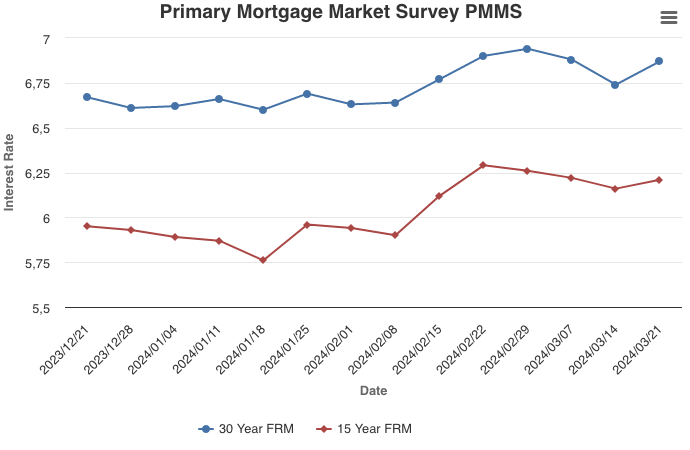

Mortgage Rates Drop Slightly

March 28, 2024

Mortgage rates moved slightly lower this week, providing a bit more room in the budgets of some prospective homebuyers. Additionally, encouraging data out on existing home sales reflects improving inventory. Regardless, rates remain elevated near seven percent as markets watch for signs of cooling inflation, hoping that rates will come down further.

Information provided by Freddie Mac.

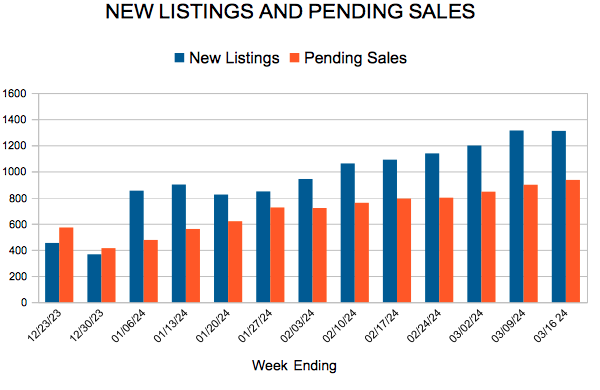

New Listings and Pending Sales

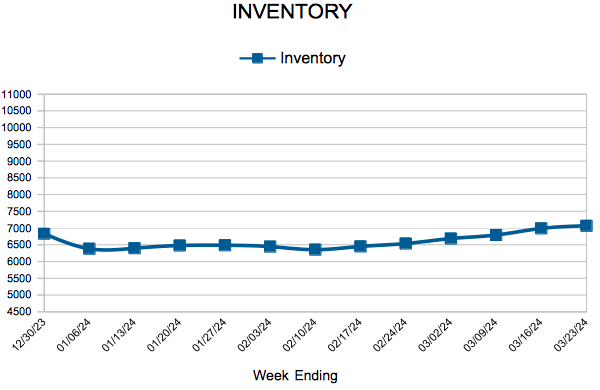

Inventory

Mortgage Rates Increase, Nearing Seven Percent

March 21, 2024

After decreasing for a couple of weeks, mortgage rates are once again on the upswing. As the spring homebuying season gets underway, existing home inventory has increased slightly and new home construction has picked up. Despite elevated rates, homebuilders are displaying renewed confidence in the housing market, focusing on the fact that there is a good amount of pent-up demand, an ongoing supply shortage and expectations that the Federal Reserve will cut rates later in the year.

Information provided by Freddie Mac.