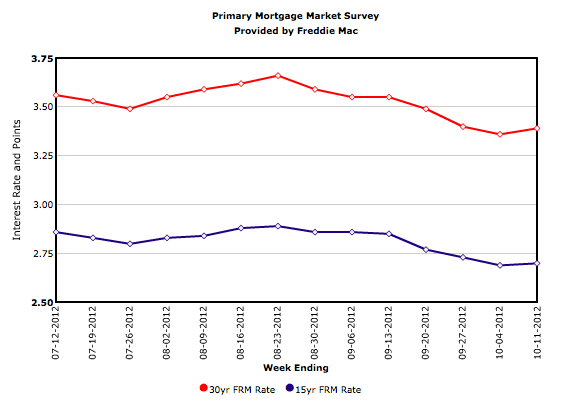

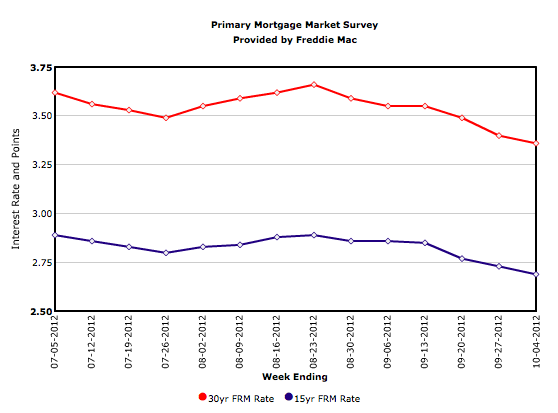

Mortgage Rates Edge Up From Record Lows

The results of Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) released on Oct. 11 showed average fixed mortgage rates moving slightly higher from their all-time record lows. For example, the 30-year fixed-rate mortgage (FRM) averaged 3.39 percent, up from 3.36 percent last week. A year ago, the 30-year FRM averaged 4.12 percent.

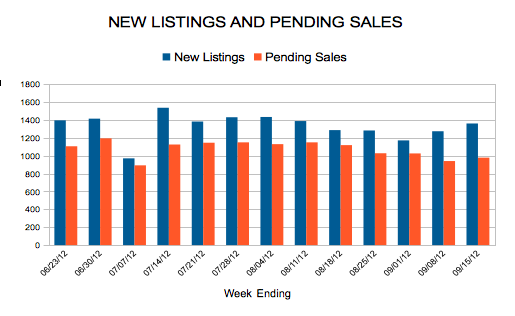

New Listings and Pending Sales

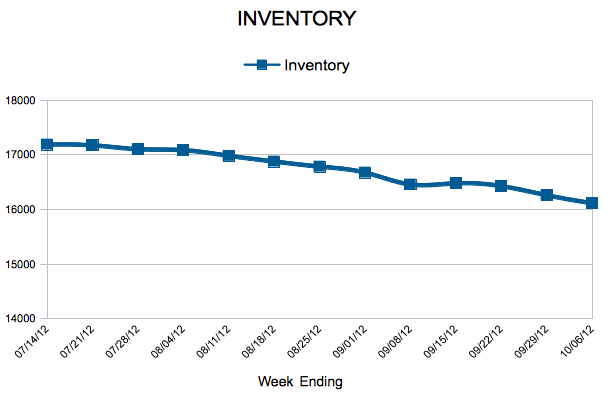

Inventory

Mortgage Rates At Record Lows For Second Consecutive Week

Average fixed mortgage rates fell to new all-time record lows for the second consecutive week, according to Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) results released on October 4. Mortgage securities purchases by the Federal Reserve and indicators of a weakening economy were contributing factors.

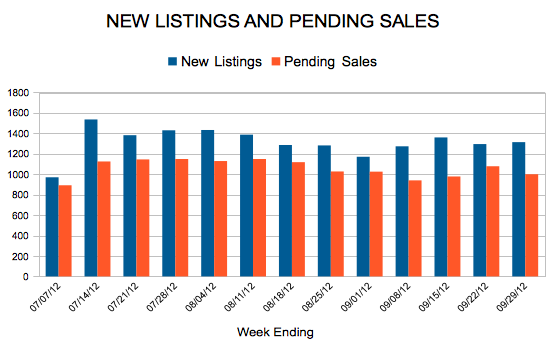

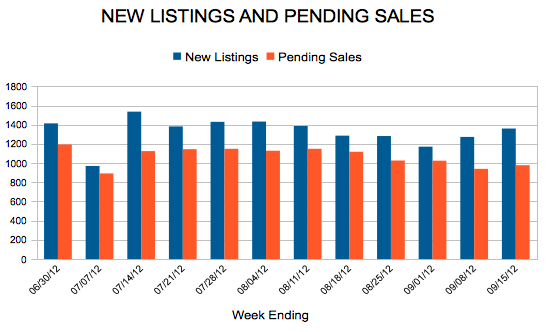

New Listings and Pending Sales

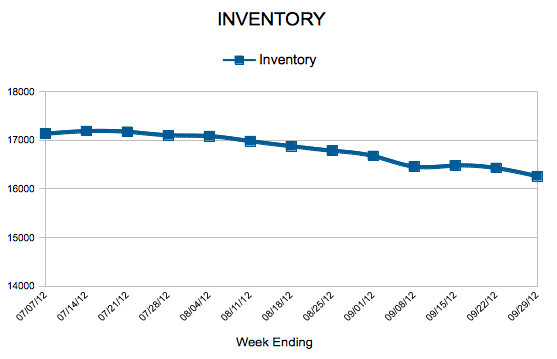

Inventory

New Listings and Pending Sales

Mortgage Rates Dip Further

Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) results released Sept. 27 show fixed mortgage rates breaking their previous average record lows. This should help to keep affordability high and refinancing strong to support an already improving housing market. All mortgage products, except the 5-year ARM, averaged new all-time record lows.

Mortgage Rates at Record Lows

Freddie Mac’s Primary Mortgage Market Survey (PMMS®) results released Sept. 20 showed fixed mortgage rates at or near their all-time record lows. The average 30-year fixed rate mortgage matched its all-time record low at 3.49 percent, and the average 15-year fixed fell to a new all-time record low at 2.77 percent.