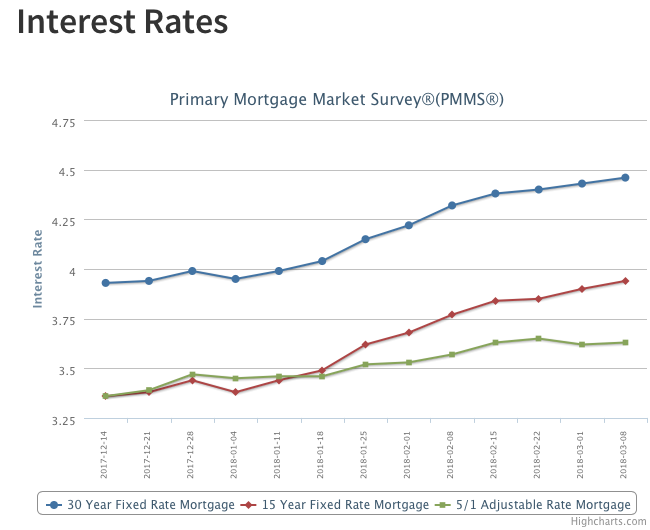

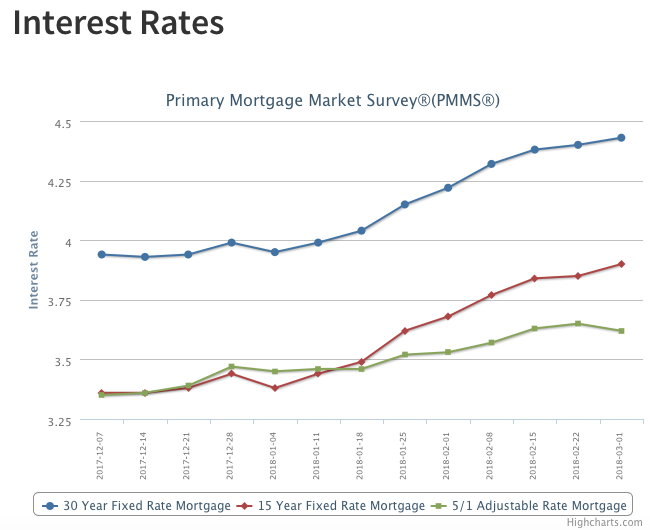

Mortgage Rates Push Higher

The 10-year Treasury yield has been bouncing around in a narrow 15 basis point range for the last month. While the yield on the 10-year Treasury is currently below the high of 2.95 percent reached two weeks ago, mortgage rates are up for the ninth consecutive week. The U.S. weekly average 30-year fixed mortgage rate rose 3 basis points to 4.46 percent in this week’s survey, its highest level since January 2014.

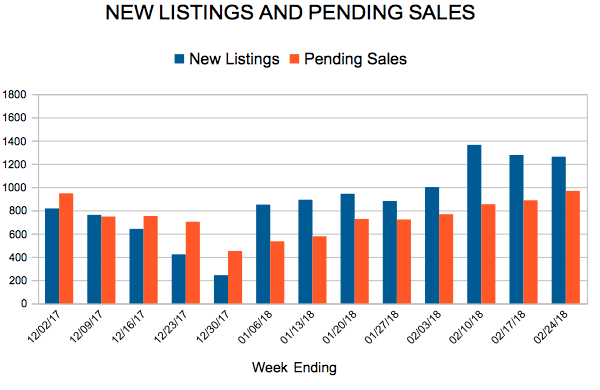

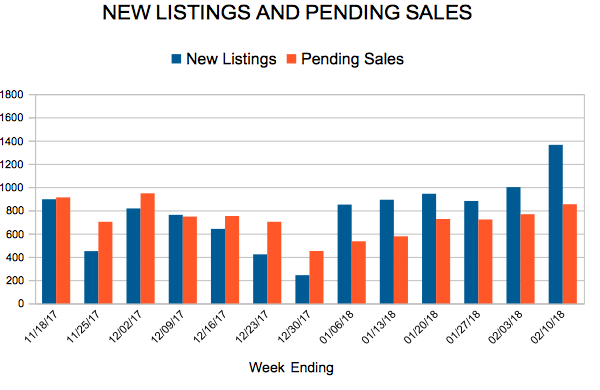

New Listings and Pending Sales

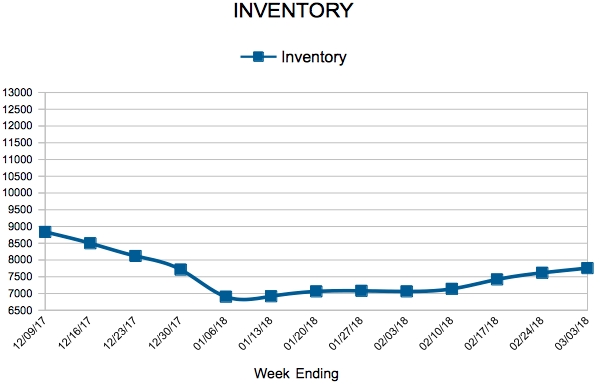

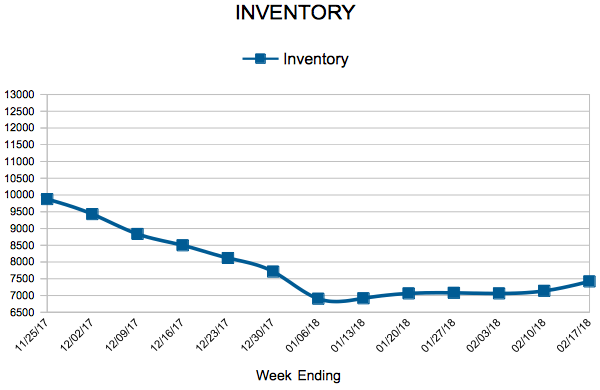

Inventory

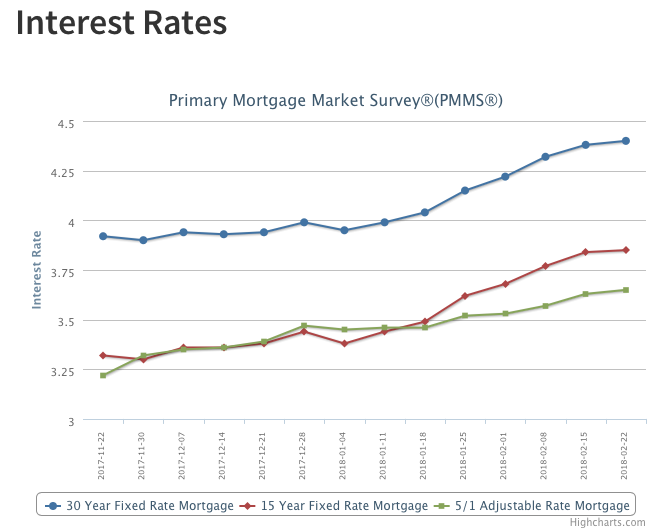

Fixed-Rate Mortgage Rates Rise for Eighth Consecutive Week

Optimistic testimony on Capitol Hill from Federal Reserve Chairman Jerome Powell sent Treasury yields higher as Powell stated his outlook for the economy has strengthened since December. Following Treasurys, the 30-year fixed mortgage rate jumped 3 basis points to reach 4.43 percent in this week’s survey. The 30-year rate has been on a tear in 2018, climbing 48 basis points since the start of the year and increasing for 8 consecutive weeks.

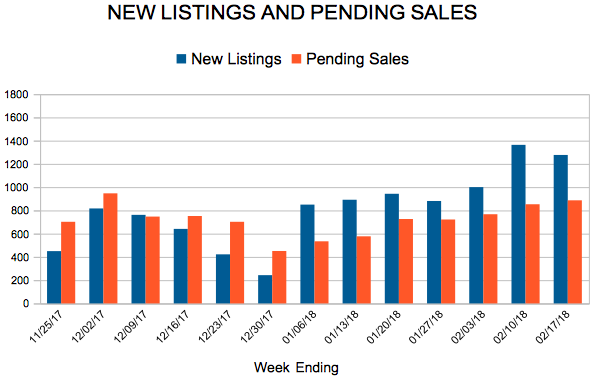

New Listings and Pending Sales

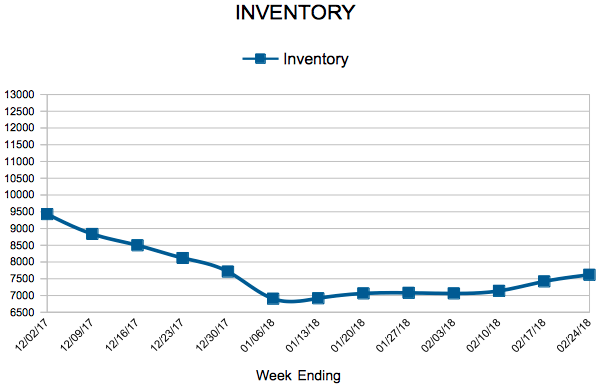

Inventory

Mortgage Rates Continue Upward Climb

Fixed mortgage rates increased for the seventh consecutive week, with the 30-year fixed mortgage rate reaching 4.40 percent in this week’s survey; the highest since April of 2014. Mortgage rates have followed U.S. Treasurys higher in anticipation of higher rates of inflation and further monetary tightening by the Federal Reserve. Following the close of our survey, the release of the FOMC minutes for February 21, 2018 sent the 10-year Treasury above 2.9 percent. If those increases stick, we will likely see mortgage rates continue to trend higher.