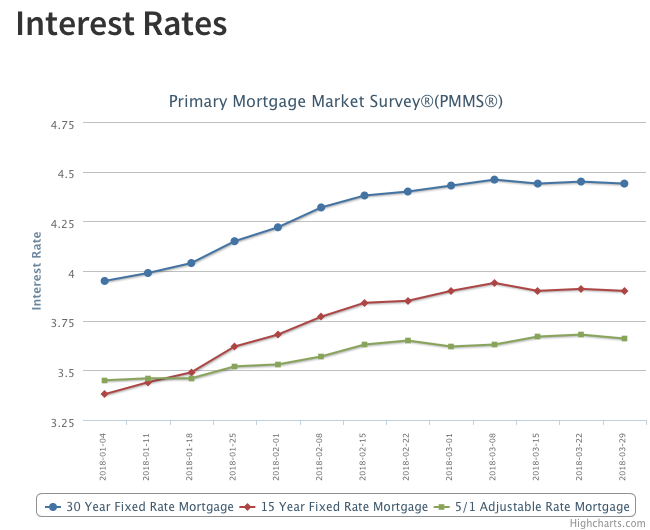

Mortgage Rates Little Changed

Treasury yields fell from a week ago helping to drive mortgage rates modestly lower. The yield on the 10-year Treasury dipped below 2.8 percent for the first time since early February of this year. The decline in Treasury yields comes as investors move into safer assets amid increased trade tensions. Following Treasurys, mortgage rates fell slightly. The U.S. weekly average 30-year fixed mortgage rate fell 1 basis point to 4.44 percent in this week’s survey.

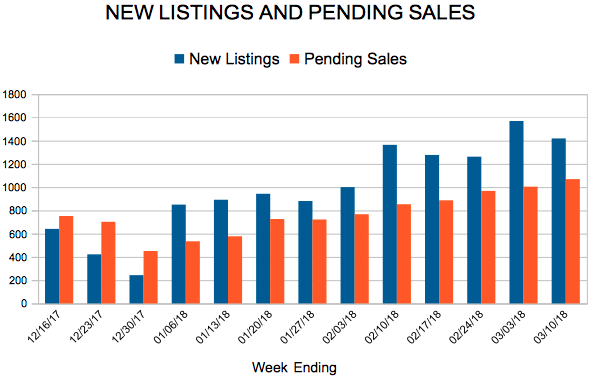

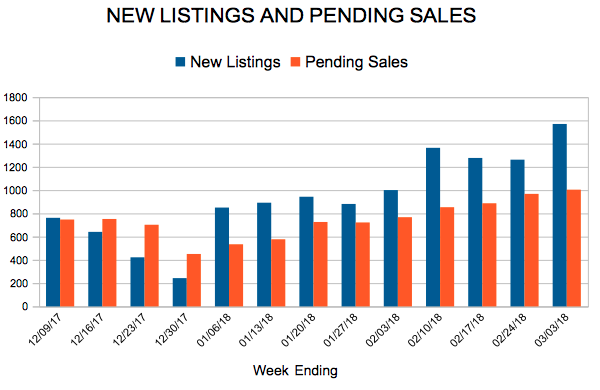

New Listings and Pending Sales

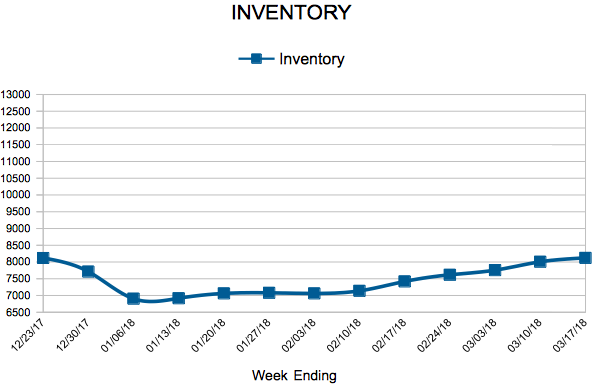

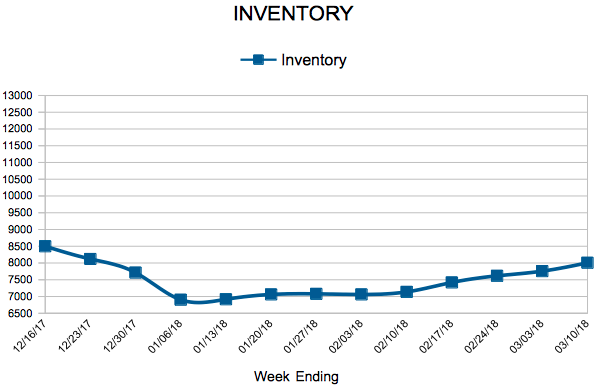

Inventory

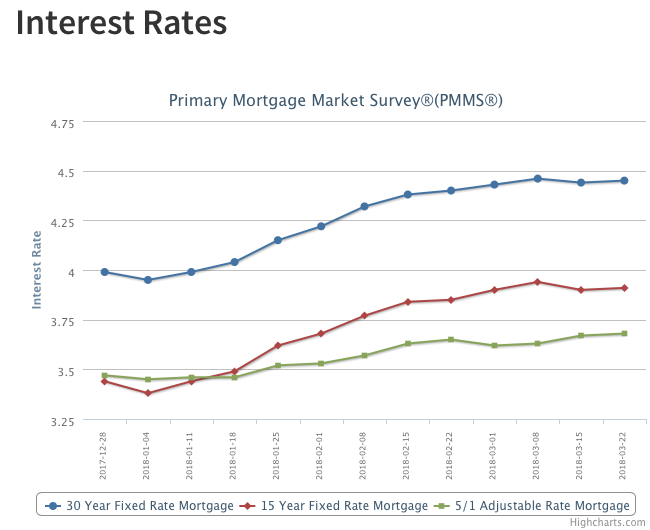

Mortgage Rates Hold Steady After Last Week’s Drop

The Federal Reserve raised interest rates today – a much-anticipated move that comes as both U.S. and global economic fundamentals continue to strengthen. The Fed’s decision to raise interest rates by a quarter of a percentage point puts the federal funds rate at its highest level since 2008. The decision, while widely expected, sent the yield on the benchmark 10-year Treasury soaring. Following Treasurys, mortgage rates shrugged off last week’s drop and continued their upward march. The U.S. weekly average 30-year fixed mortgage rate rose 1 basis point to 4.45 percent in this week’s survey.

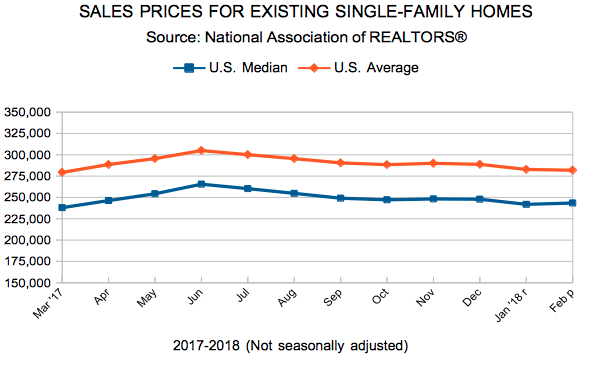

Existing Home Sales

New Listings and Pending Sales

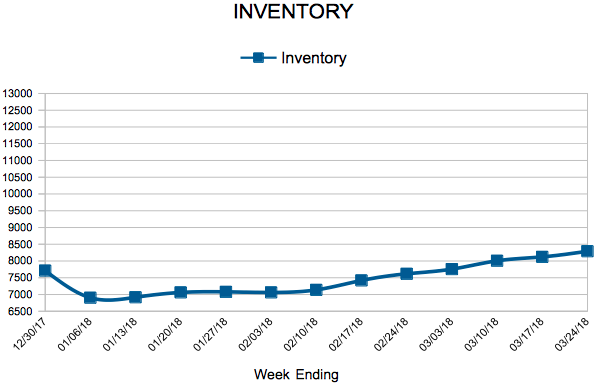

Inventory

Mortgage Rates Drop for First Time in 2018

Tuesday’s Consumer Price Index report indicated inflation may be cooling down; headline consumer price inflation was 2.2 percent year-over-year in February. Following this news, the 10-year Treasury fell slightly. Mortgage rates followed Treasurys and ended a nine-week surge. The U.S. weekly average 30-year fixed mortgage rate fell 2 basis points to 4.44 percent in this week’s survey, its first decline this year.