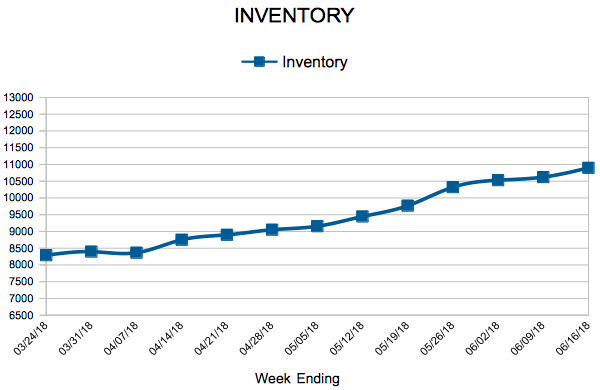

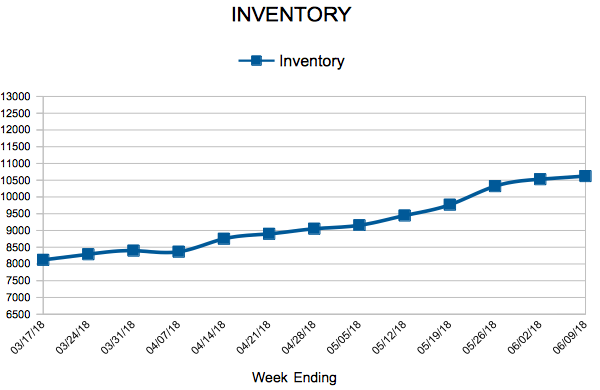

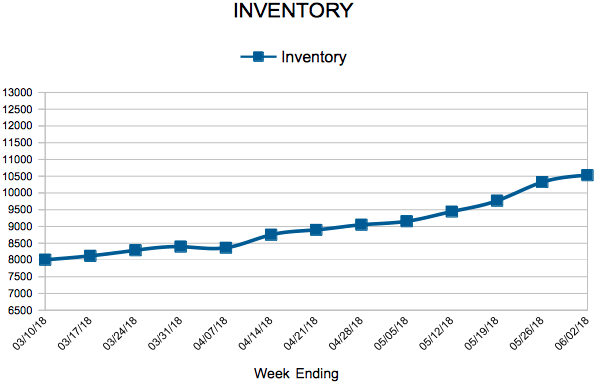

Inventory

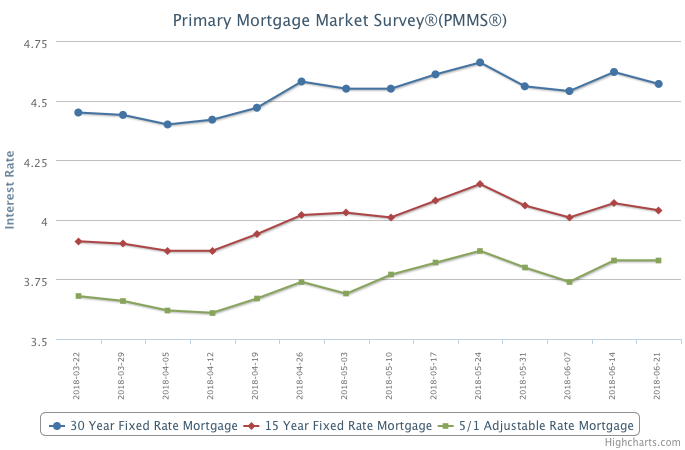

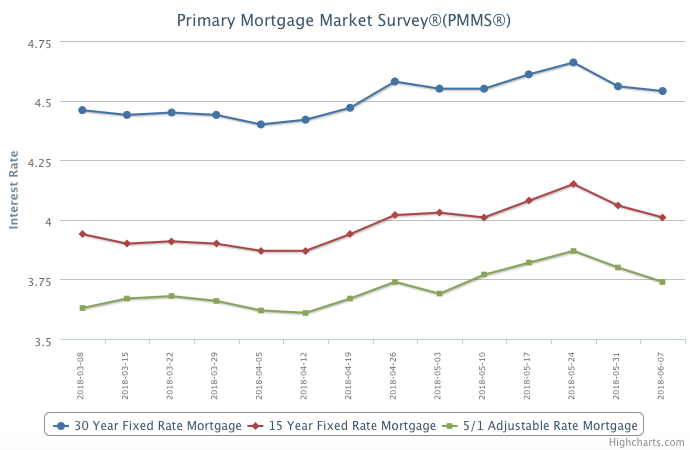

Mortgage Rates Retreat

Mortgage rates inched back over the past week and have now declined in three of the past four weeks.

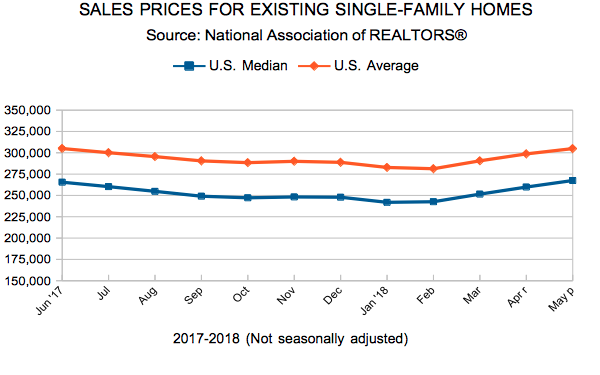

After a sharp run-up in the early part of 2018, mortgage rates have stabilized over the last three months, with only a modest uptick since March. However, existing-home sales have hit a wall, declining in six of the last nine months on a year-over-year basis.

This indicates that persistently low supply levels, and not this year’s climb in mortgage rates, are handcuffing sales – especially at the lower end of the market. Home shoppers can’t buy inventory that doesn’t exist.

Existing Home Sales

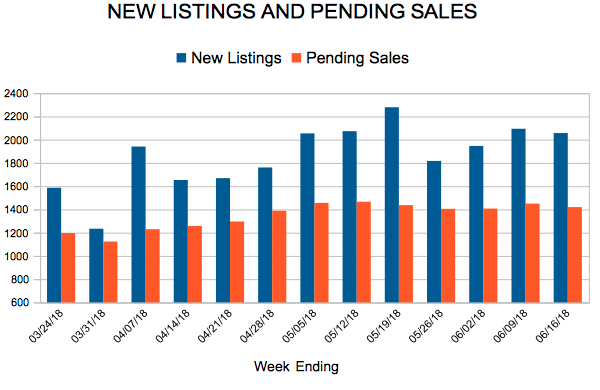

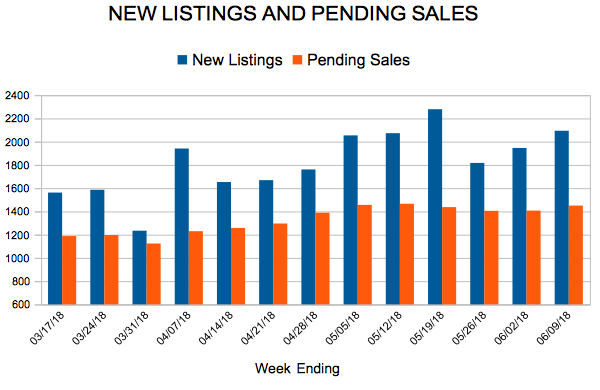

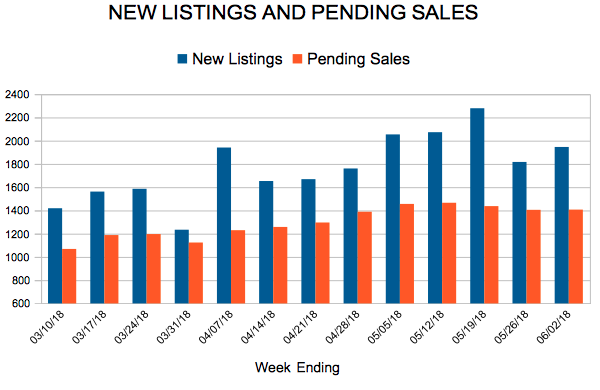

New Listings and Pending Sales

Inventory

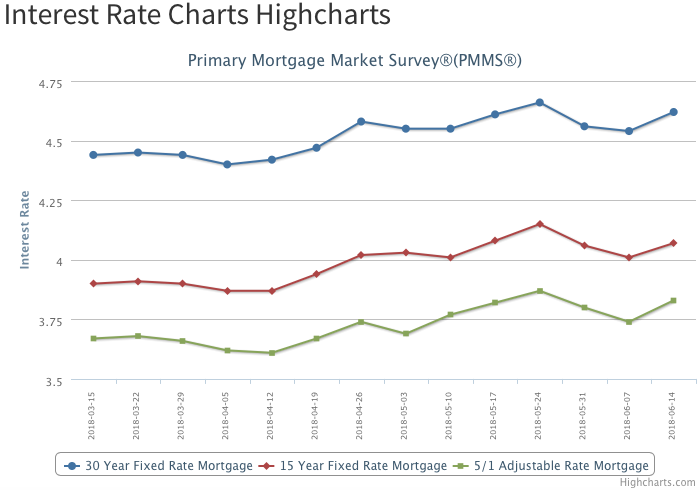

Mortgage Rates Back on the Rise

June 14, 2018

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year. The 30-year fixed-rate mortgage climbed eight basis points to 4.62 percent, and the Federal Reserve Board on Wednesday raised the federal funds rate by 25 basis points.

The good news is that the impact of rising rates on consumer budgets will be smaller than past rate hike cycles. That is because a much smaller segment of mortgage loans in today’s market are pegged to short-term rate movements. The adjustable rate mortgage (ARM) share of outstanding loans is a lot smaller now – 8 percent versus 31 percent – than during the Fed’s last round of tightening between 2004 and 2006.

New Listings and Pending Sales

Inventory

Mortgage Rates Inch Backward

Mortgage rates dipped for the second consecutive week. Homebuyers have taken advantage of the recent moderation in rates, which led to a 4 percent increase in purchase applications last week. Although demand has remained steadfast against the backdrop of this year’s higher borrowing costs, it’s important to note that the growth rate of purchase loan balances has moderated so far this year – and particularly since March. This slowdown indicates that buyers are having difficulty stretching to keep up with the pace of home-price growth.