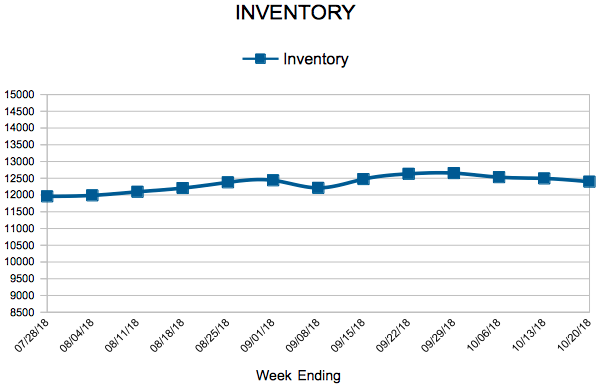

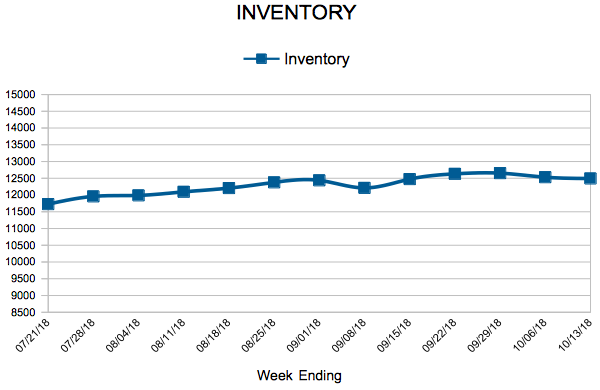

Inventory

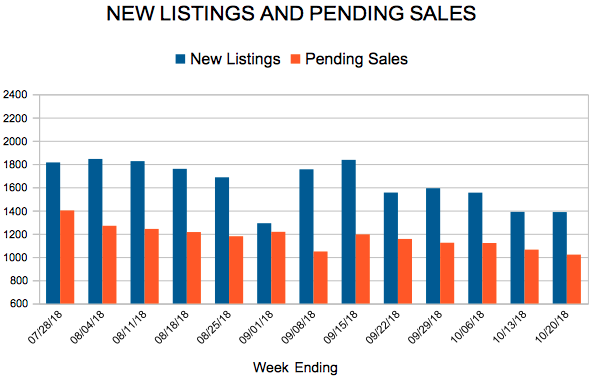

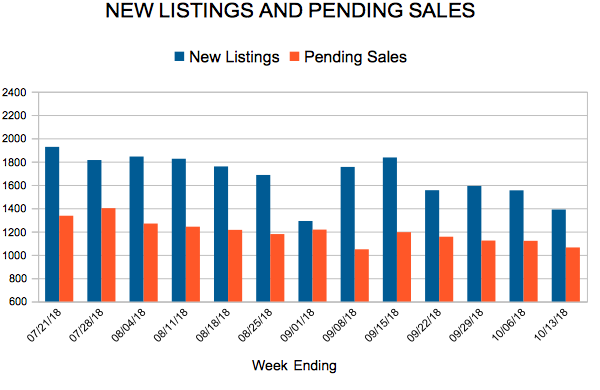

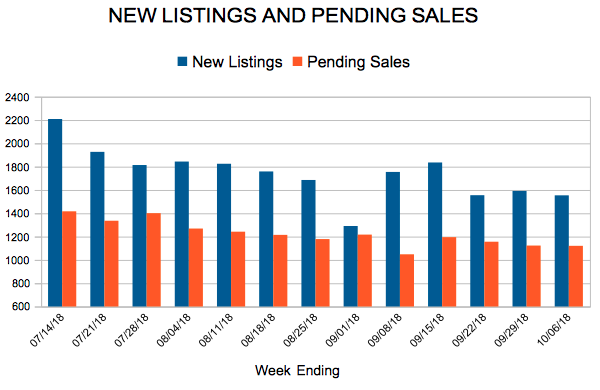

New Listings and Pending Sales

Inventory

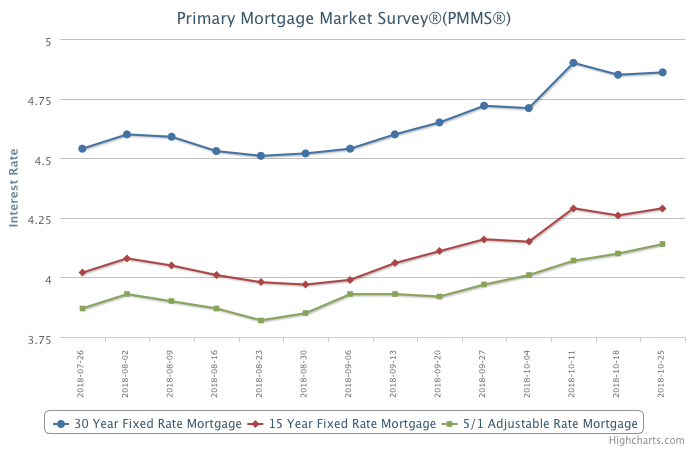

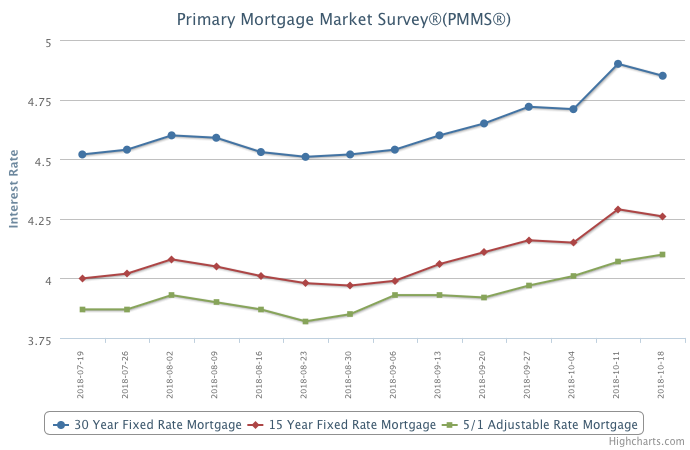

Mortgage Rates Inch Forward

October 25, 2018

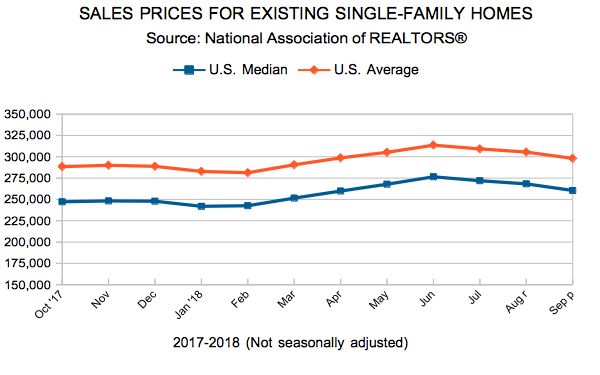

Despite volatility in the stock market, the 30-year fixed-rate mortgage inched forward just 1 basis point to 4.86 percent this week. We expect rates to continue to rise, which will put downward pressure on homebuying activity. While higher borrowing costs will keep some people out of the market, buyers with more flexibility could take advantage of the decreased competition.

Information provided by Freddie Mac.

Existing Home Sales

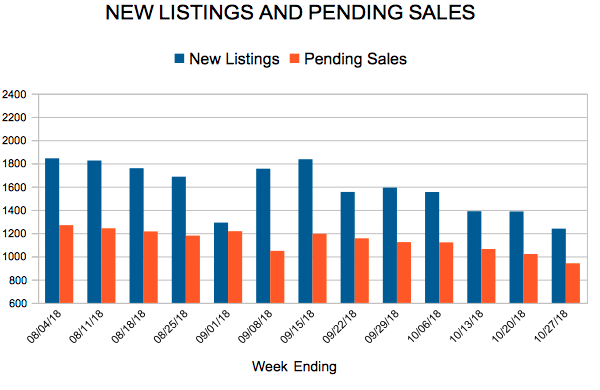

New Listings and Pending Sales

Inventory

Mortgage Rates Take a Breather

The modest decline in mortgage rates is a welcome respite from the rapid increase in rates the last few weeks. While the housing market has clearly softened in reaction to the rise in mortgage rates, the economy and consumer sentiment remain very robust and that will sustain purchase demand, particularly in affordable markets and neighborhoods.

Information provided by Freddie Mac.