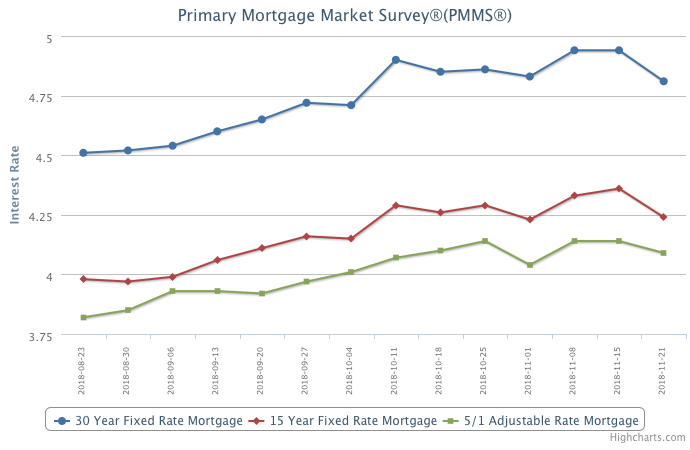

Mortgage Rates Pull Back

November 21, 2018

The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81 percent, the largest weekly drop since January 2015. Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.

Information provided by Freddie Mac.

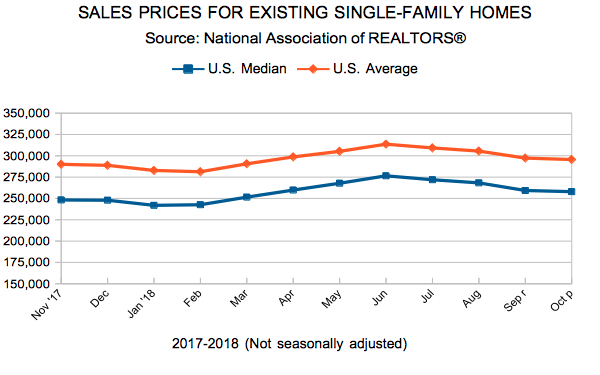

Existing Home Sales

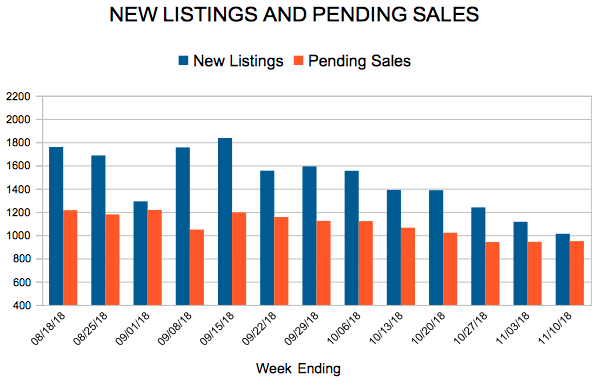

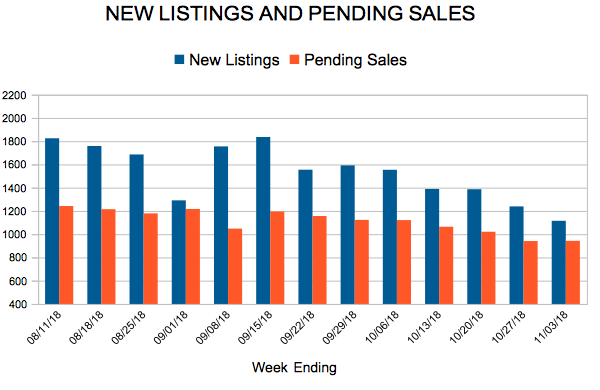

New Listings and Pending Sales

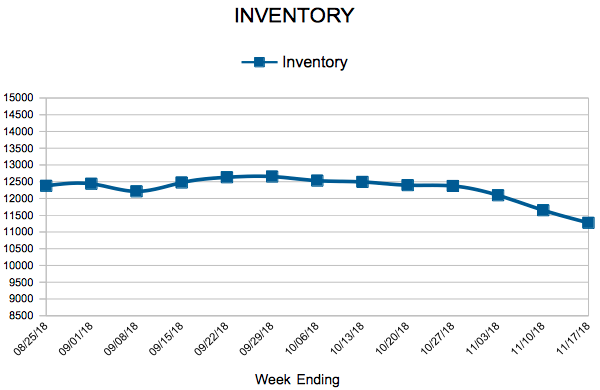

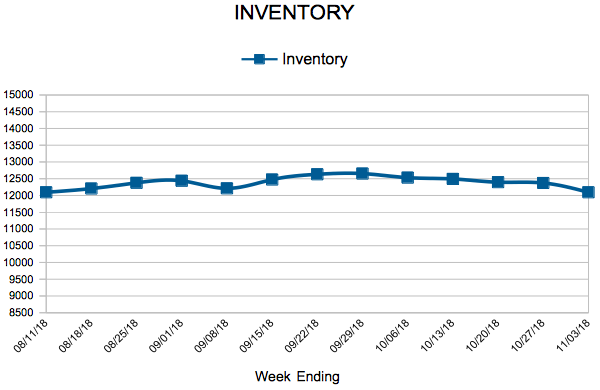

Inventory

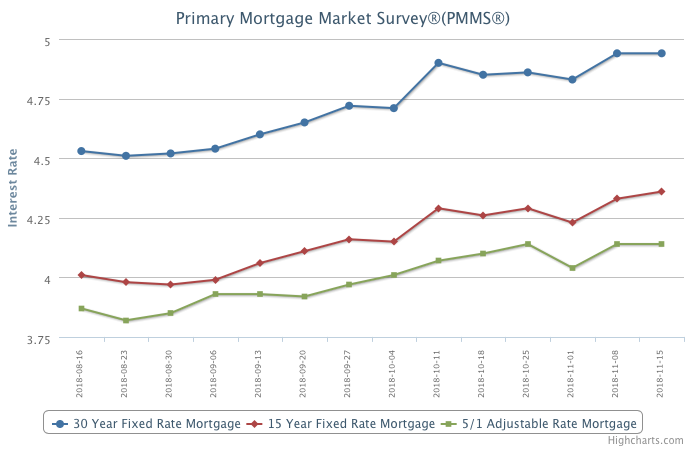

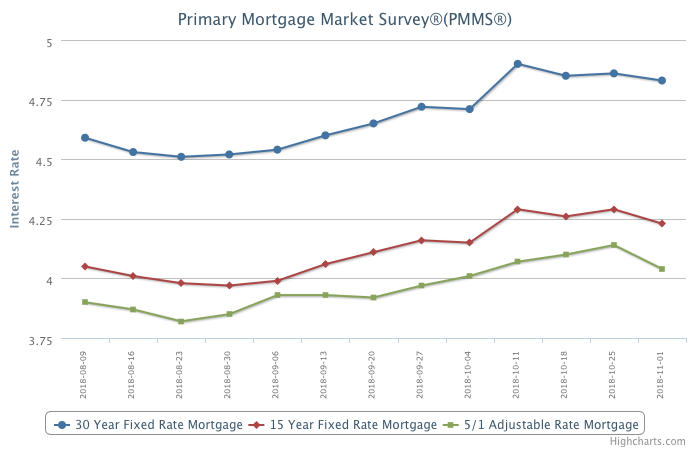

Mortgage Rates Stabilize

November 15, 2018

Despite recent market volatility, mortgage rates remained steady this week. The stability in mortgage rates reflects the moderation in inflationary pressures in the economy due to lower oil prices and subdued wage growth. On the margin, lower energy costs are a positive for the home sales market, particularly for lower-middle income suburban buyers who spend proportionately more income on transportation costs.

Information provided by Freddie Mac.

New Listings and Pending Sales

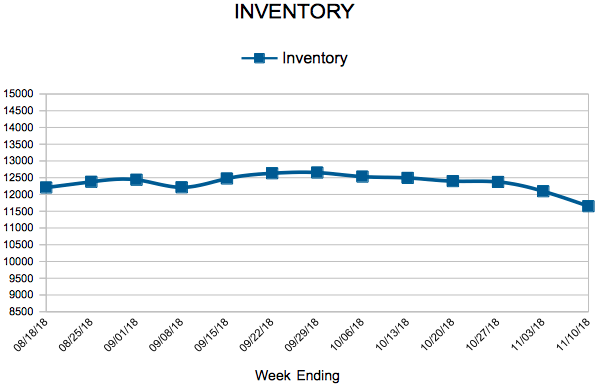

Inventory

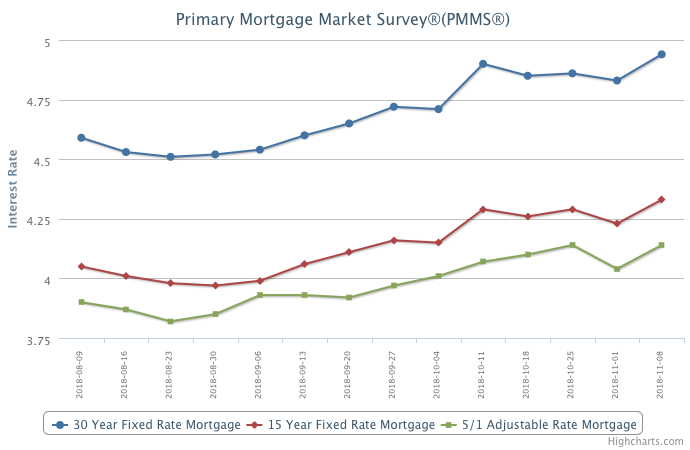

Mortgage Rates Hit Seven-Year High

November 8, 2018

The economy continued to show resilience as strong business activity and growth in employment drove the 30-year fixed mortgage rate to a seven year high of 4.94 percent – up 11 basis points from last week.

Higher mortgage rates have led to a slowdown in national home price growth, but the price deceleration has been primarily concentrated in affluent coastal markets such as California and the state of Washington. The more affordable interior markets – which have not yet experienced a slowdown home price growth – may see price growth start to moderate and affordability squeezed if mortgage rates continue to march higher.

Information provided by Freddie Mac.

Mortgage Rates Fall Back

November 1, 2018

While higher mortgage rates have led to a decline in home sales this year, the weakness has been concentrated in expensive segments versus entry-level and first-time buyer which remains firm throughout most of the rest of the country. Despite higher mortgage rates, the monthly mortgage payment remains affordable. For many buyers the chronic lack of entry-level supply is a larger hurdle than higher mortgage rates because choices are limited and the inventory shortage has caused home prices to rise well above fundamentals.

Information provided by Freddie Mac.