New Listings and Pending Sales

Reply

December 20, 2018

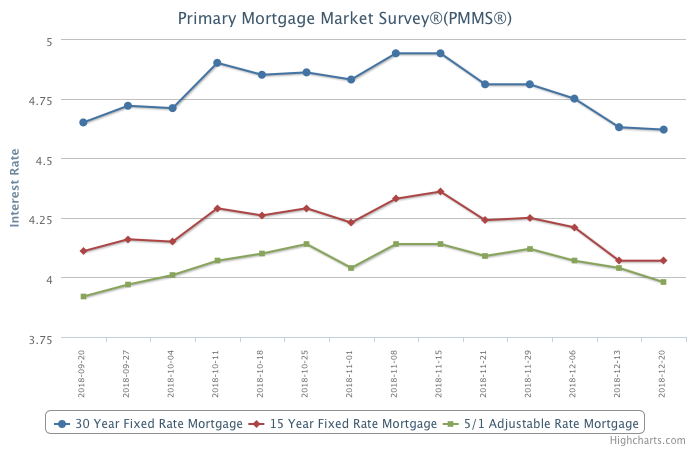

The response to the recent decline in mortgage rates is already being felt in the housing market. After declining for six consecutive months, existing home sales finally rose in October and November and are essentially at the same level as during the summer months. This modest rebound in sales indicates that homebuyers are very sensitive to mortgage rate changes – and given the further drop in rates we’ve seen this month, we expect to see a modest rebound in home sales as well.

Information provided by Freddie Mac.