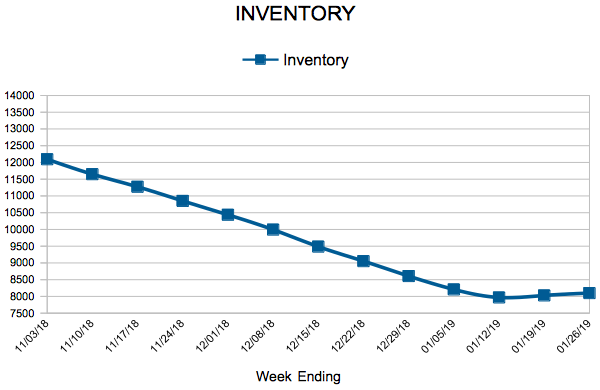

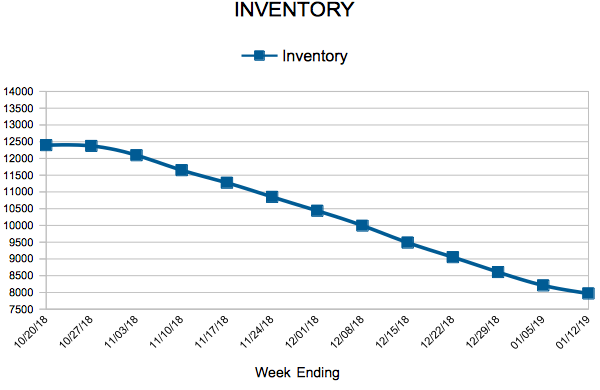

Inventory

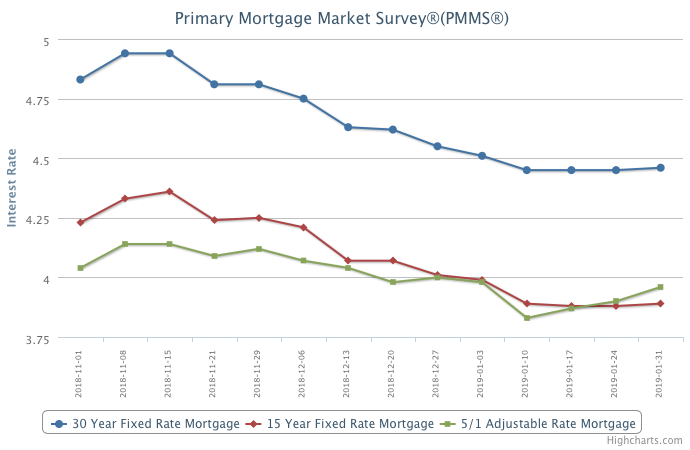

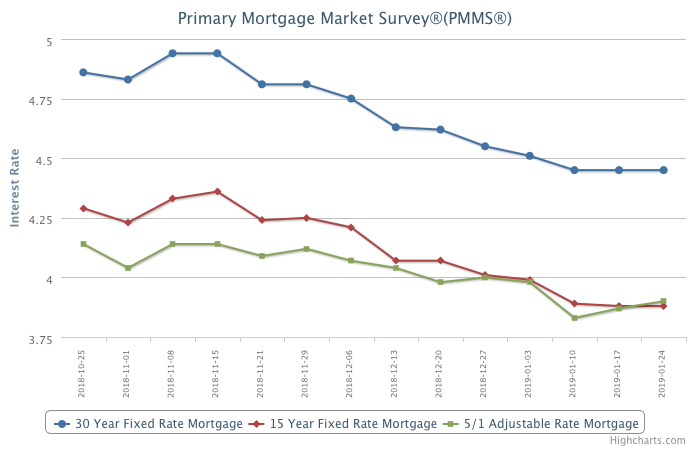

Mortgages Rates Tick Up

January 31, 2019

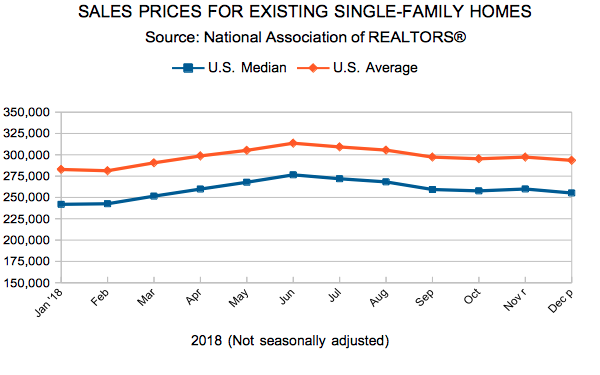

Purchase applications were down this week after soaring early in the year. However, softening house price appreciation along with increasing inventory of homes on the market – and historically low mortgage rates – should give a boost to the spring homebuying season.

Information provided by Freddie Mac.

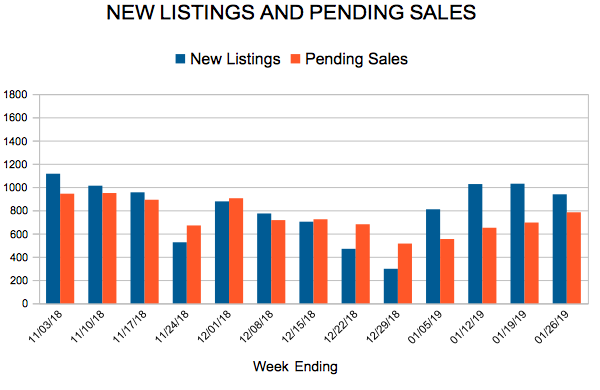

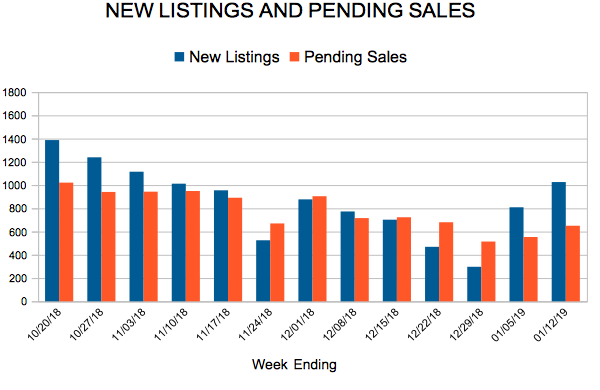

New Listings and Pending Sales

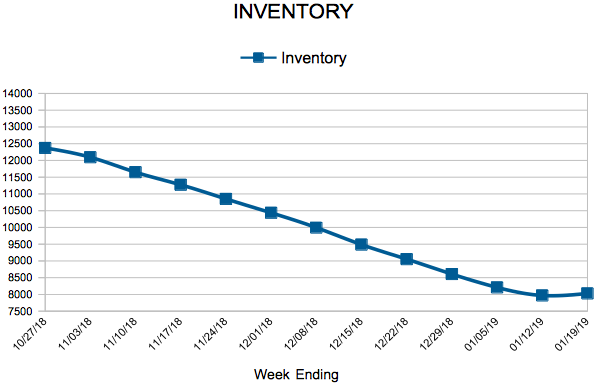

Inventory

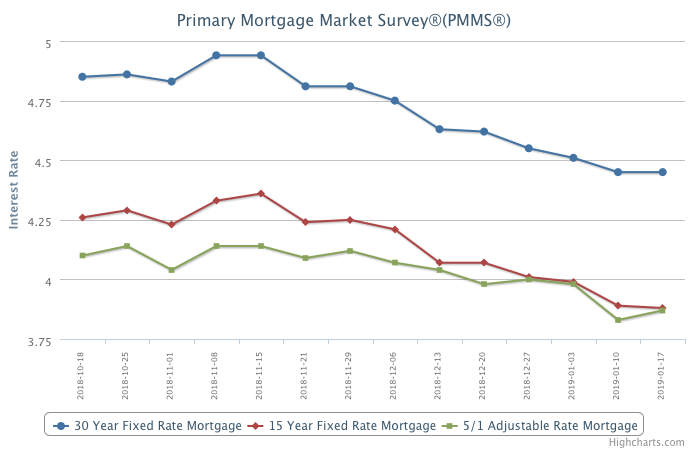

Fixed-Rate Mortgages Remain Unchanged

January 24, 2019

Mortgage rates have stabilized during the last month and are essentially at the same level as last spring – yet the most recent home sales are roughly half a million lower over the same period. Given that the economy remains on solid footing and weekly mortgage purchase application activity has been strong so far in 2019, we expect the decline in home sales to moderate or even reverse over the next couple of months.

Information provided by Freddie Mac.

Existing Home Sales

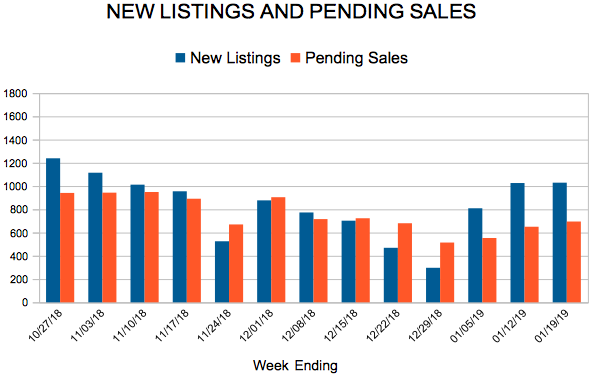

New Listings and Pending Sales

Inventory

Mortgage Rates Hold Steady

January 17, 2019

Weaker manufacturing data and a more dovish tone from the Federal Reserve left mortgage rates unchanged relative to last week. However, interest rate-sensitive sectors of the economy – such as consumer mortgage demand and homebuilder construction sentiment – are on the mend, which indicates that lower interest rates are beginning to have a positive impact on some segments of the economy.

Information provided by Freddie Mac.