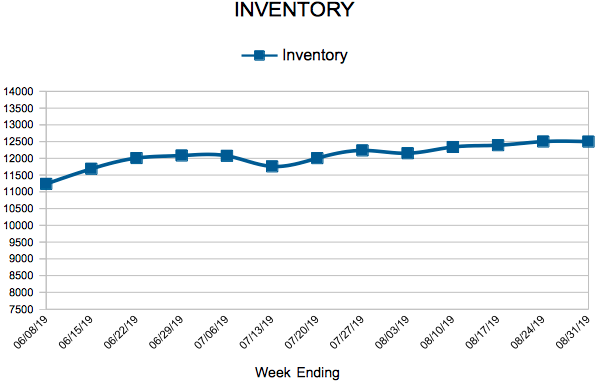

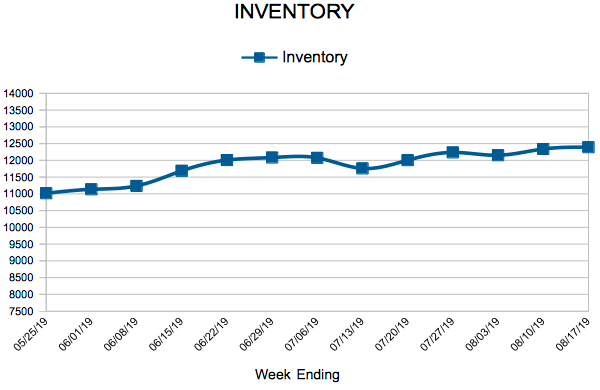

Inventory

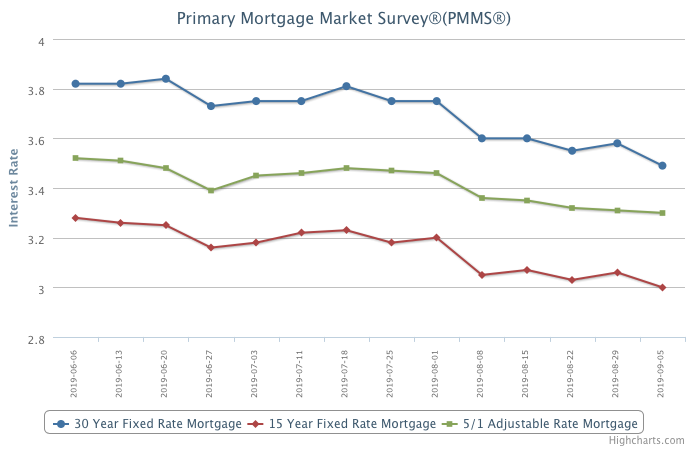

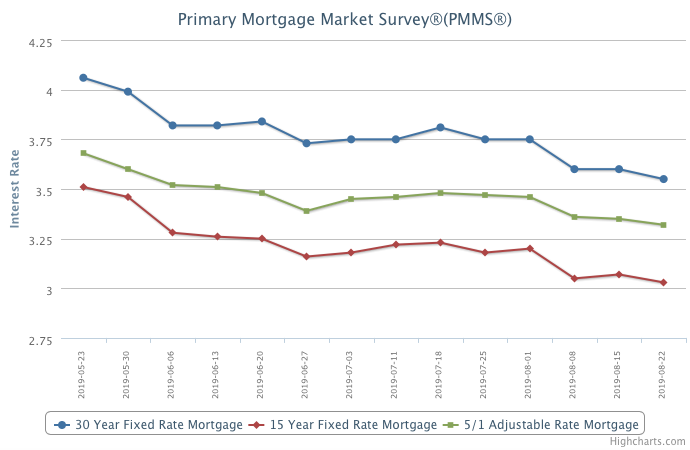

Mortgage Rates Drop

September 5, 2019

Mortgage rates continued the summer swoon due to weaker economic data. While economic growth is clearly slowing due to rising manufacturing and trade headwinds, economic fundamentals are still solid for U.S. consumers. The unemployment rate is low, housing affordability is improving, homebuyer demand is rising, and home price growth is stable.

Information provided by Freddie Mac.

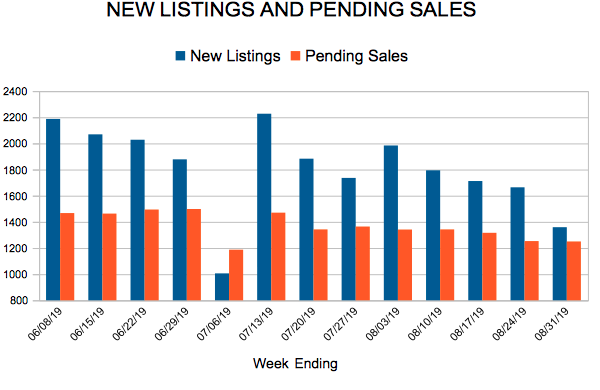

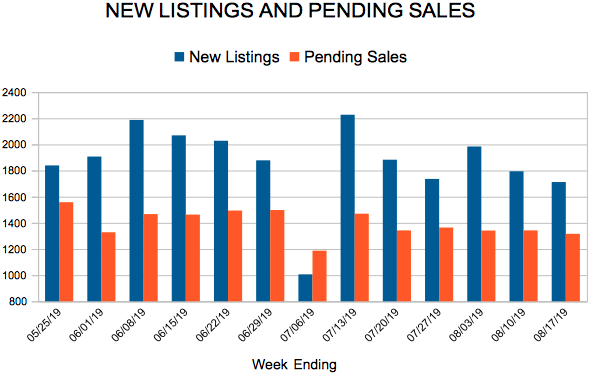

New Listings and Pending Sales

Inventory

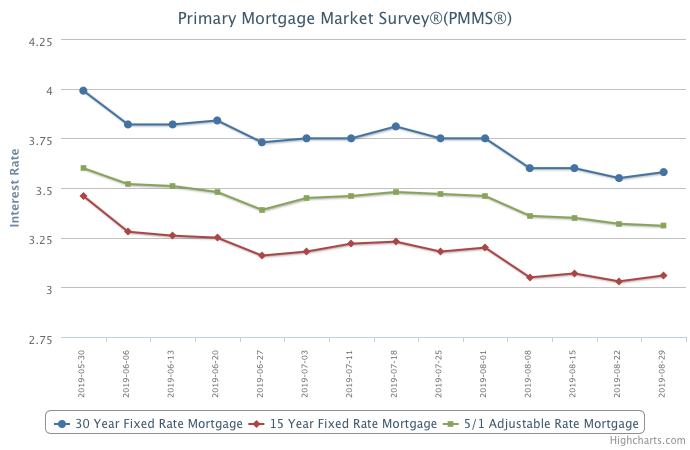

Mortgage Rates Generally Hold Steady

August 29, 2019

Mortgage rates inched up slightly this week, closing the month with the 30-year fixed-rate mortgage rate averaging 3.6 percent – almost a full percent lower from the same time last year. Low mortgage rates along with a strong labor market are fueling the consumer-driven economy by boosting their purchasing power, which will certainly support housing market activity in the coming months.

Information provided by Freddie Mac.

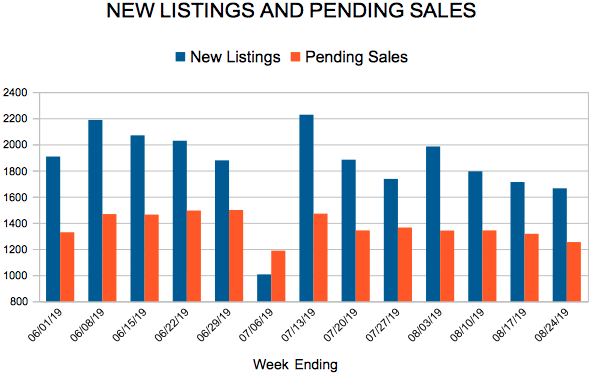

New Listings and Pending Sales

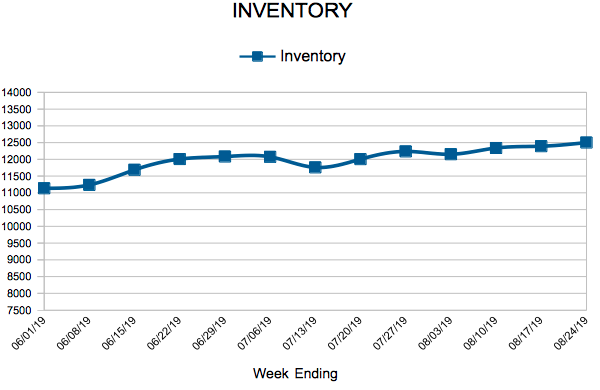

Inventory

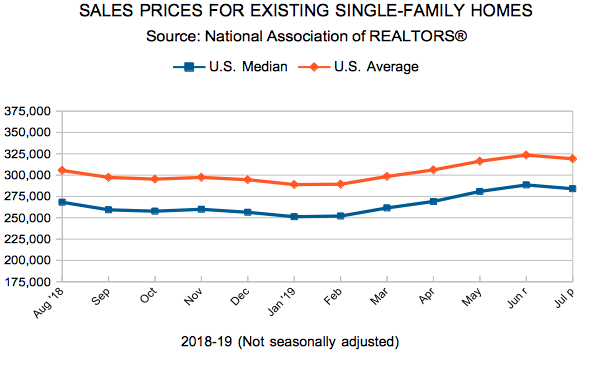

Real Estate Market Strengthens as Mortgage Rates Continue to Drop

August 22, 2019

The drop in mortgage rates continues to stimulate the real estate market and the economy. Home purchase demand is up five percent from a year ago and has noticeably strengthened since the early summer months, while refinances surged to their highest share in three and a half years. Households that refinanced in the second quarter of 2019 will save an average of $1,700 a year, which is equivalent to about $140 each month. The benefit of lower mortgage rates is not only shoring up home sales, but also providing support to homeowner balance sheets via higher monthly cash flow and steadily rising home equity.

Information provided by Freddie Mac.