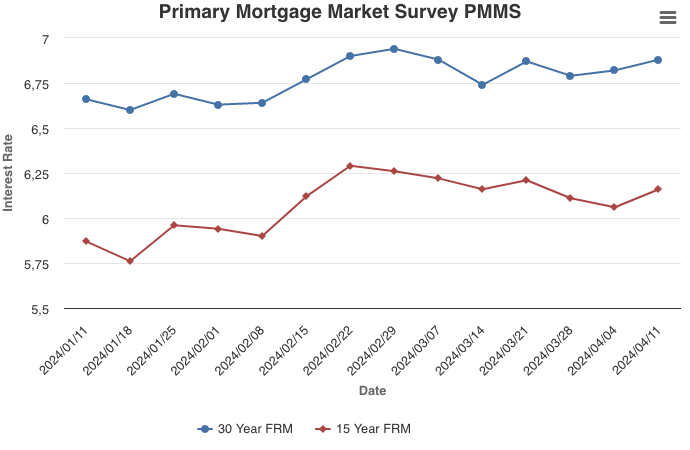

April 11, 2024

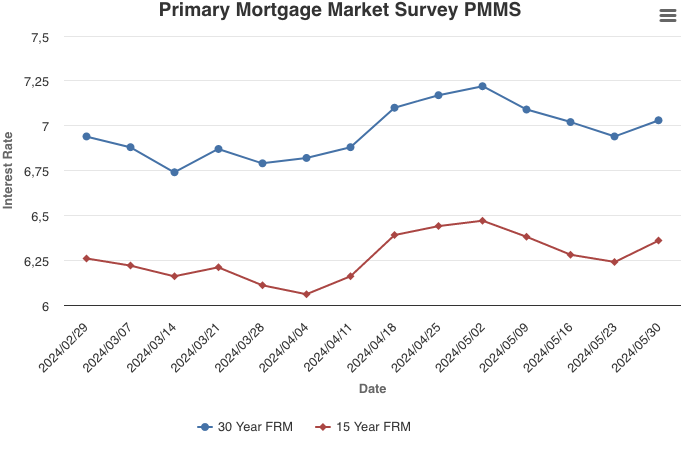

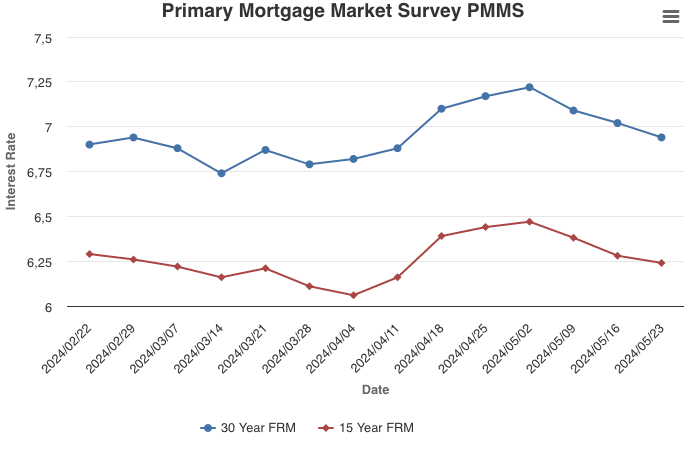

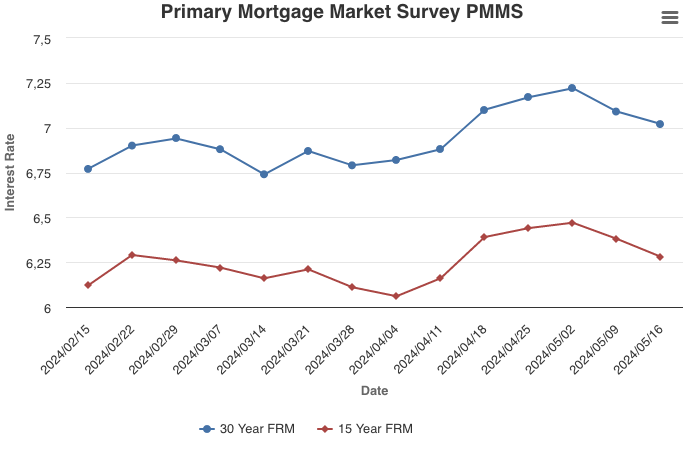

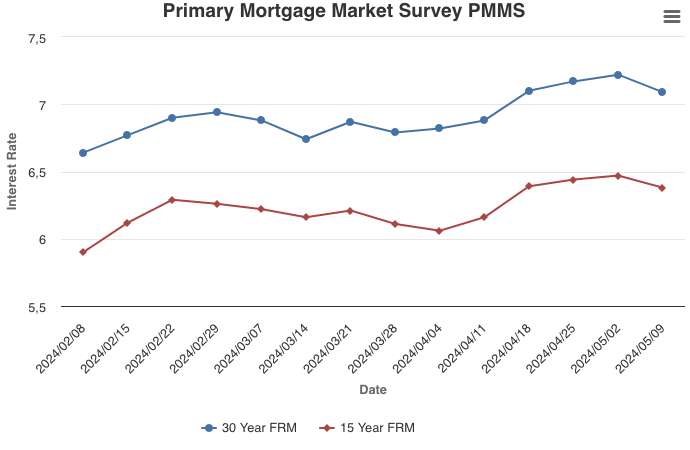

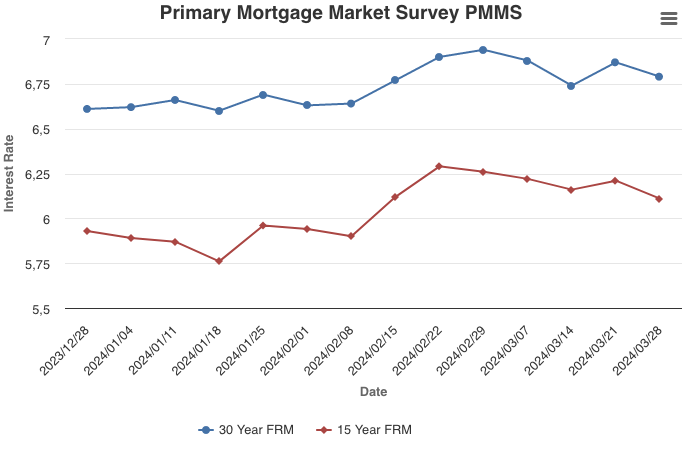

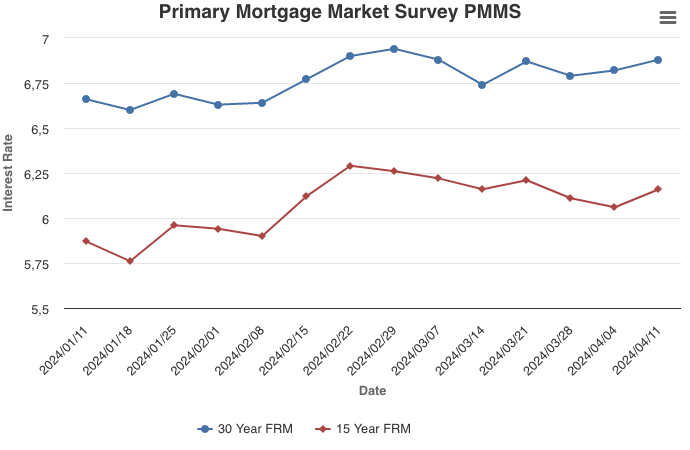

Mortgage rates have been drifting higher for most of the year due to sustained inflation and the reevaluation of the Federal Reserve’s monetary policy path. While newly released inflation data from March continues to show a trend of very little movement, the financial market’s reaction paints a far different economic picture. Since inflation decelerated from 9% to 3% between June 2022 and June 2023, the annual growth rate of inflation has remained effectively flat, ranging from 3.1% to 3.7% and averaging 3.3%. The March estimate of 3.5% annual growth is in the middle of that range. However, the market’s reaction was dramatically different, as illustrated by a significant drop in the Dow Jones Industrial Average post-announcement.

It’s clear that while the trend in inflation data has been close to flat for nearly a year, the narrative is much less clear and resembles the unrealized expectations of a recession from a year ago.

Information provided by Freddie Mac.