Category Archives: Interest Rates

Reply

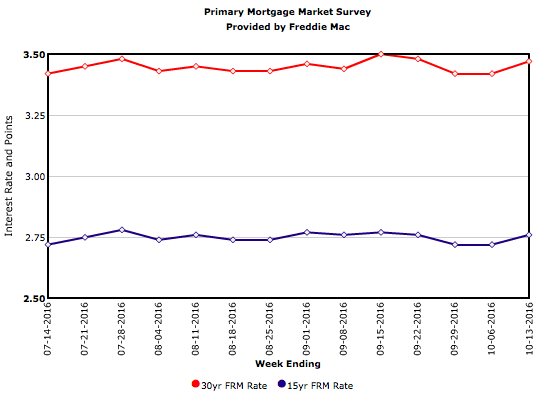

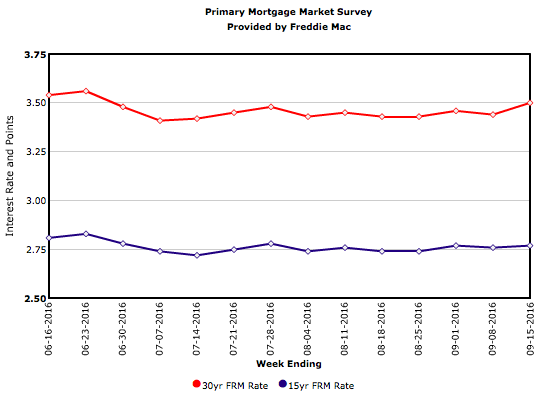

Mortgage Rates Largely Unchanged

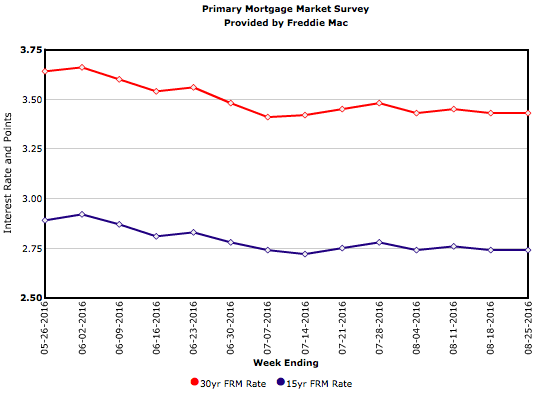

Mortgage Rates Hit 10-Week Low

Mortgage Rates Tick Down

Mortgage Rates Head Up

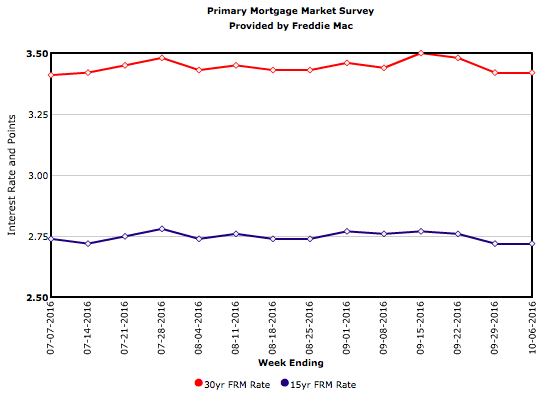

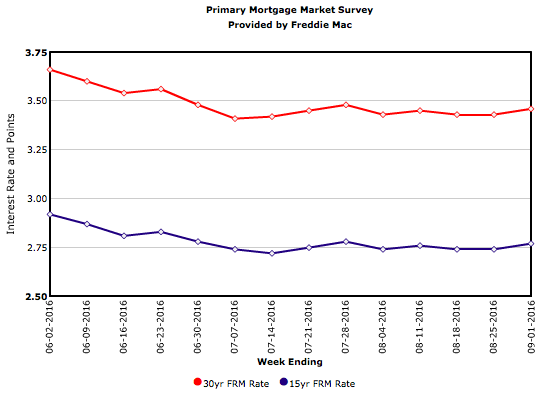

Low Mortgage Rates Continue to Spur Refinancing

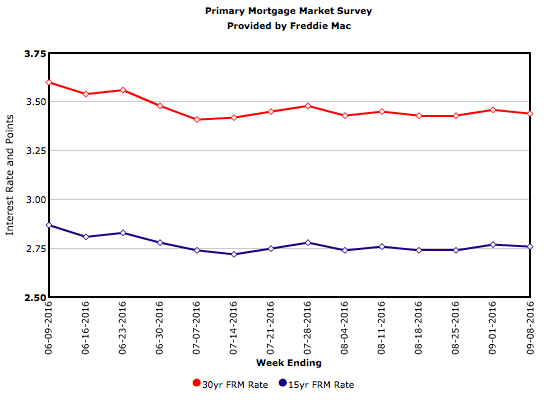

The 30-year fixed-rate mortgage fell 2 basis points to 3.44 percent this week. As mortgage rates continue to range between 3.41 and 3.48 percent, many are taking advantage of the historically low rates by refinancing. Since the Brexit vote, the refinance share of mortgage activity has remained above 60 percent.

Mortgage Rates Edge Higher

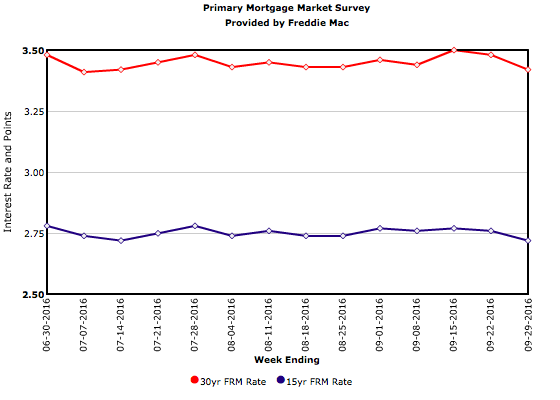

Fixed Mortgage Rates Unchanged

Mortgage Rates Nudge Lower

Mortgage Rates Little Changed

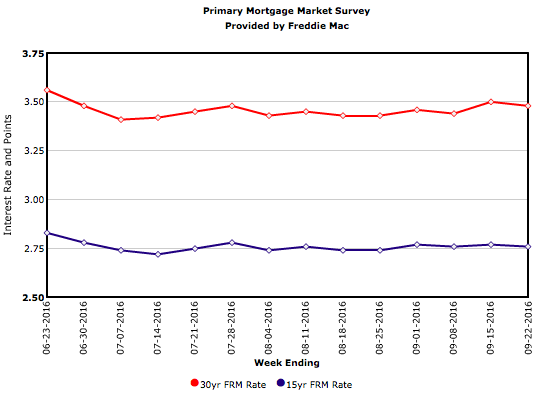

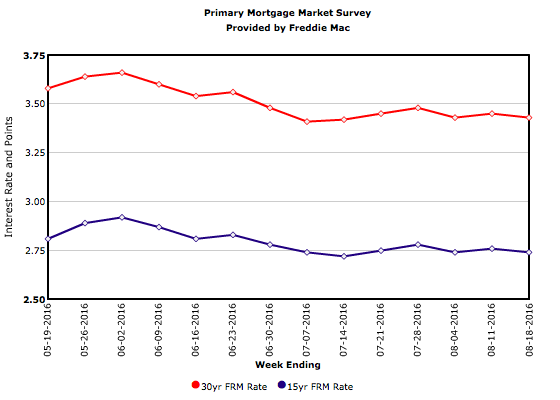

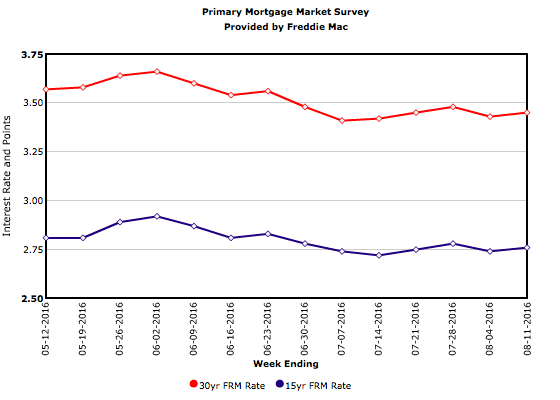

A surprisingly strong July jobs report showed 255,000 jobs added and 0.3 percent wage growth from last month, exceeding many experts’ expectations. In response, the 10-Year Treasury yield rose to its highest level since June and the 30-year fixed-rate mortgage increased 2 basis points to 3.45 percent.