Category Archives: Interest Rates

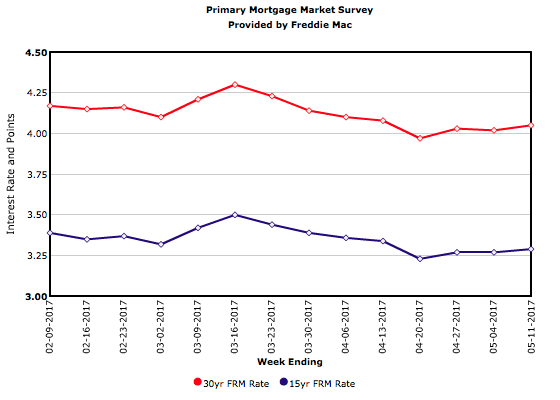

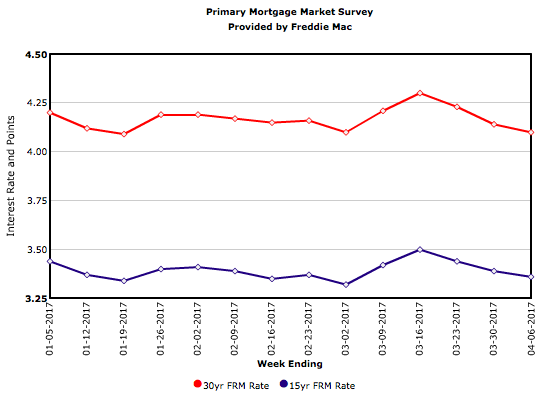

Mortgage Rates Hold Steady

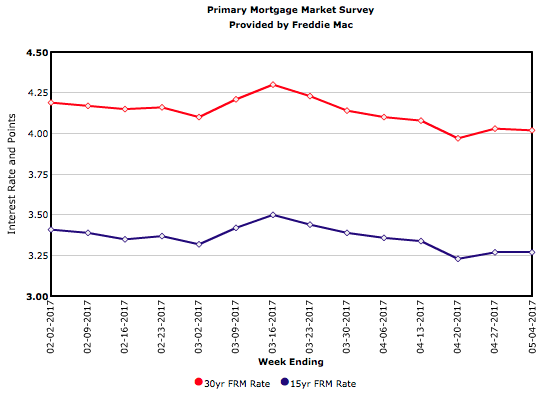

Mortgage Rates Increase After Weeks of Decline

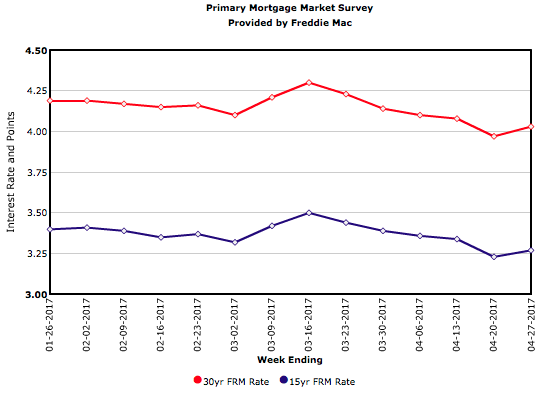

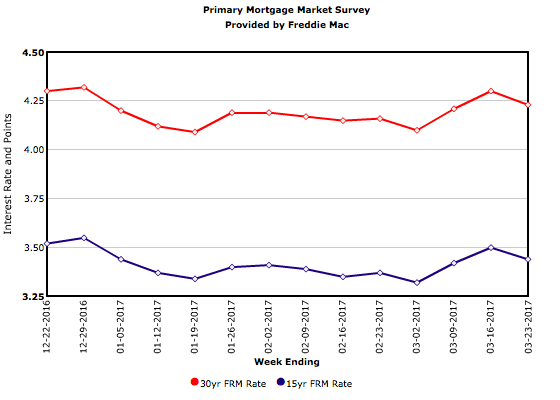

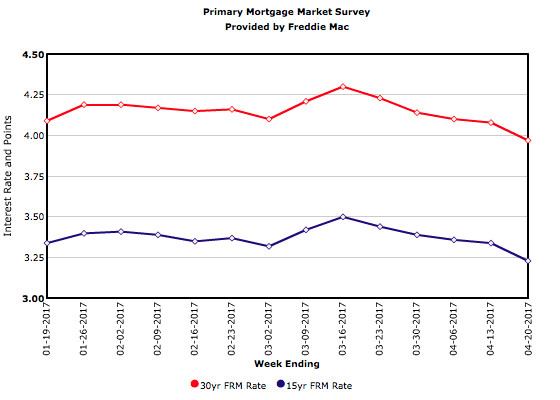

Mortgage Rates Tumble Below 4 Percent

The 30-year mortgage rate fell 11 basis points this week to 3.97 percent, dropping below the psychologically-important 4 percent level for the first time since November. Weak economic data and growing international tensions are driving investors out of riskier sectors and into Treasury securities. This shift in investment sentiment has propelled rates lower.

Mortgage Rates Hit Lowest Mark of 2017

Mortgage Rates Move Lower

Mortgage Rates See Another Significant Decline

Mortgage Rate Drop Signals Continued Uncertainty

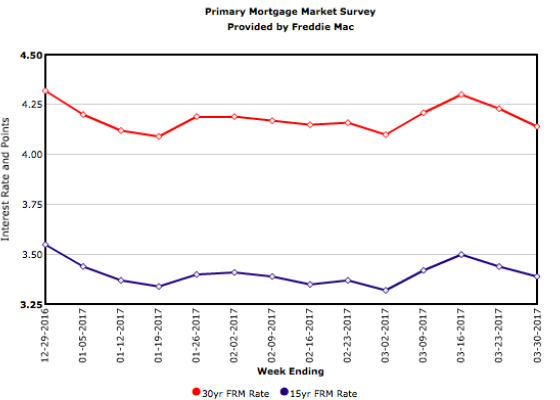

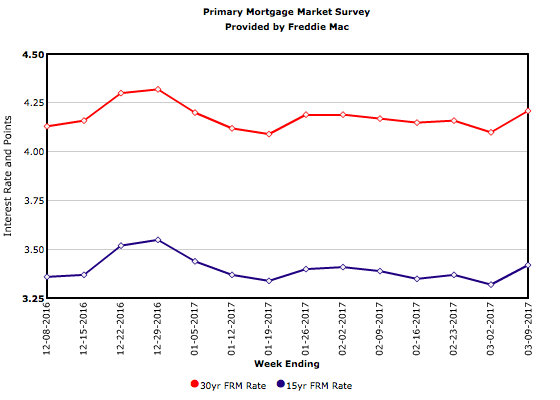

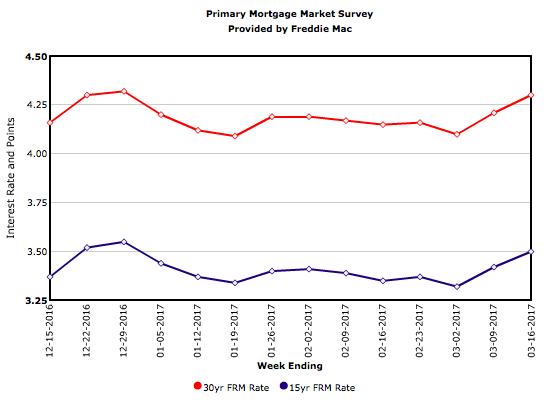

Mortgage Rates Move Higher

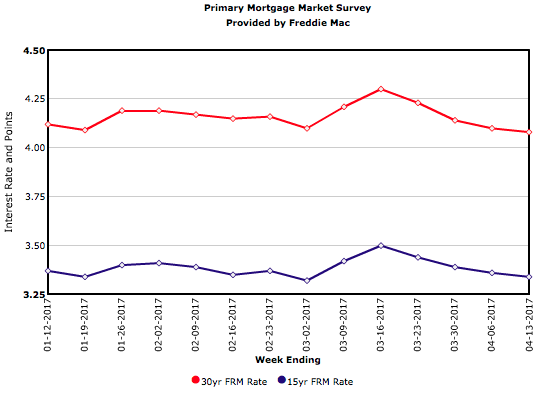

The FOMC announced its first rate hike of 2017 and hinted at additional increases throughout the remainder of the year. Although Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) was conducted prior to the Fed’s decision, the release of the February jobs report all but guaranteed a rate hike and boosted the 30-year mortgage rate 9 basis points to 4.30 percent this week.