Category Archives: Interest Rates

Reply

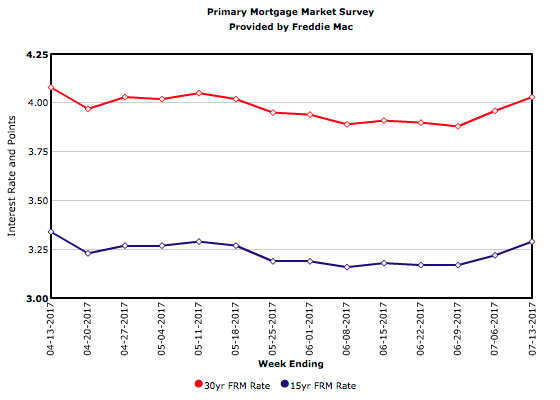

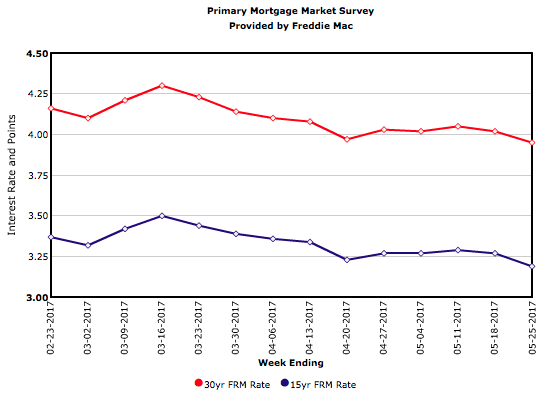

Mortgage Rates Jump Again

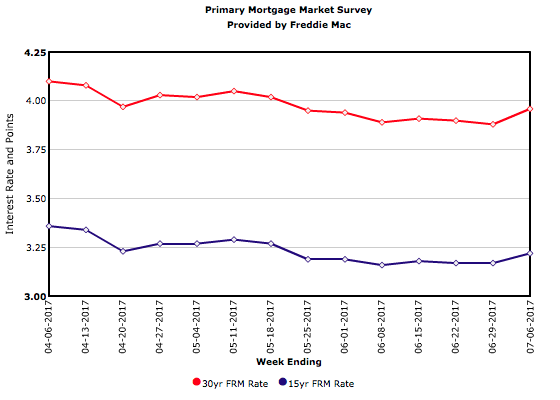

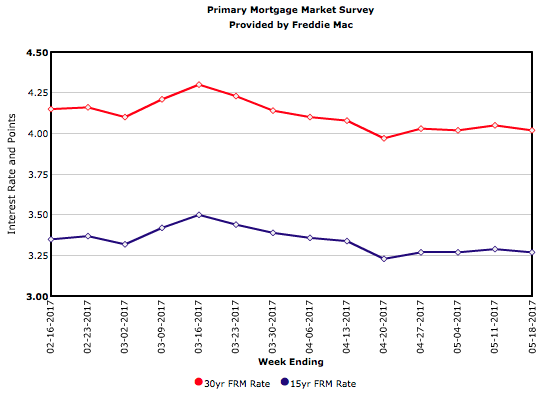

Mortgage Rates Jump

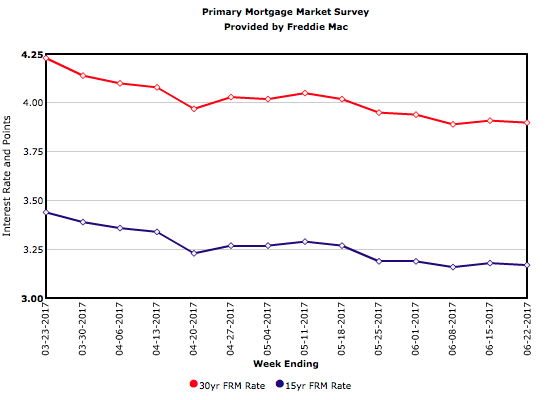

30-Year Fixed Mortgage Rate Hits New Low

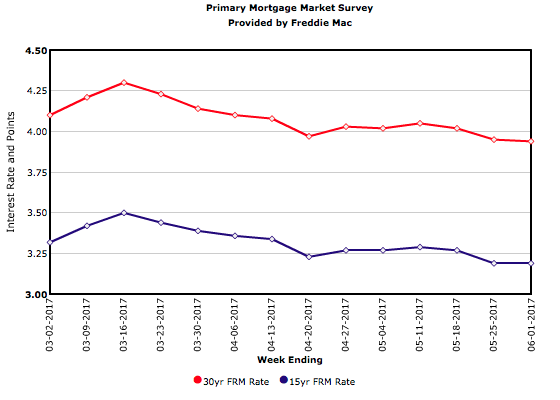

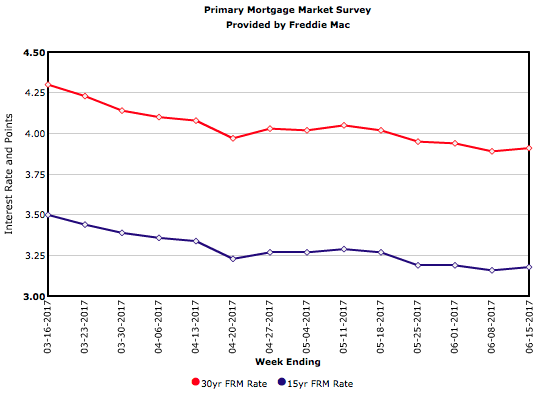

The 30-year mortgage rate fell 2 basis points to 3.88 percent this week. However, the majority of this Primary Mortgage Market Survey® (PMMS®) was conducted prior to Tuesday’s sell-off in the bond market which drove Treasury yields higher. Mortgage rates may increase in next week’s survey if Treasury yields continue to rise.

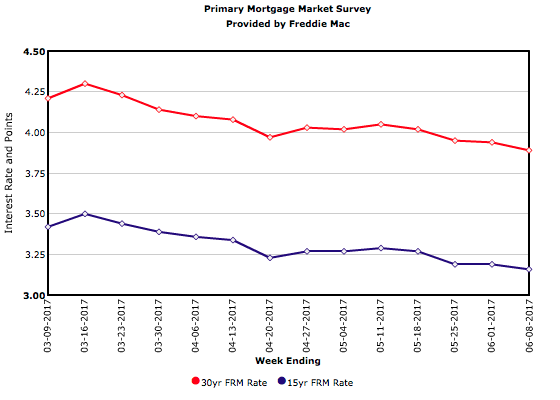

Mortgage Rates Continue to Hold

Mortgage Rates Inch Up After Extended Decline

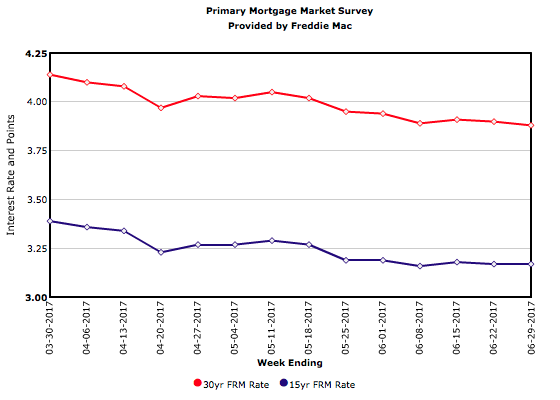

The 30-year mortgage rate rose 2 basis points over the week to 3.91 percent. However, Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) was conducted before investors drove Treasury yields sharply lower in a reaction to the surprisingly weak CPI release. If that drop in yields sticks, mortgage rates are likely to follow in next week’s survey.