Category Archives: Interest Rates

Reply

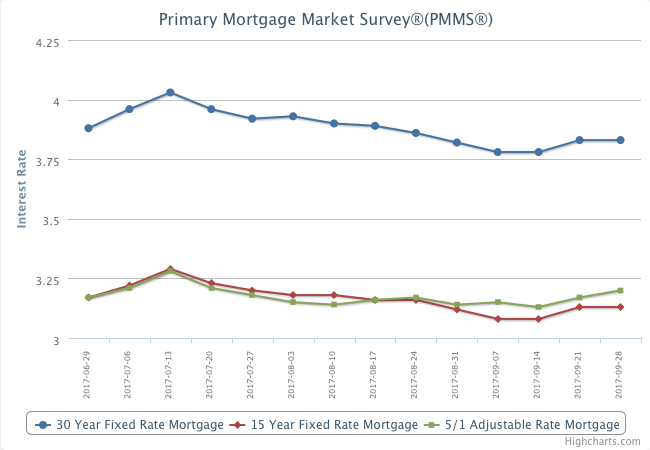

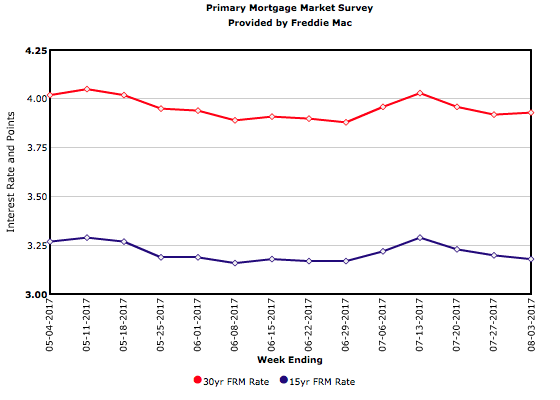

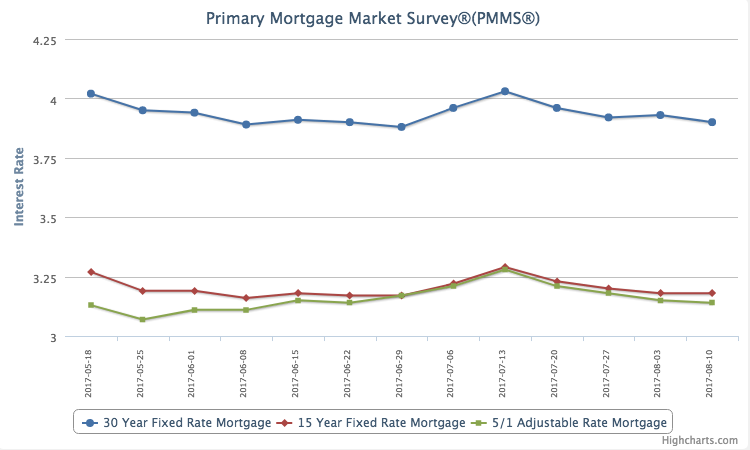

Mortgage Rates Increase After Lengthy Decline

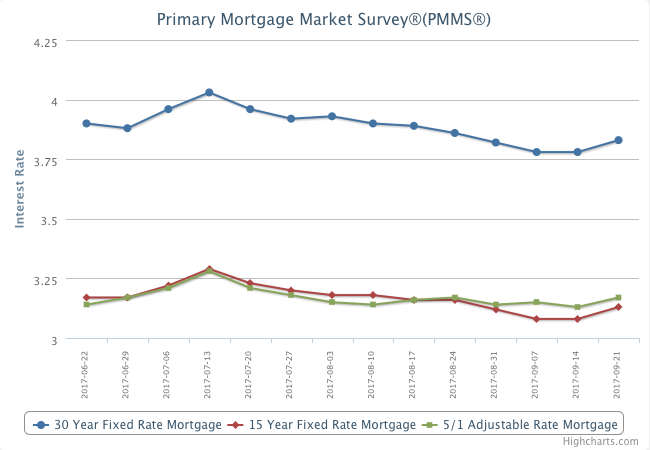

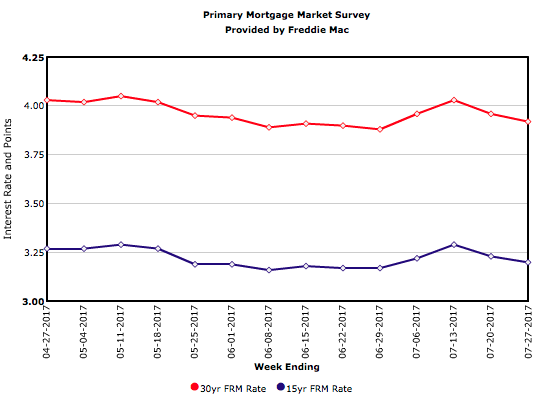

Mortgage Rates Hold at 2017 Low

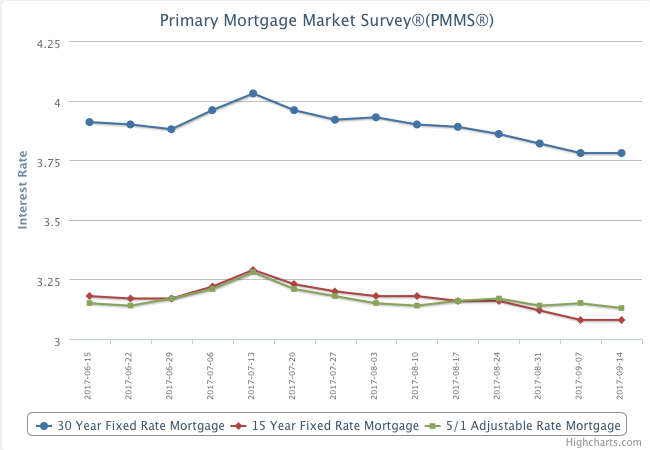

30-Year Mortgage Rate Hits Another 2017 Low

Mortgage Rates Continue to Drop

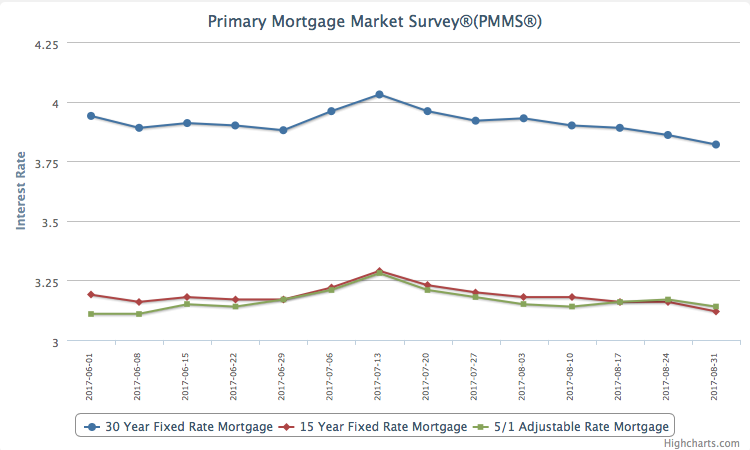

The 10-year Treasury yield fell to a new 2017-low on Tuesday. In response, the 30-year mortgage rate dropped 4 basis points to 3.82 percent, reaching a new year-to-date low for the second consecutive week. However, recent releases of positive economic data could halt the downward trend of mortgage rates.

30-Year Mortgage Rate Hits 2017 Low

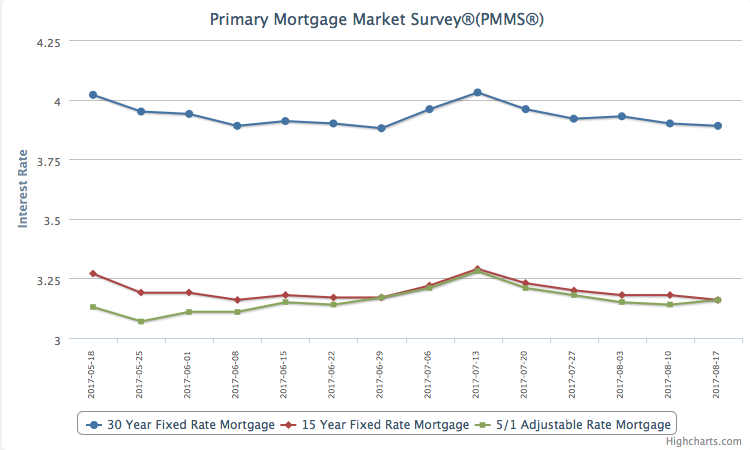

Mortgage Rates Drop Again

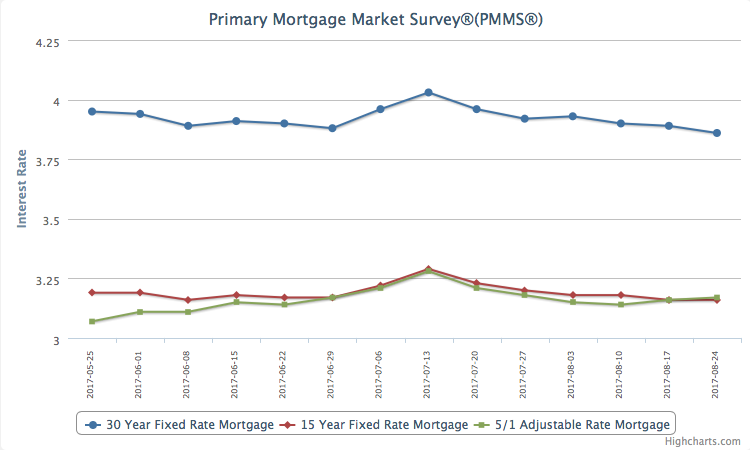

Mortgage Rates Inch Lower

After holding relatively flat last week, the 10-year Treasury yield fell 4 basis points this week. The 30-year mortgage rate moved in tandem with Treasury yields, dropping 3 basis points to 3.90 percent. Earlier this week, Federal Reserve officials highlighted the influence of continued weak inflation data on rates.