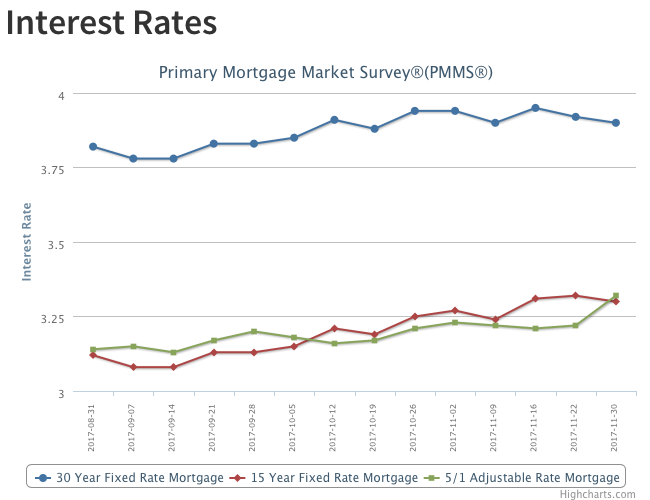

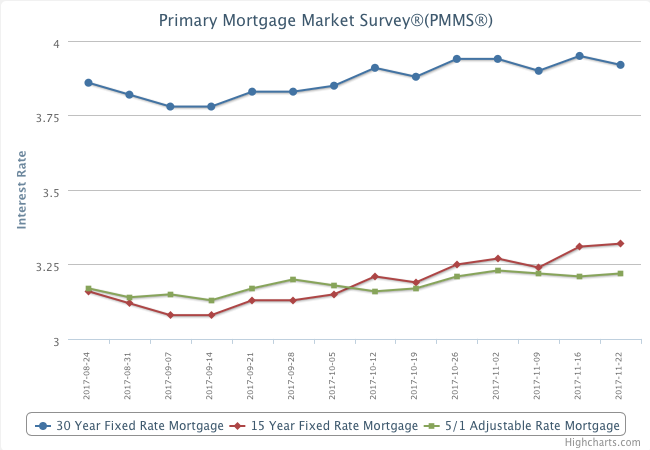

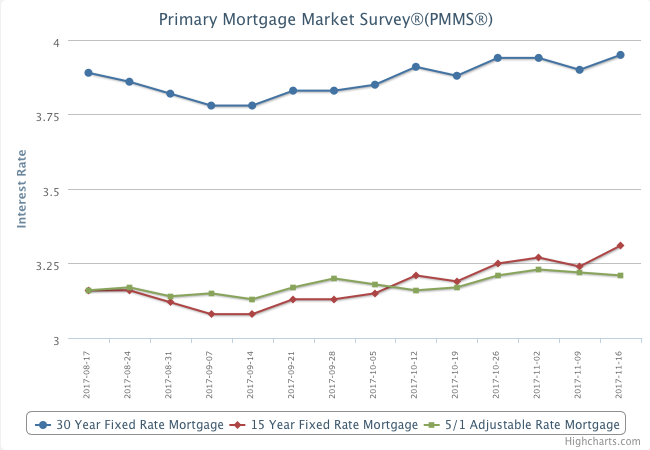

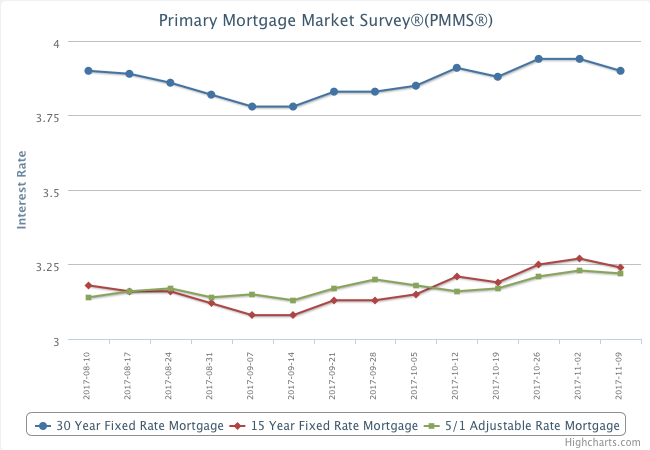

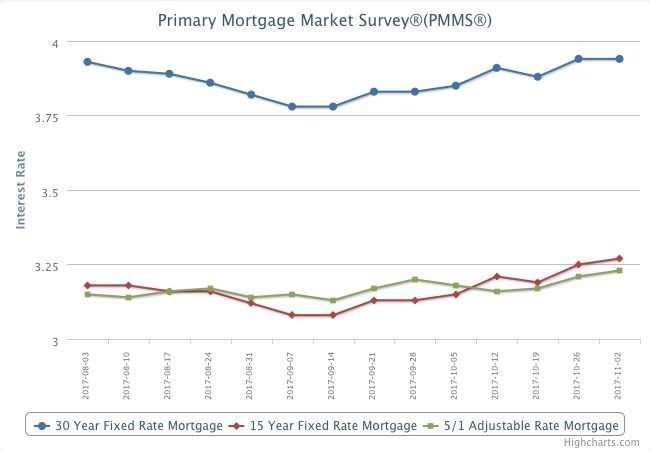

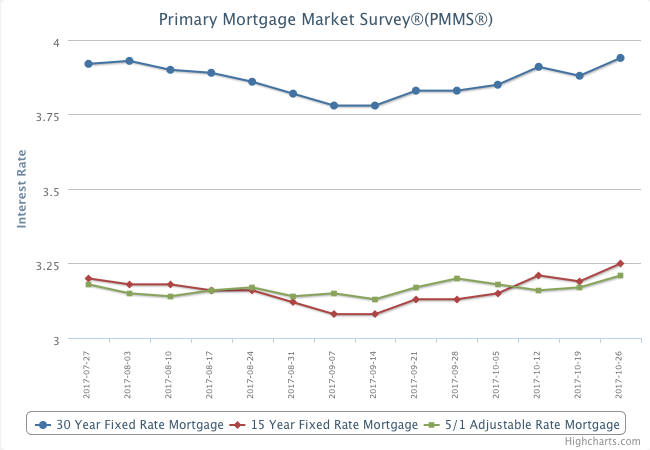

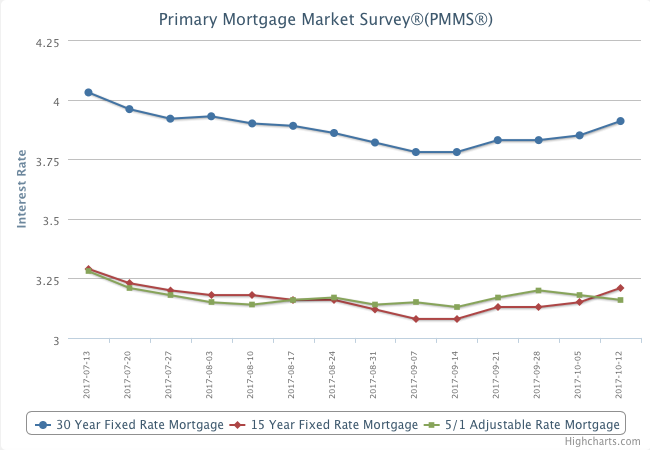

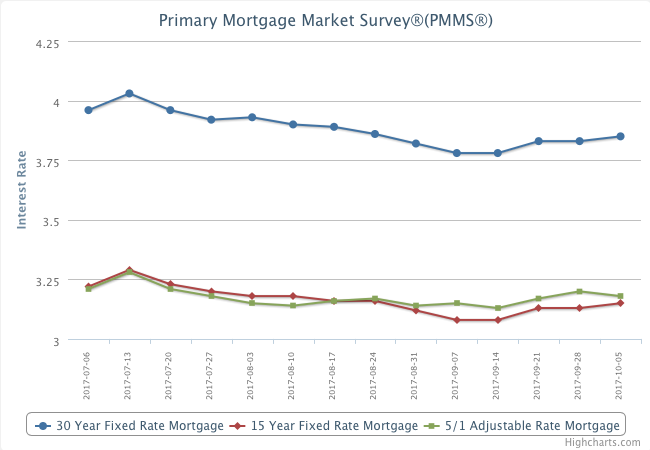

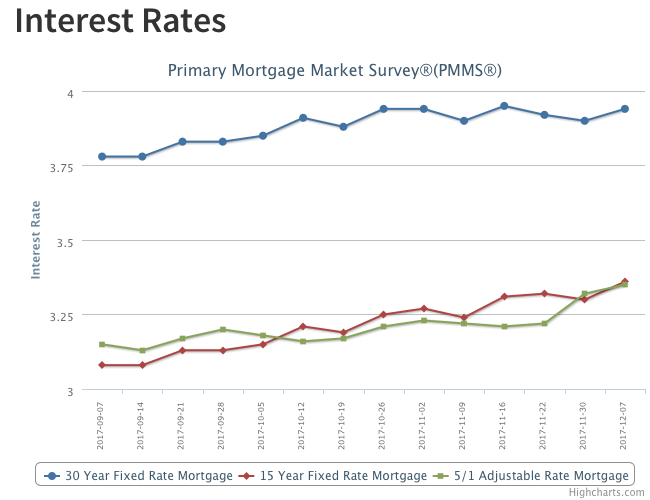

This week’s survey reflects last week’s uptick in long-term interest rates, with the 30-year fixed mortgage rate up 4 basis points to 3.94 percent. The 30-year mortgage rate has been bouncing around in a 10 basis point range since September.

While long-term rates have been relatively steady week-to-week, shorter term interest rates have been on the rise. The spread between the 30-year fixed mortgage and the 5/1 Hybrid ARM rate was 59 basis points this week, down 43 basis points from earlier this year. With a narrower spread between fixed and adjustable mortgage rates, more borrowers are opting for a fixed product.