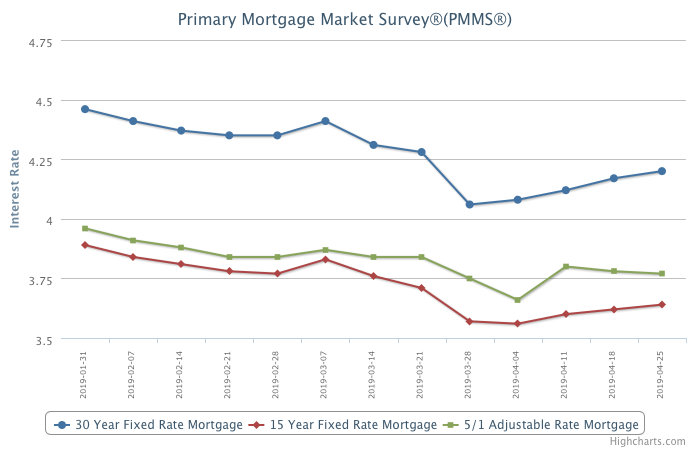

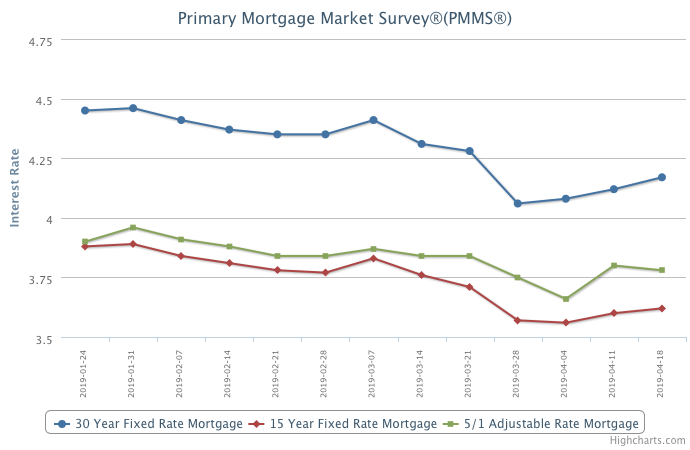

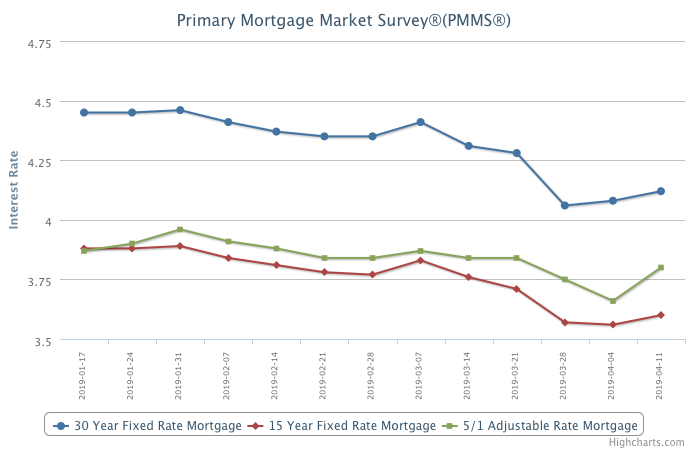

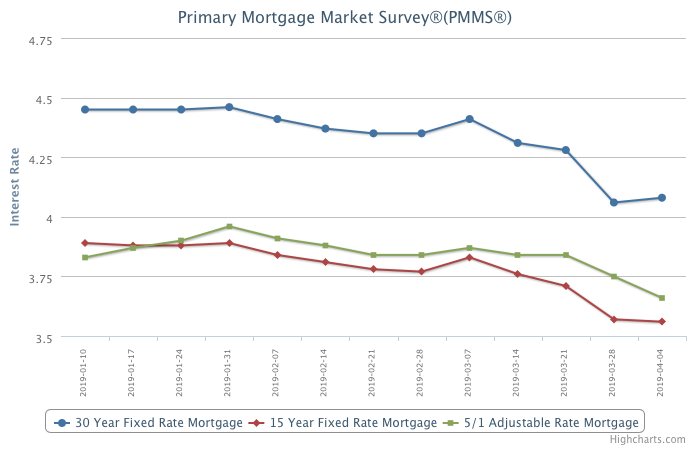

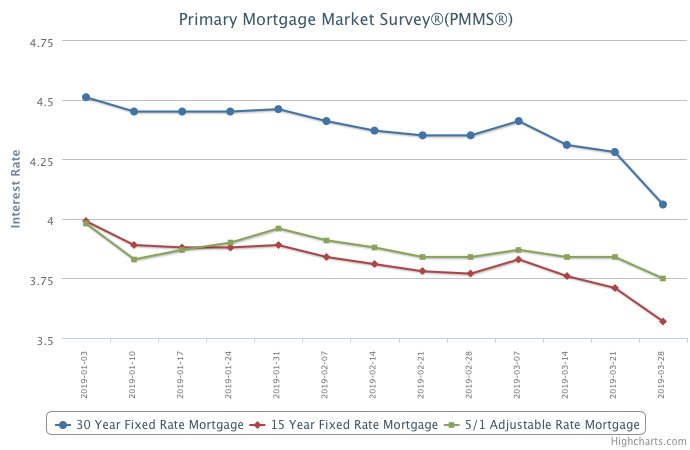

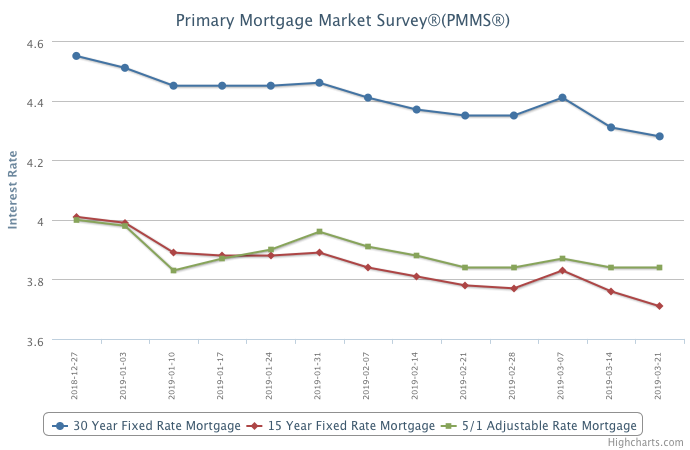

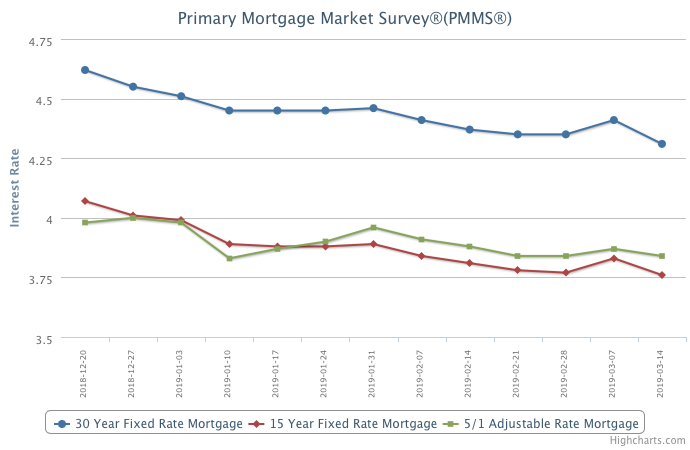

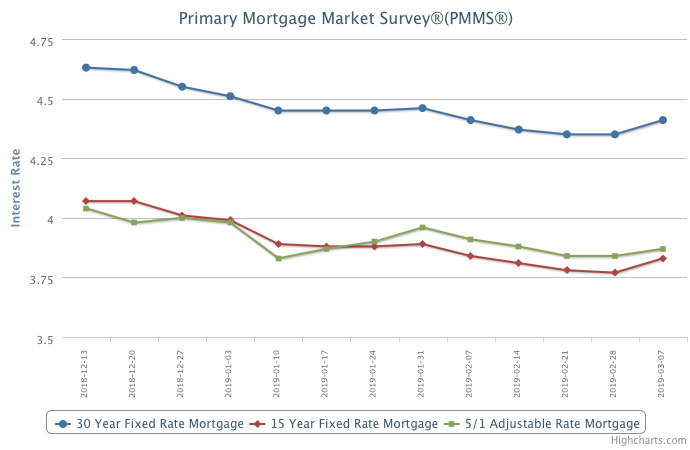

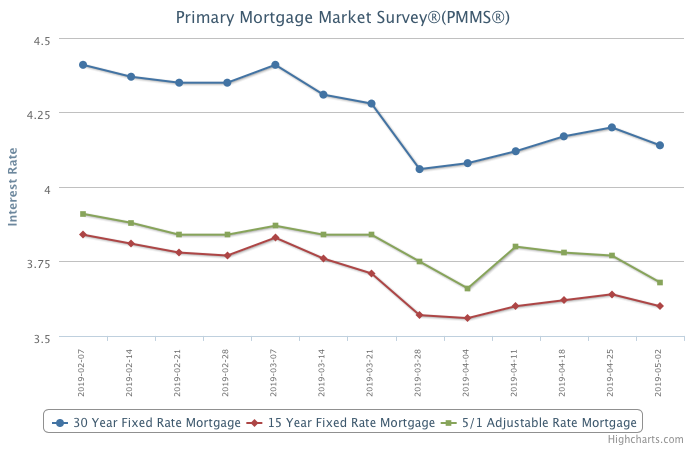

May 2, 2019

Slightly weaker inflation and labor economic data caused mortgage rates to dip this week. Moving into summer, we expect rates to be about a quarter to half a percentage point lower than where they were last year, which is good news for the housing market. These lower rates combined with solid economic growth, low inflation and rebounding consumer confidence should provide a solid foundation for home sales to continue to improve over the next couple of months.

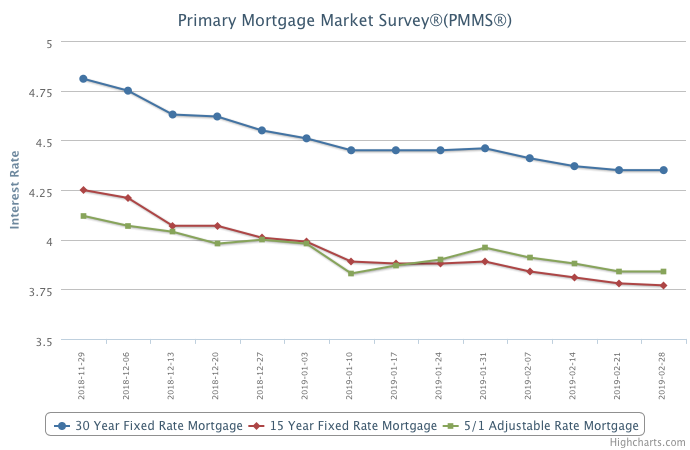

Information provided by Freddie Mac.