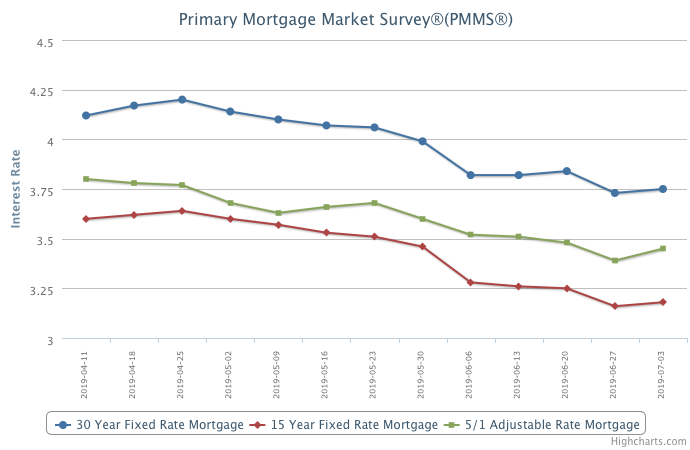

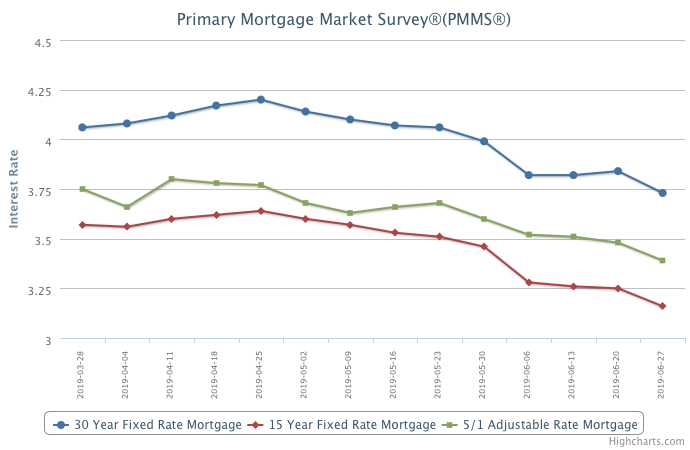

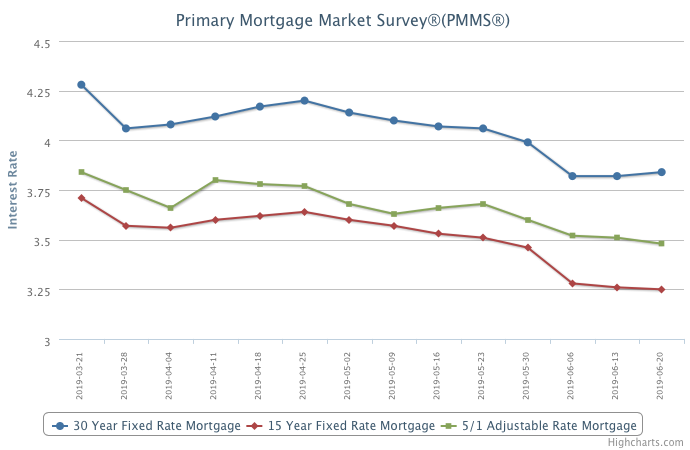

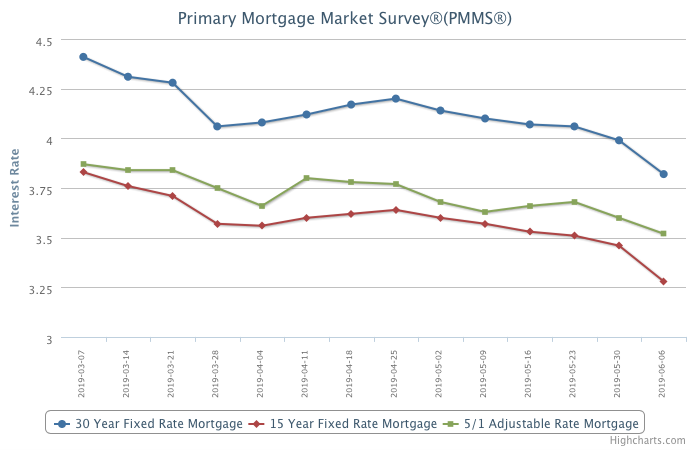

July 11, 2019

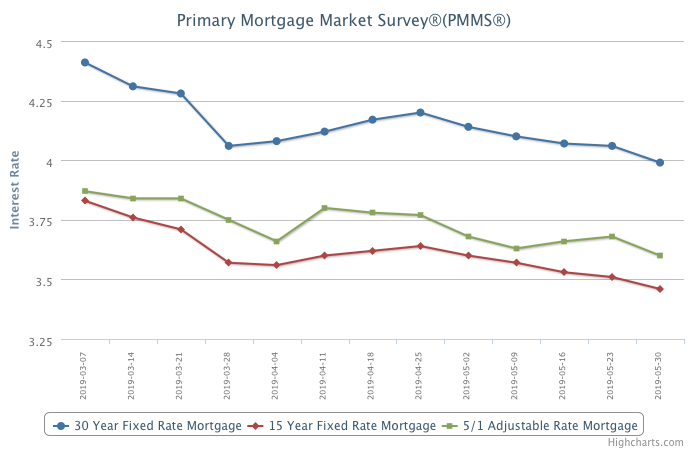

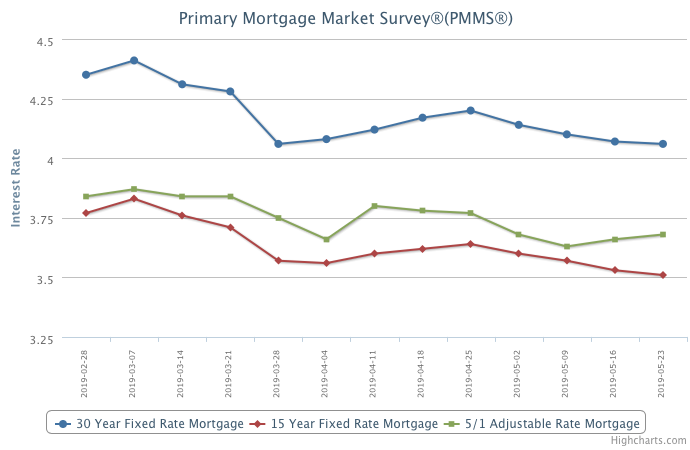

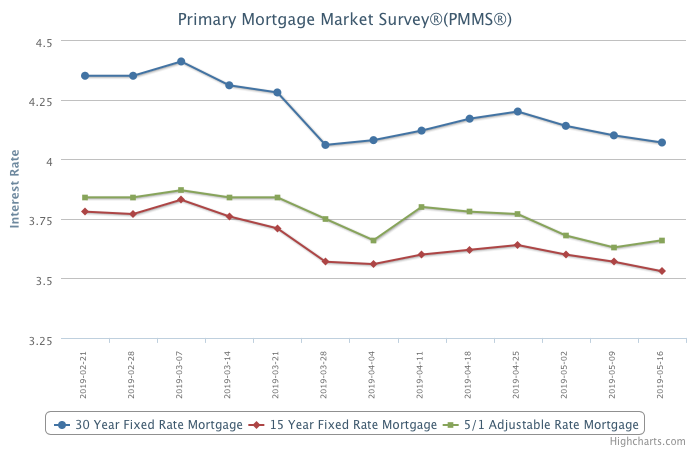

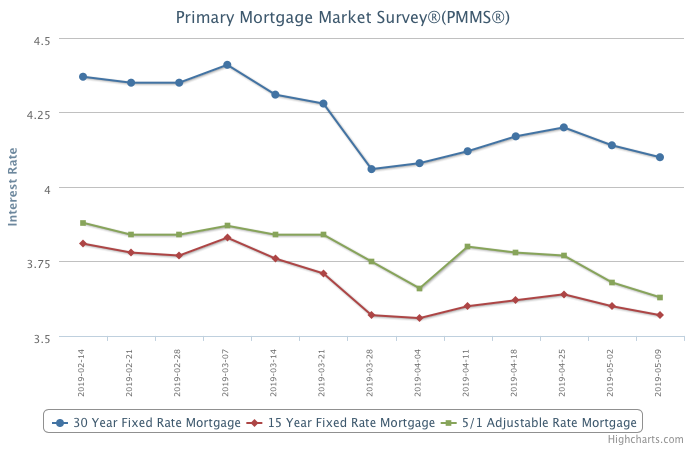

The recent stabilization in mortgage rates reflects modestly improving U.S. economic data and a more accommodative tone from the Federal Reserve to respond to the rising downside economic risk from trade tensions and soft global economic data. On the housing front, the latest weekly purchase application data suggests homebuyer demand continues to rise, which is consistent with the slowly improving real estate data from the last two months.

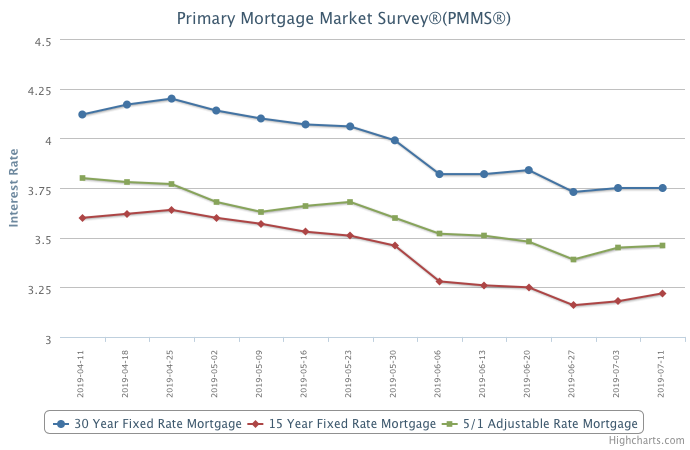

Information provided by Freddie Mac.