November 27, 2019

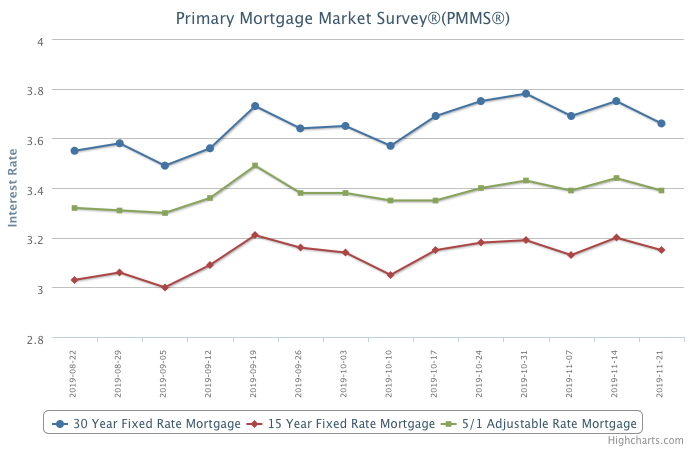

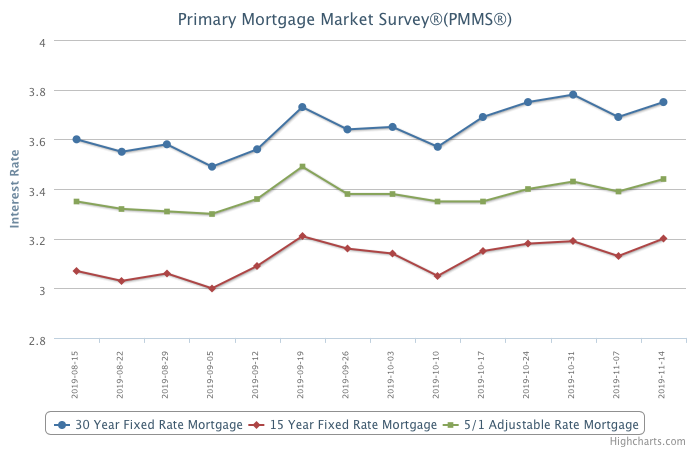

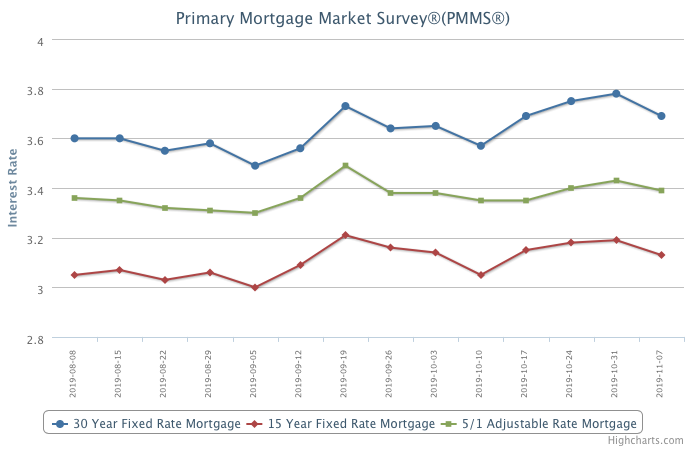

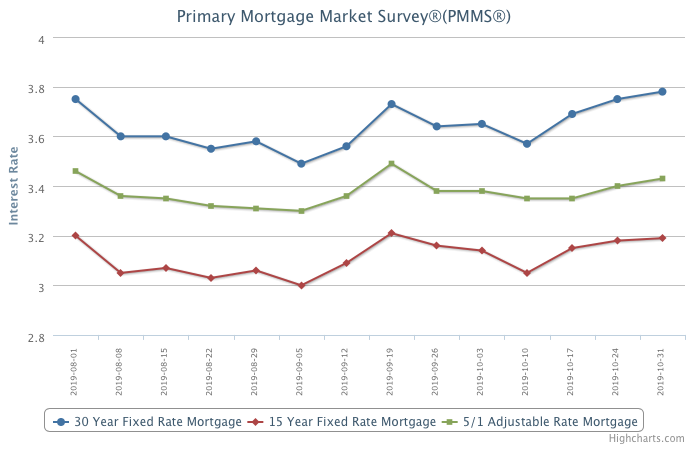

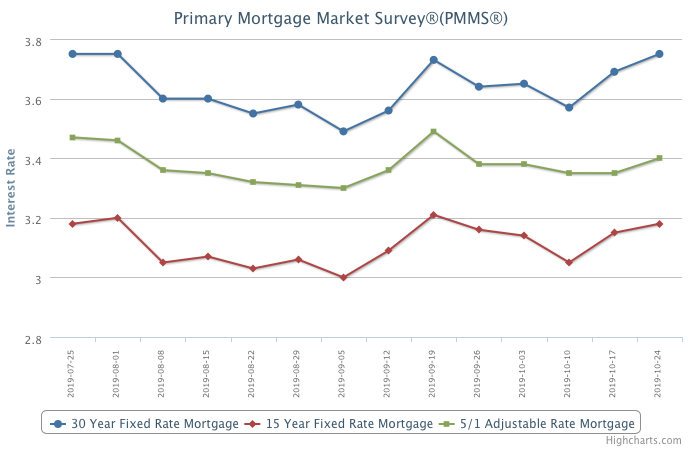

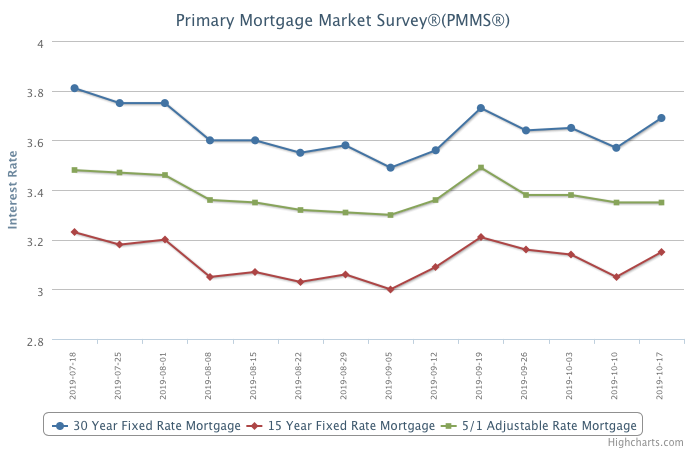

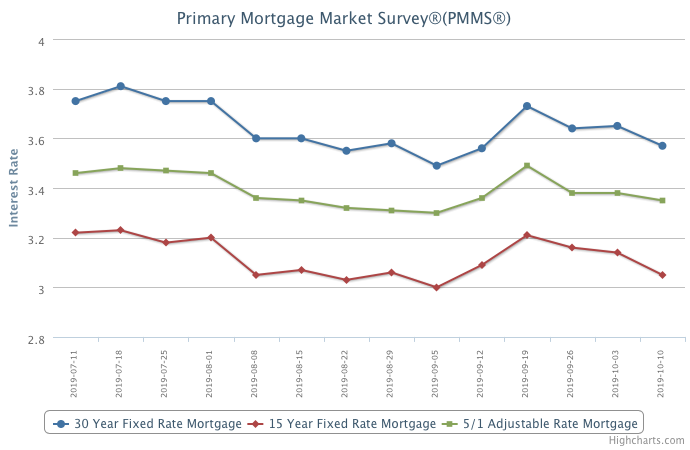

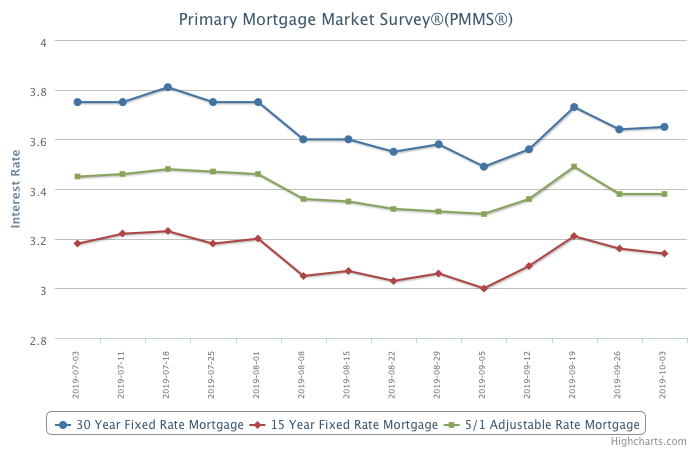

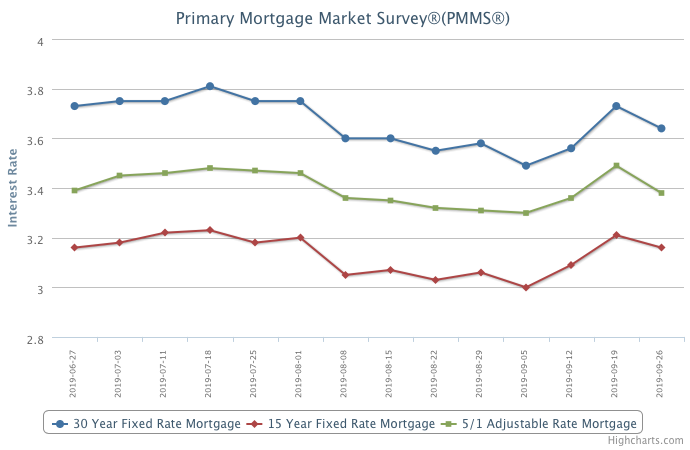

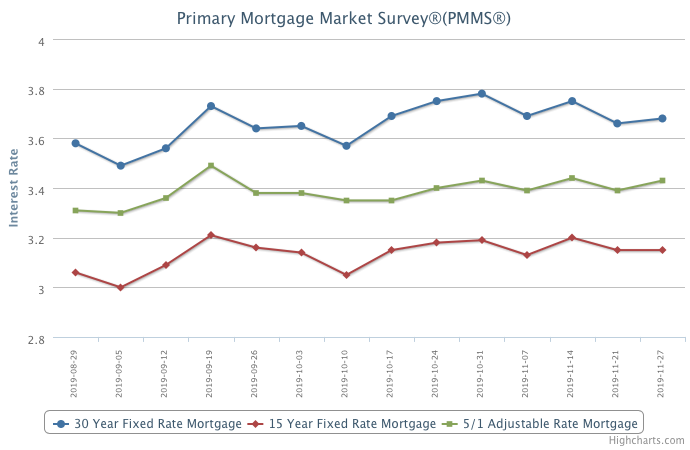

Following a decline in the first nine months of 2019, mortgage rates have traded narrower during the last two months with a modest drift upward due to an improved economic outlook. While there has been a lag in the housing market’s response to lower rates, real estate volumes have clearly shifted into a higher gear. Moreover, the recent improvement in the cyclical segments of the economy and easing financial conditions will provide a gentle tailwind to the real estate market rebound over the next few months.

Information provided by Freddie Mac.