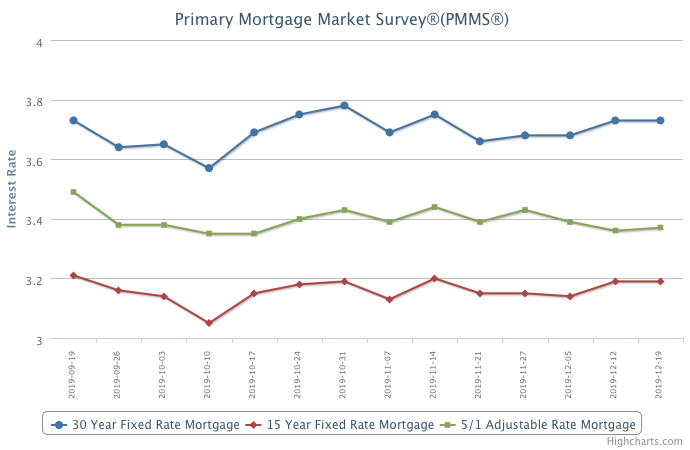

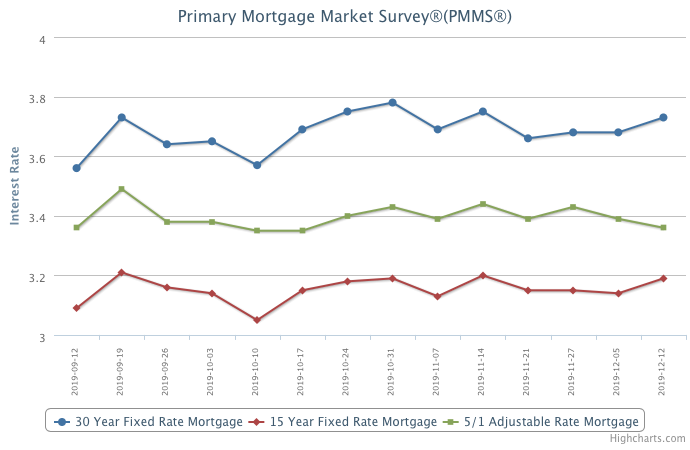

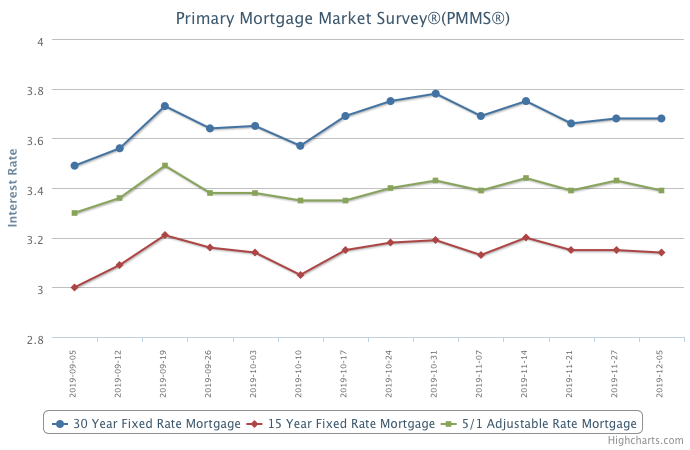

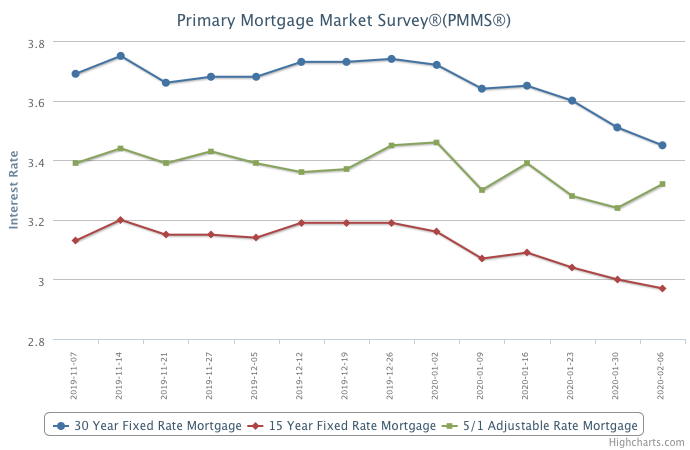

February 6, 2020

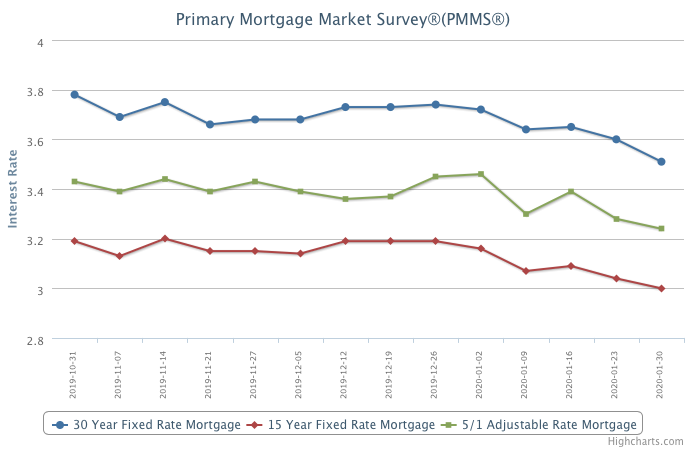

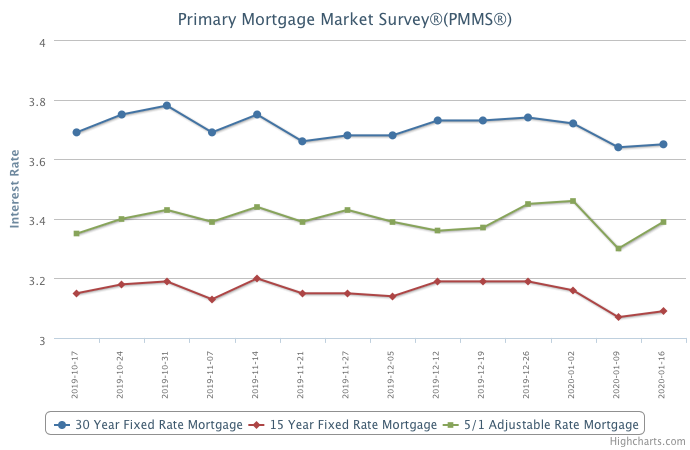

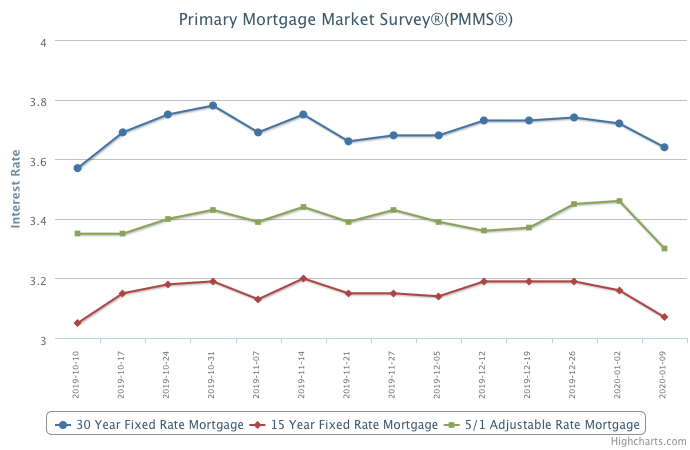

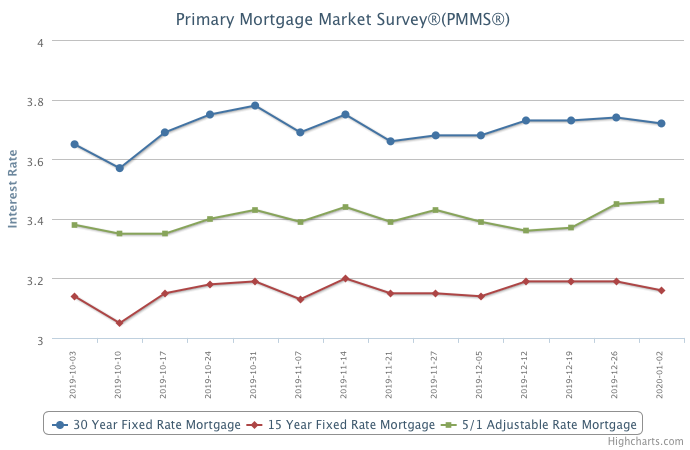

As rates fell for the third consecutive week, markets staged a rebound with increases in manufacturing and service sector activity. The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.

Information provided by Freddie Mac.