June 25, 2020

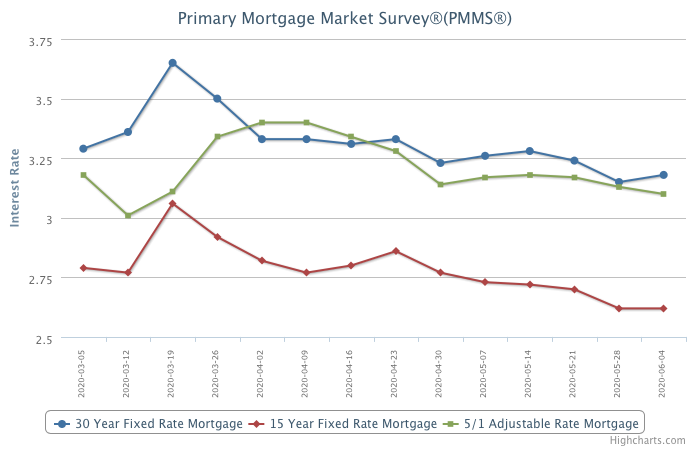

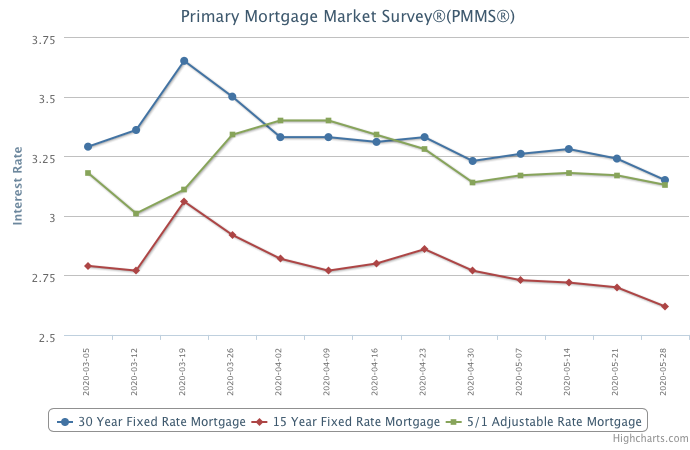

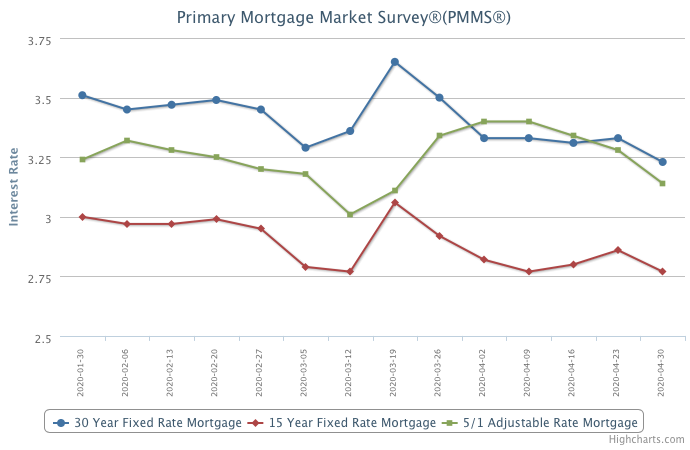

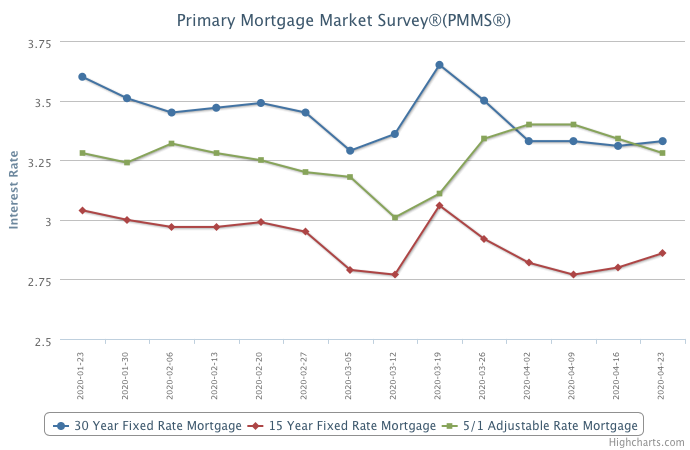

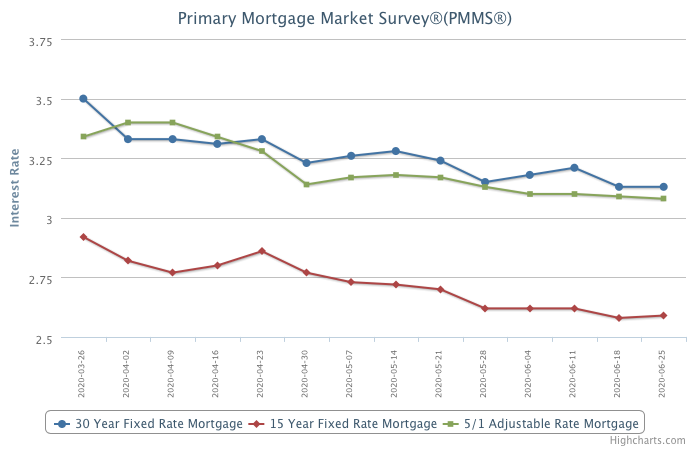

After the Great Recession, it took more than ten years for purchase demand to rebound to pre-recession levels, but in this crisis, it took less than ten weeks. The rebound in purchase demand partly reflects deferred sales as well as continued interest from prospective buyers looking to take advantage of the low mortgage rate environment.

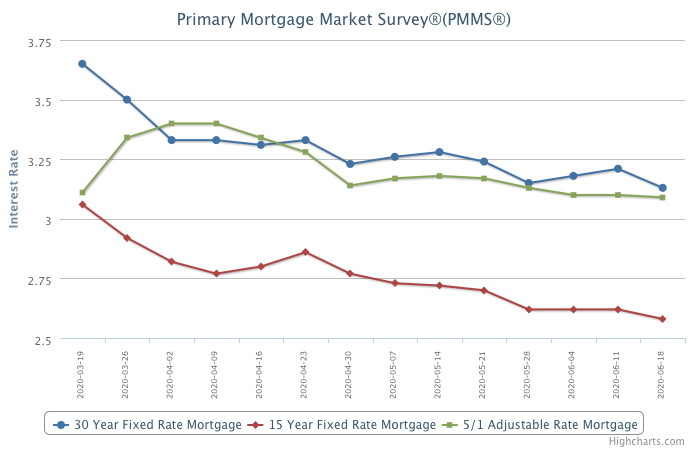

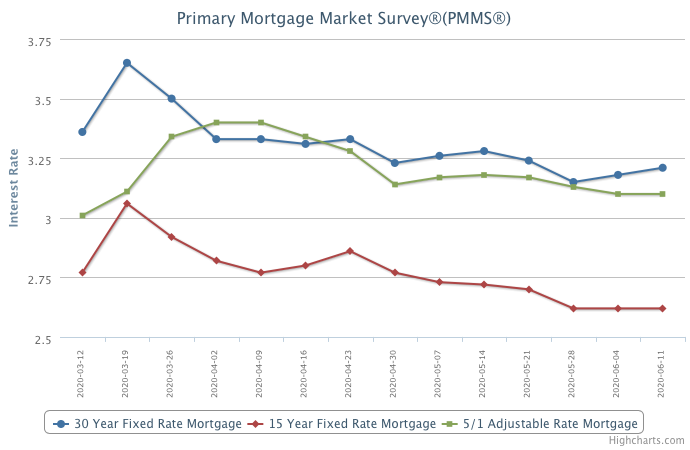

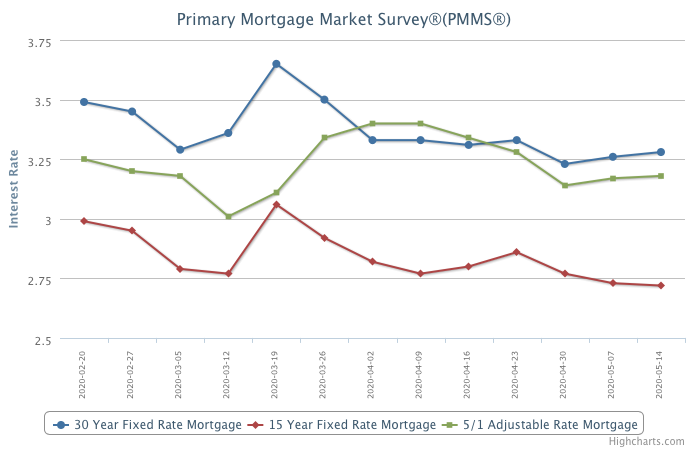

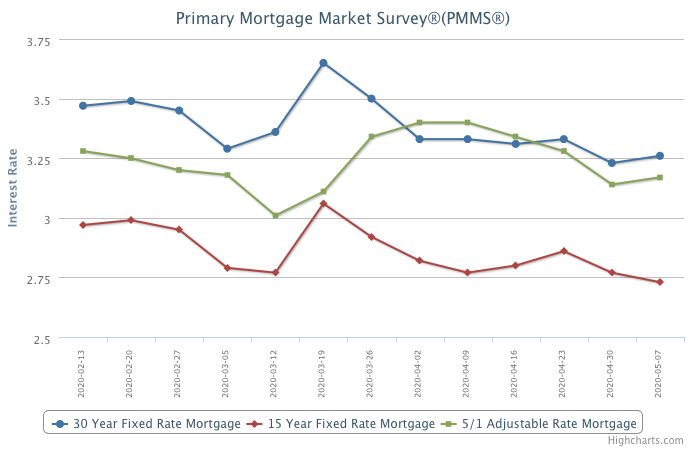

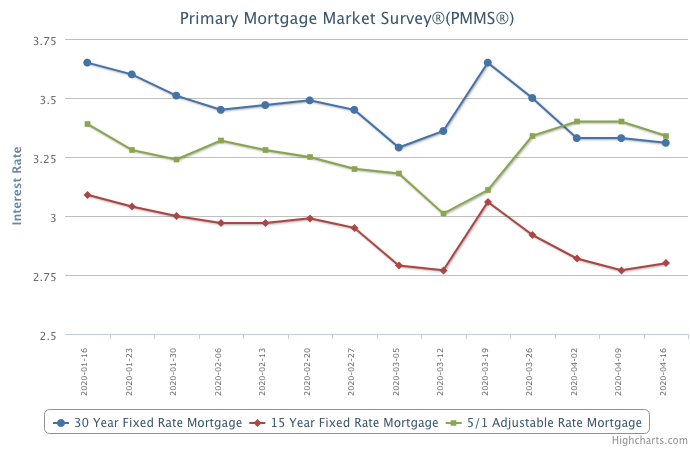

Information provided by Freddie Mac.