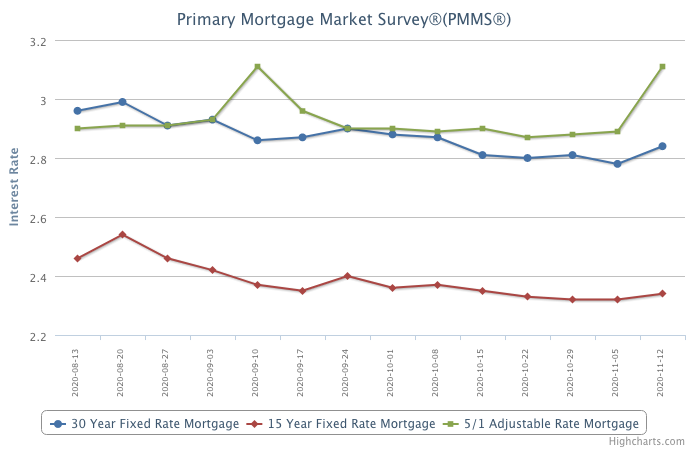

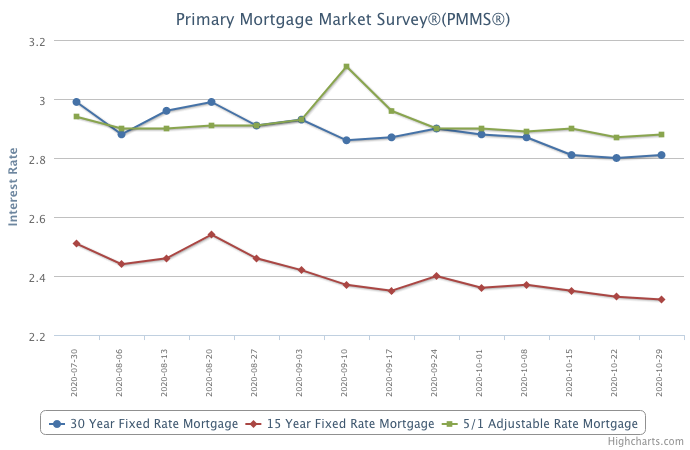

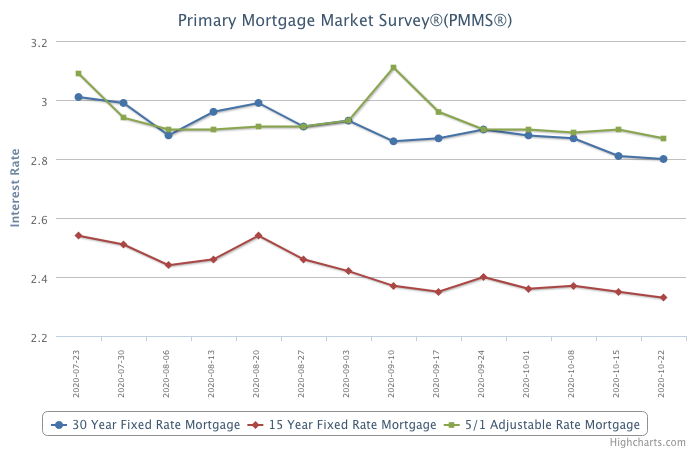

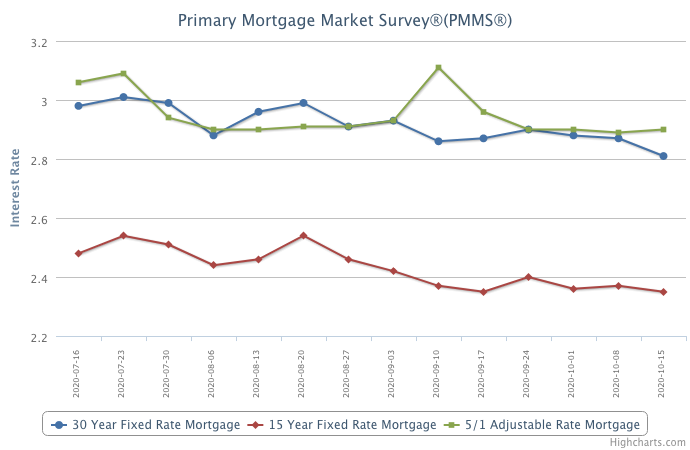

November 12, 2020

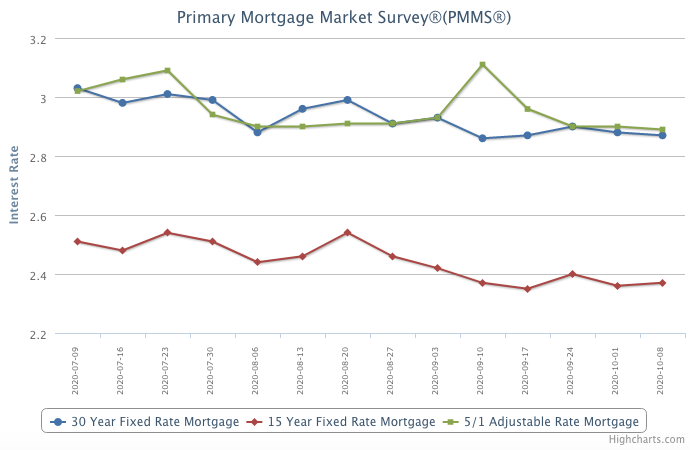

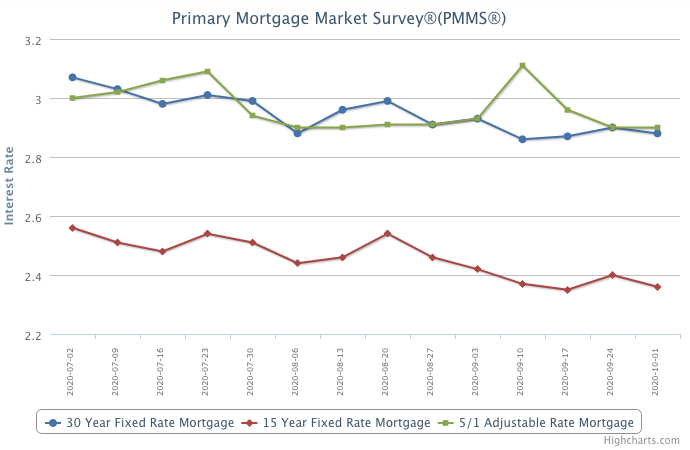

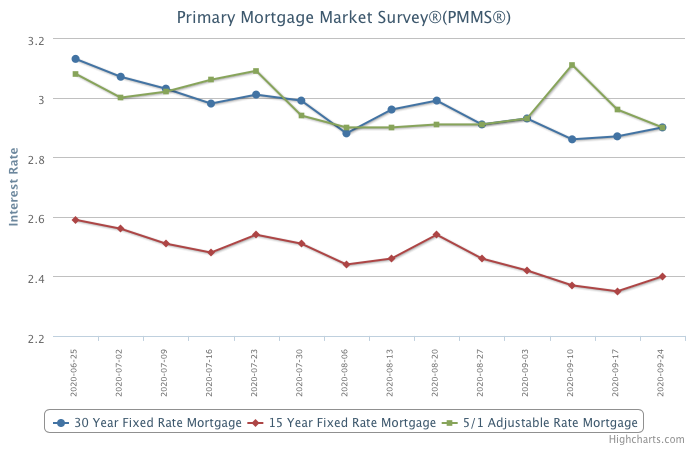

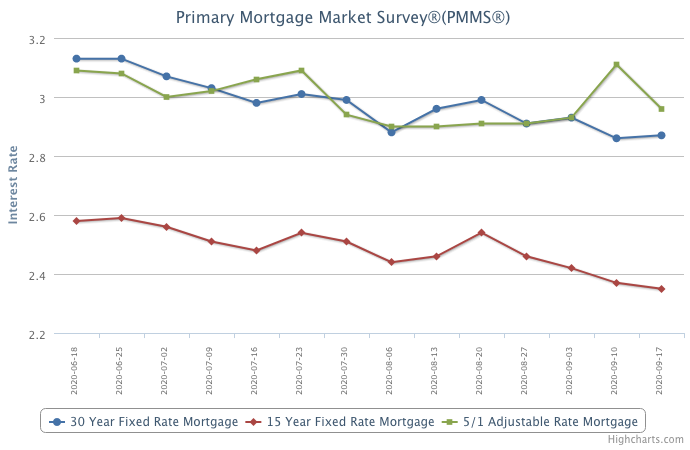

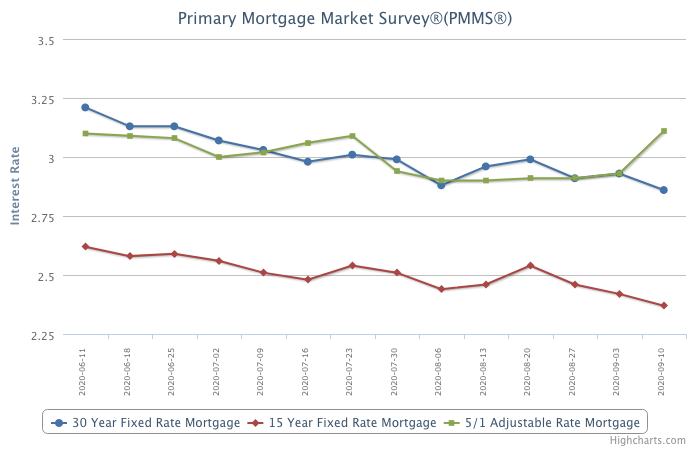

Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine. Despite this rise, mortgage rates remain about a percentage point below a year ago and the low rate environment is supportive of both purchase and refinance demand. Heading into late fall, the housing market continues to grow and buttress the economy.

Information provided by Freddie Mac.