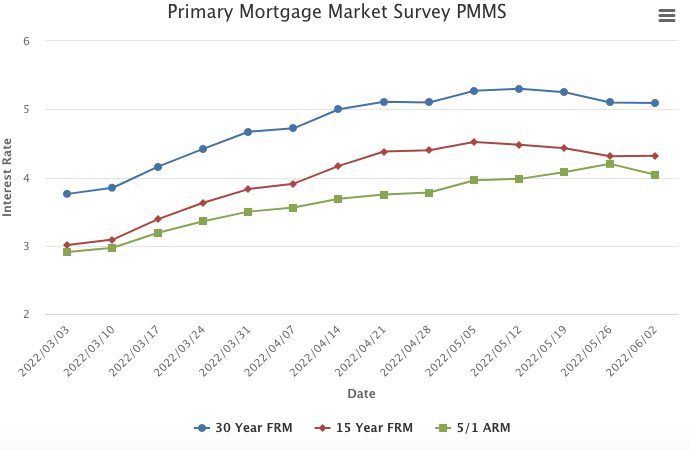

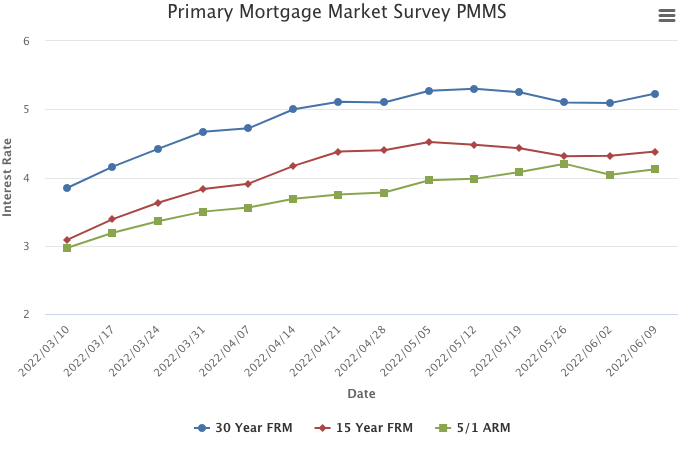

June 9, 2022

After little movement the last few weeks, mortgage rates rose again on the back of increased economic activity and incoming inflation data. The housing market is incredibly rate-sensitive, so as mortgage rates increase suddenly, demand again is pulling back. The material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home.

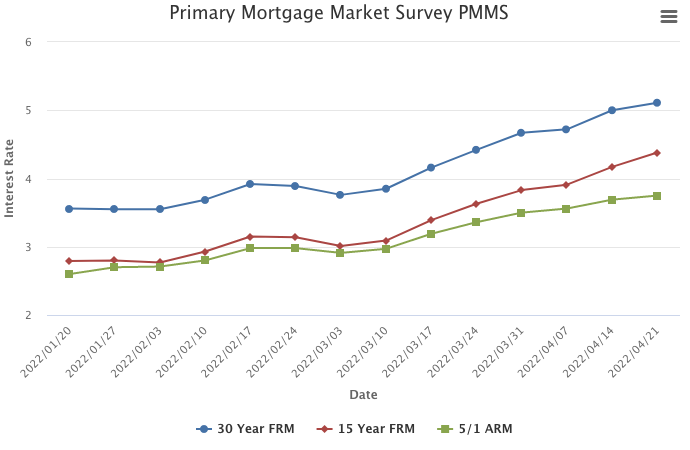

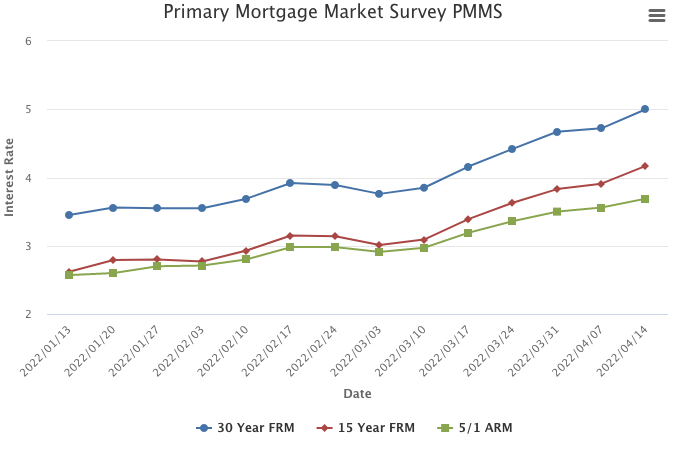

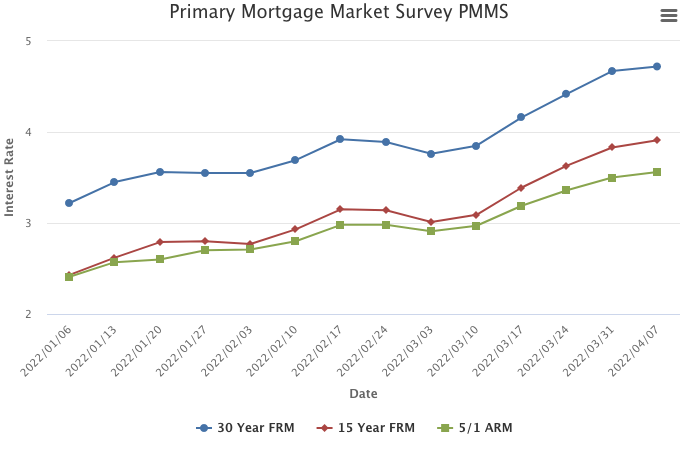

Information provided by Freddie Mac.