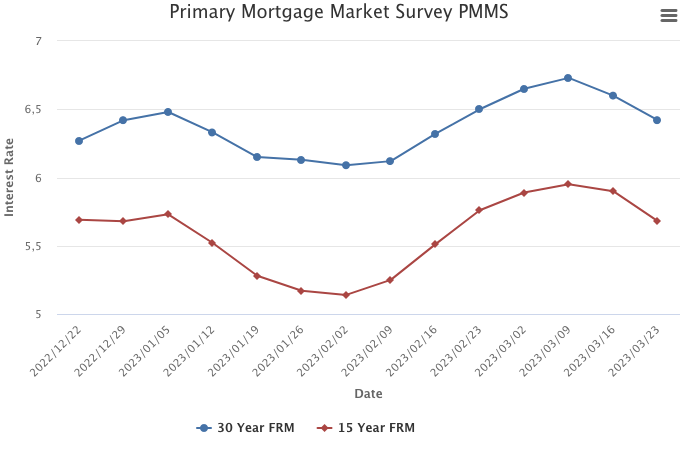

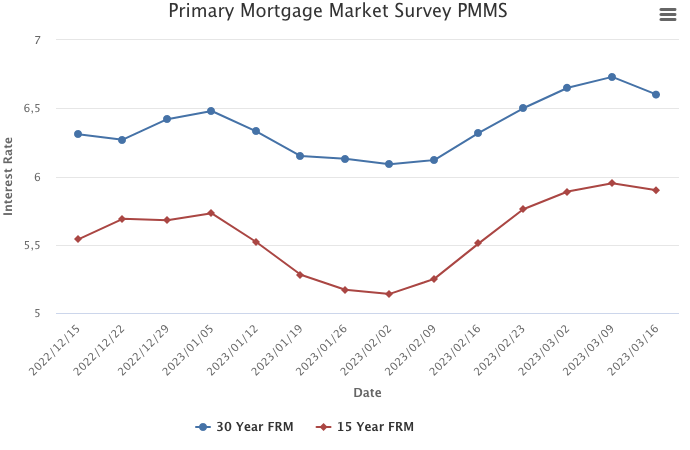

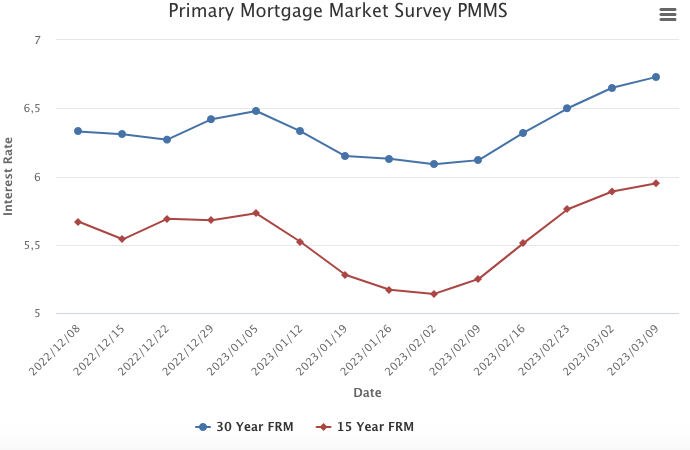

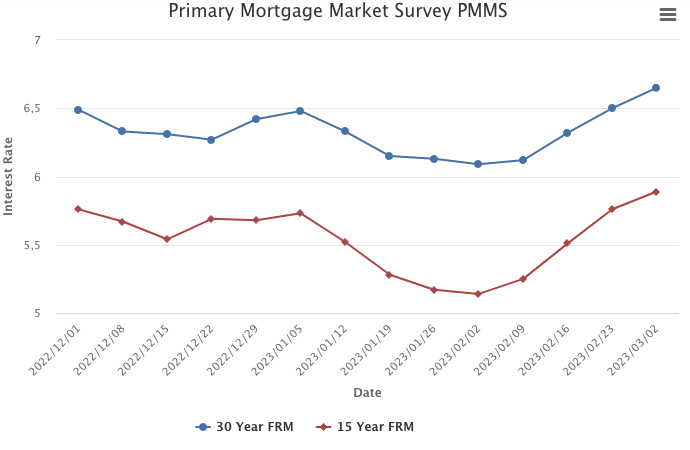

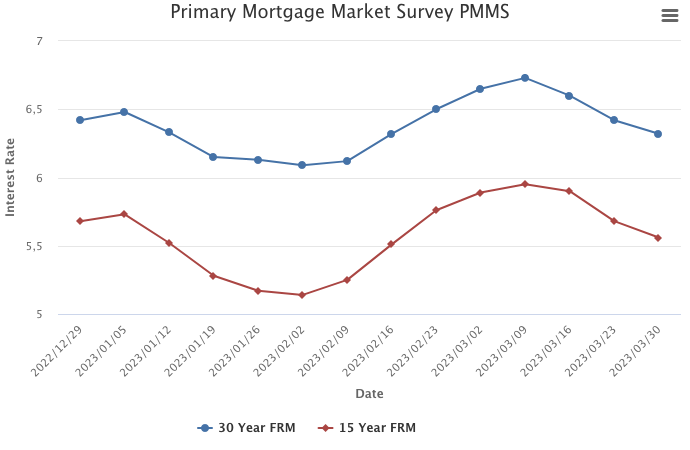

March 30, 2023

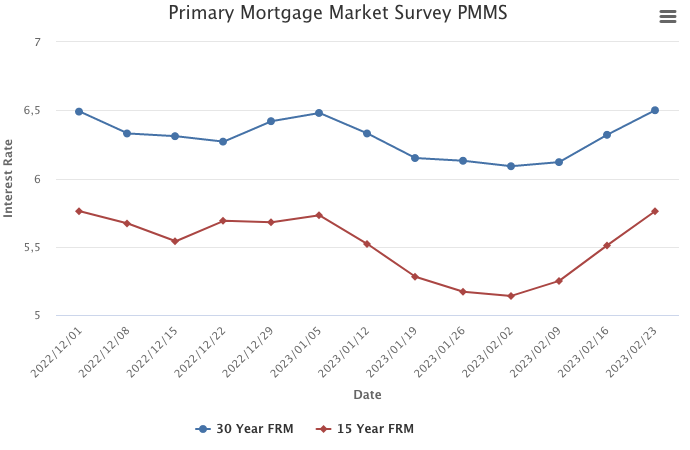

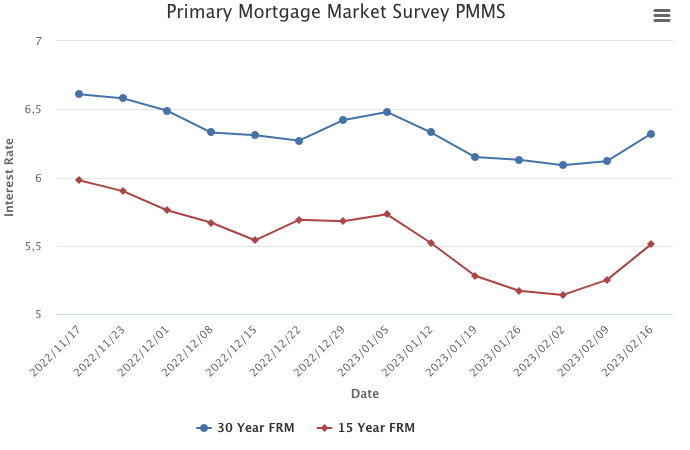

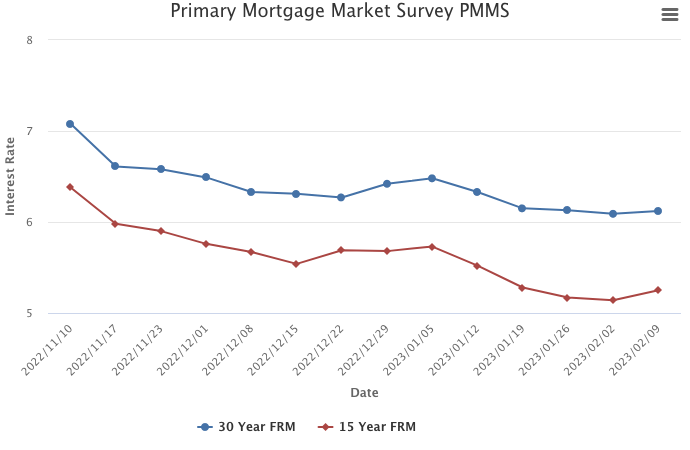

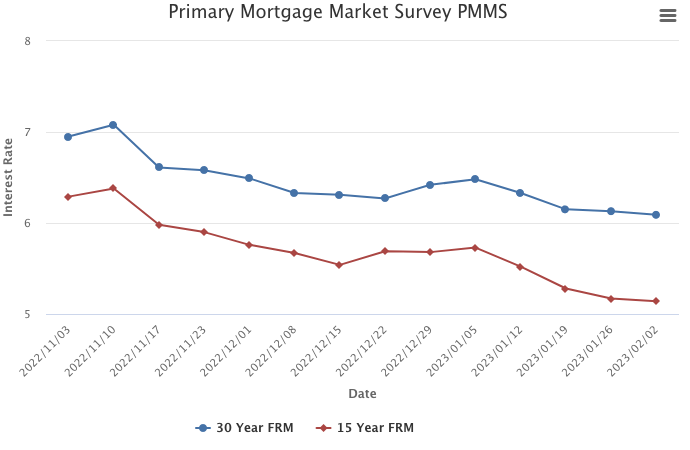

Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market but, as the spring homebuying season gets underway, low inventory remains a key challenge for prospective buyers.

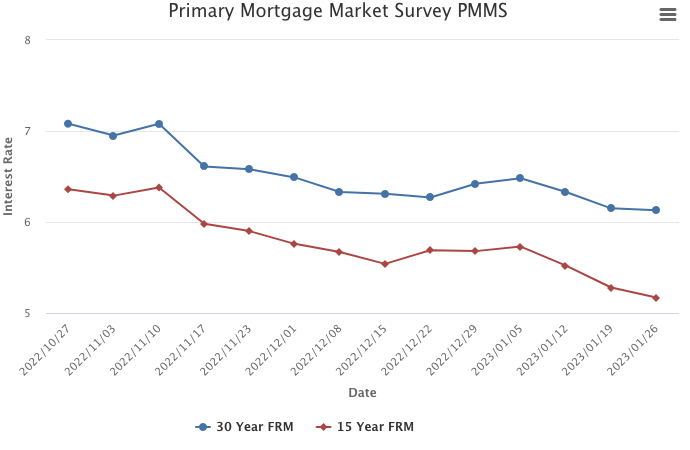

Information provided by Freddie Mac.