Author Archives: admin

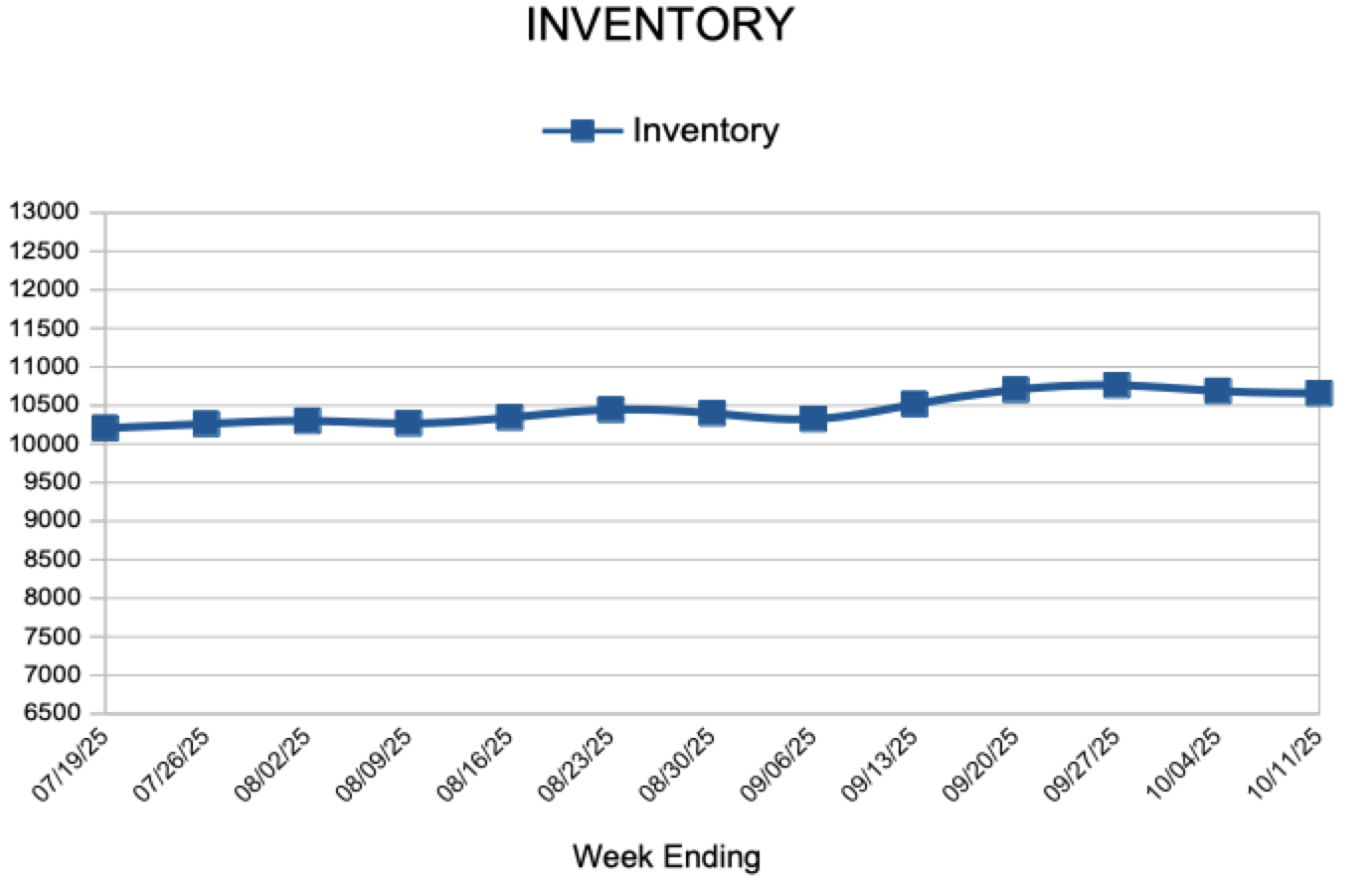

Inventory

Mortgage Rates Continue to Trend Down

October 30, 2025

Mortgage rates decreased for the fourth consecutive week. The last few months have brought lower rates and homebuyers are increasingly entering the market.

Information provided by Freddie Mac.

New Listings and Pending Sales

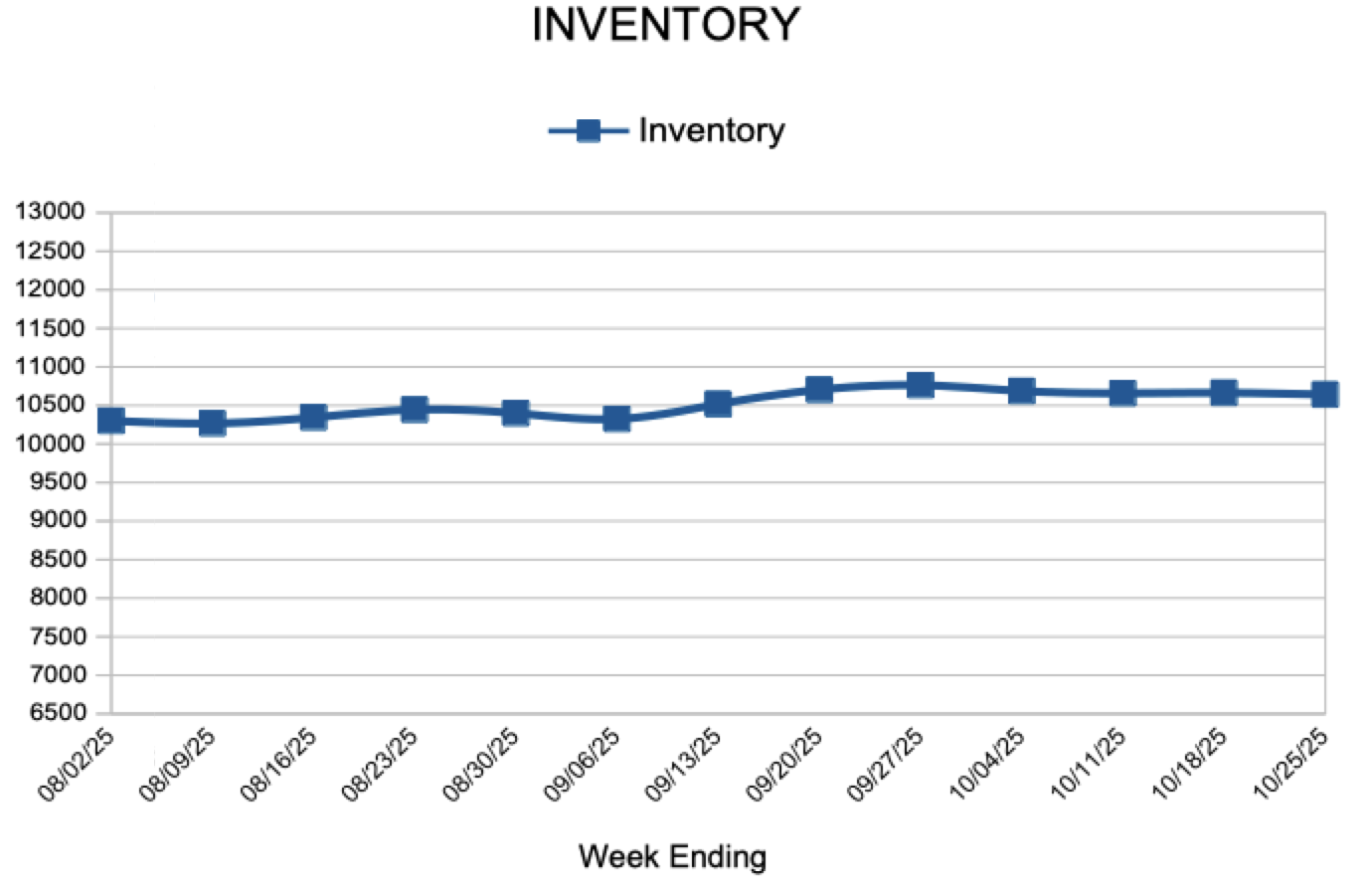

Inventory

Mortgage Rates Decrease to Lowest Level in Over a Year

October 23, 2025

Mortgage rates continued to trend down this week, hitting their lowest level in over a year. At the start of 2025, the 30-year fixed-rate mortgage surpassed 7%, while today it hovers nearly a full percentage point lower. This dynamic has kept refinancings high, accounting for more than half of all mortgage activity for the sixth consecutive week.

Information provided by Freddie Mac.

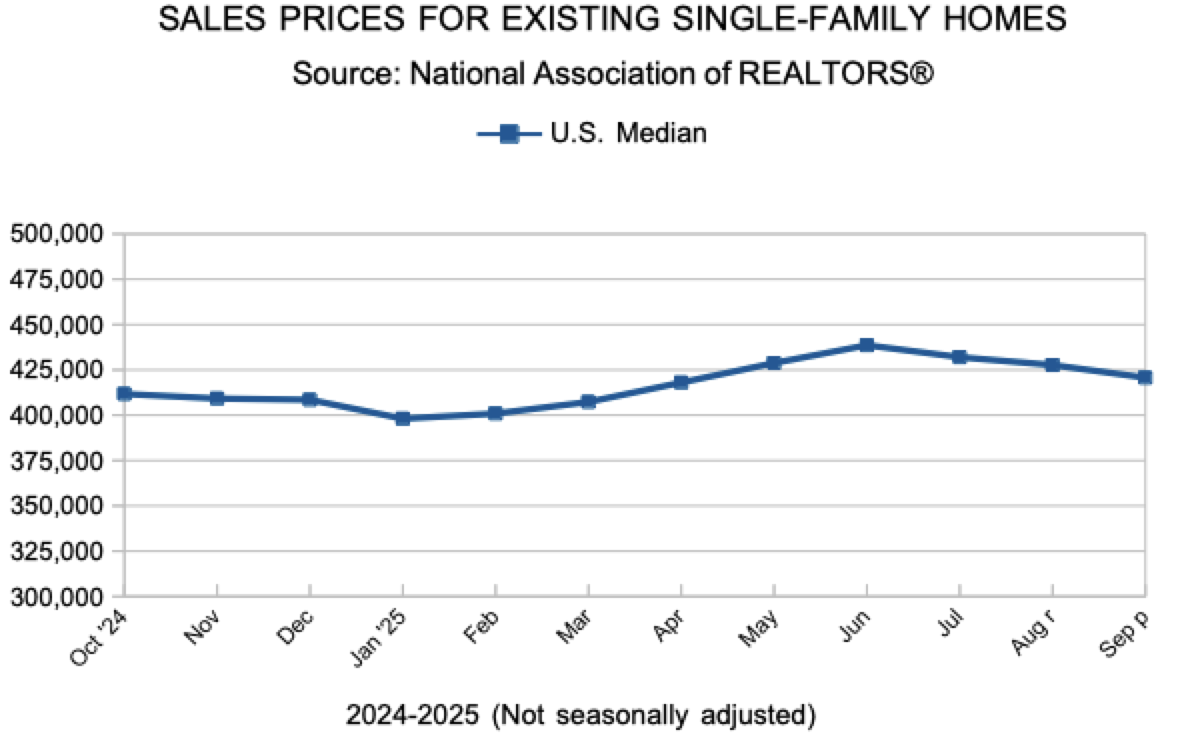

Existing Home Sales

New Listings and Pending Sales

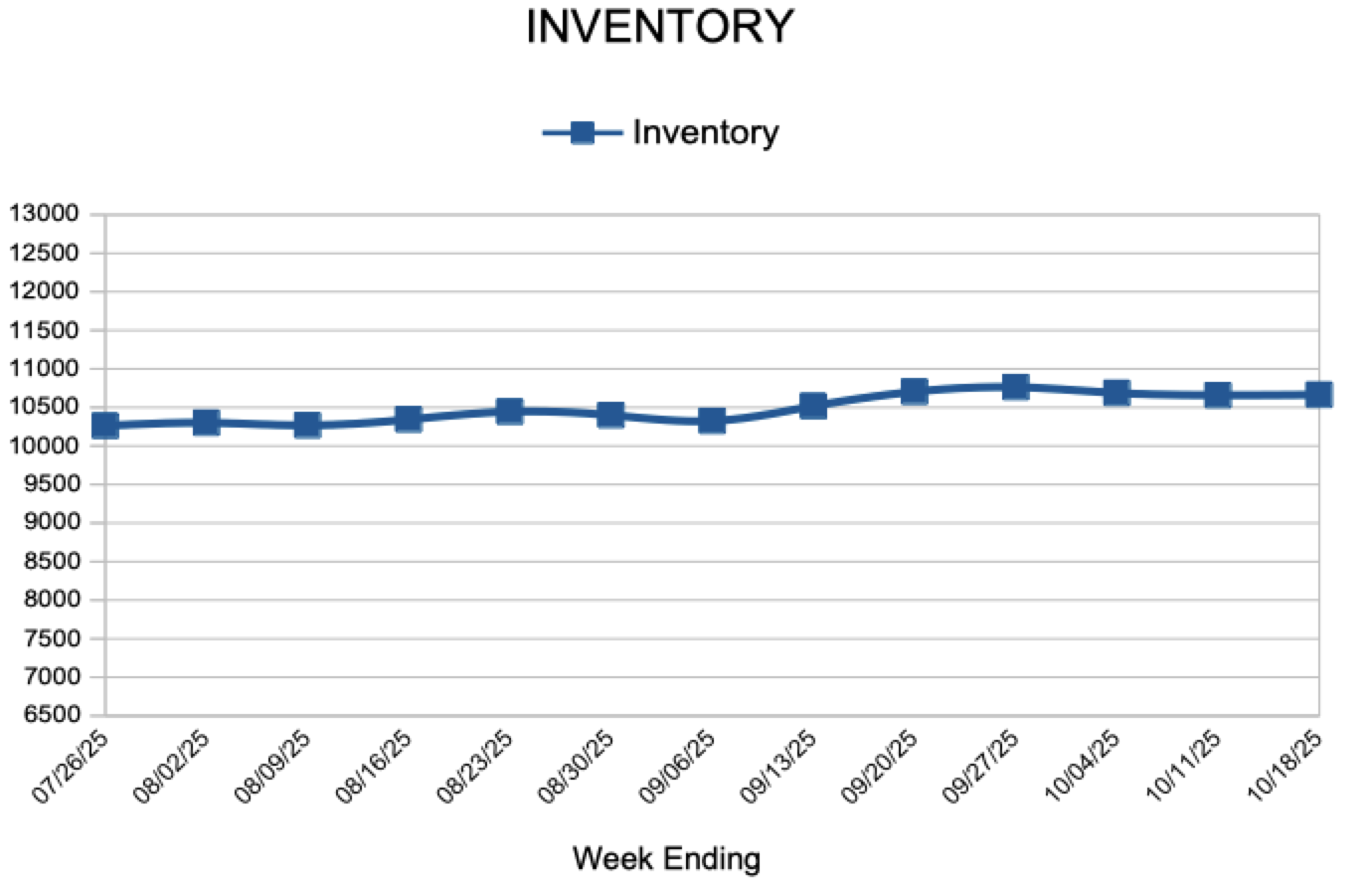

Inventory

Mortgage Rates Decrease

October 16, 2025

Mortgage rates inched down this week and have held relatively steady over the past several weeks. Importantly, homeowners have noticed these consistently lower rates, driving an uptick in refinance activity. Combined with increased housing inventory and slower house price growth, these rates also are creating a more favorable environment for those looking to buy a home.

Information provided by Freddie Mac.