February 1, 2024

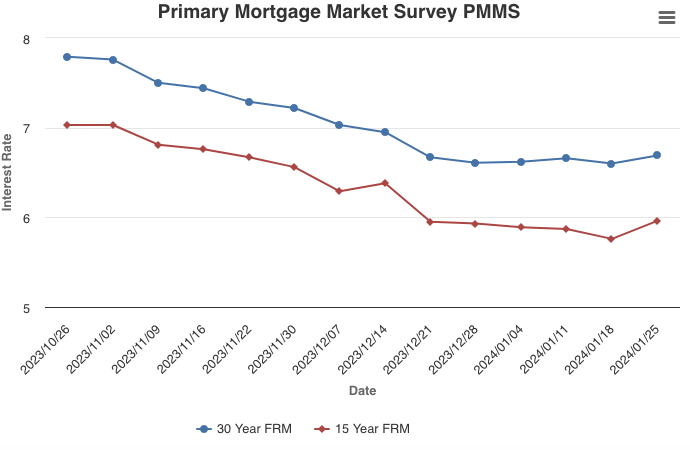

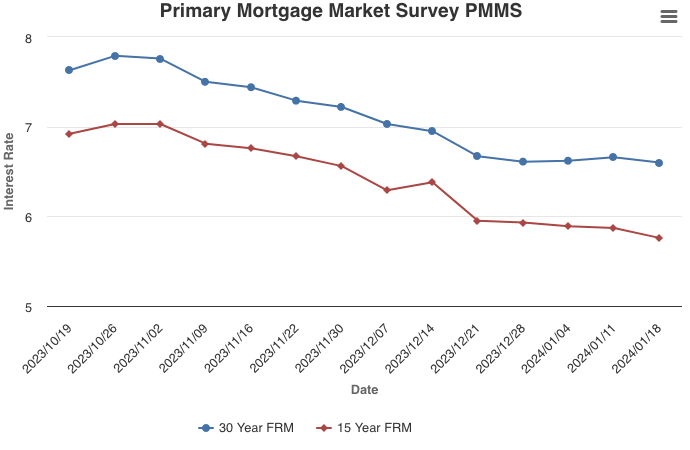

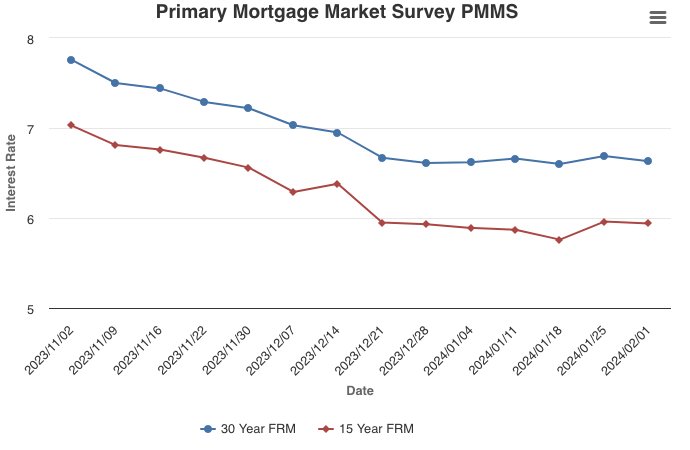

Although affordability continues to impact homeownership, the combination of a solid economy, strong demographics and lower mortgage rates are setting the stage for a more robust housing market. Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation, rates are expected to decline further. The economy continues to outperform due to solid job and income growth, while household formation is increasing at rates above pre-pandemic levels. These favorable factors should provide strong fundamental support to the market in the months ahead.

Information provided by Freddie Mac.