Author Archives: admin

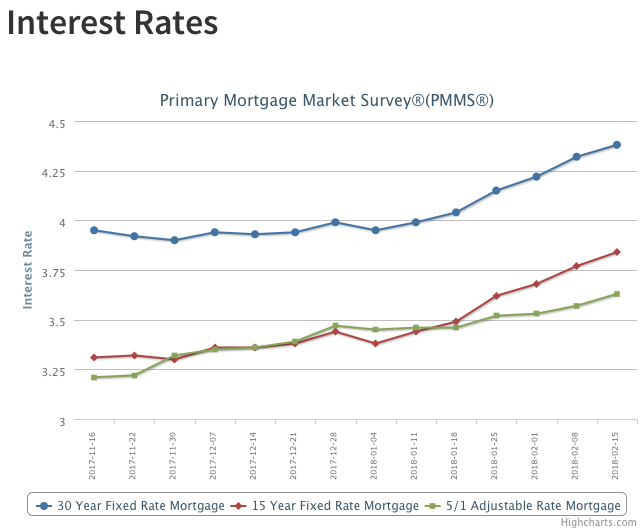

Mortgage Rates Continue to Climb

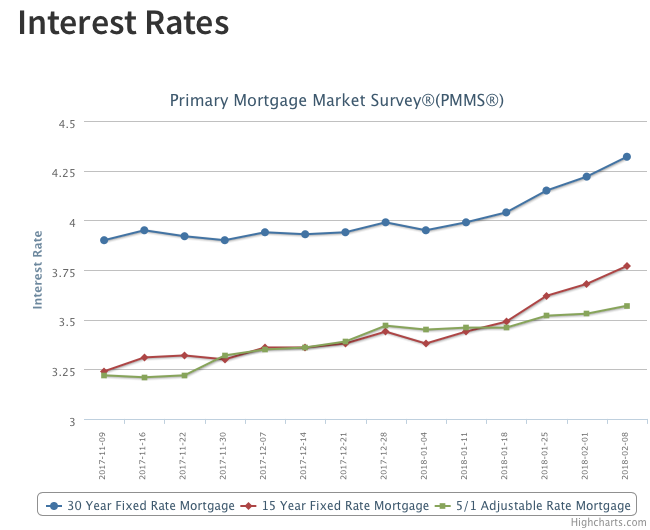

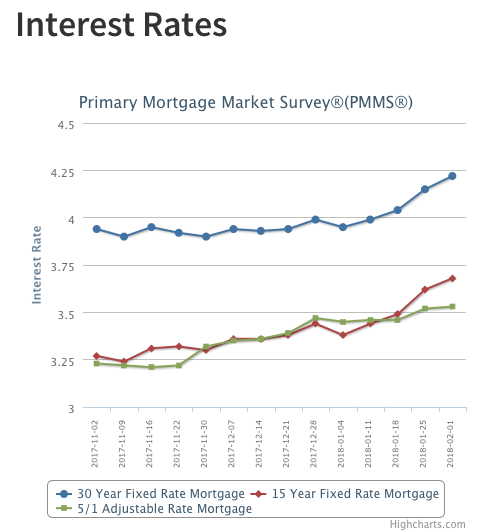

Wednesday’s Consumer Price Index report showed higher-than-expected inflation; headline consumer price inflation was 2.1 percent year-over-year in January two tenths of a percentage point higher than the consensus forecast. Inflation measures were broad-based, cementing expectations that the Federal Reserve will go forward with monetary tightening later this year. Following this news, the 10-year Treasury reached its highest level since January 2014, climbing above 2.90 percent. Mortgage rates have also surged. After jumping 10 basis points last week, the 30-year fixed-rate mortgage rose 6 basis points to 4.38 percent, its highest level since April 2014.

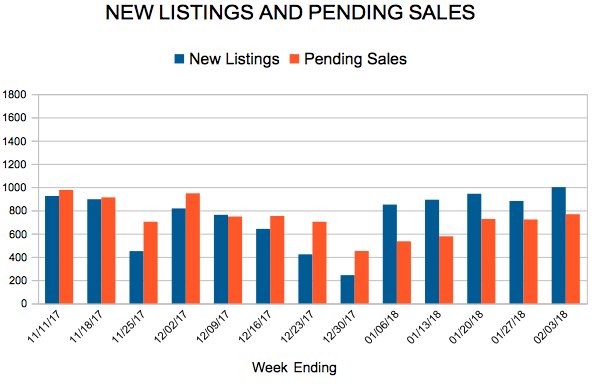

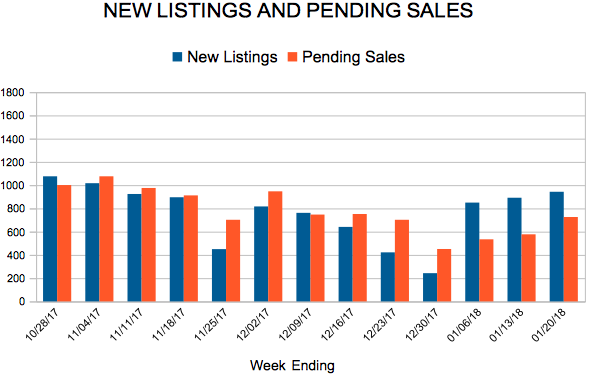

New Listings and Pending Sales

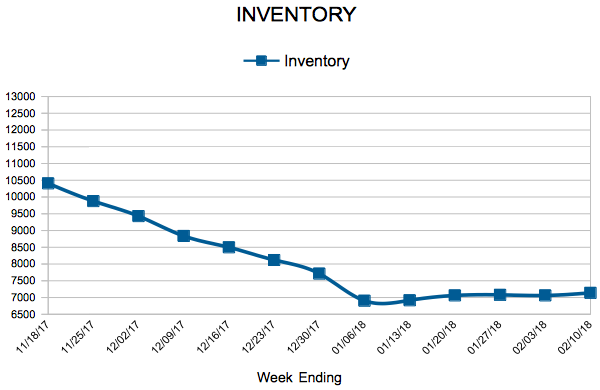

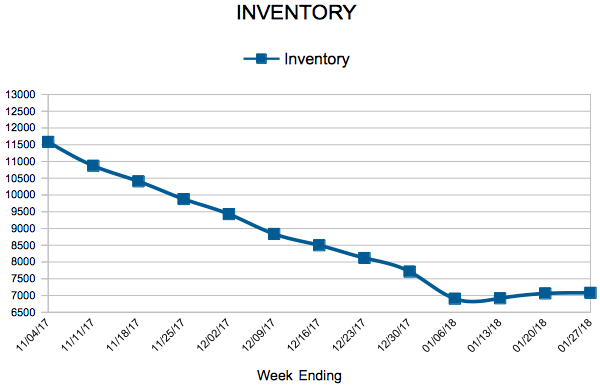

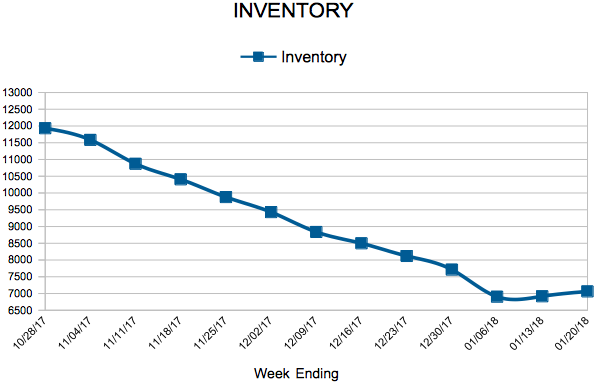

Inventory

Mortgage Rates Jump Again

The U.S. weekly average 30-year fixed mortgage rate rocketed up 10 basis points to 4.32 percent this week. Following a turbulent Monday, financial markets settled down with the 10-year Treasury yield resuming its upward march. Mortgage rates have followed. The 30-year fixed mortgage rate is up 33 basis points since the start of the year. Will higher rates break housing market momentum? It’s too early to tell for sure, but initial readings indicate housing markets are sustaining their momentum so far. The MBA reported that purchase applications are up 8 percent from a year ago in their latest Weekly Mortgage Applications Survey.

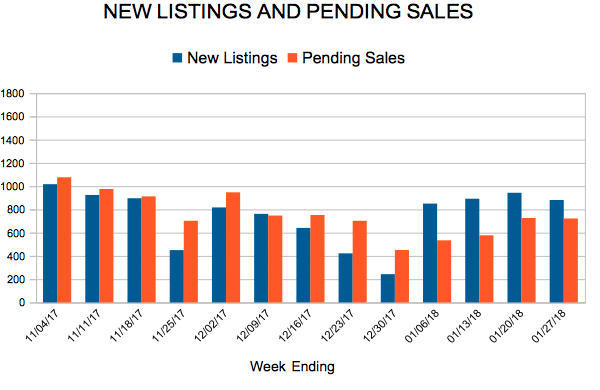

New Listings and Pending Sales

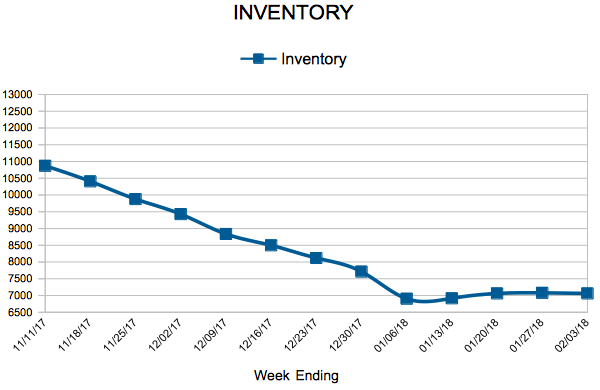

Inventory

Mortgage Rates Continue to Rise

The Federal Reserve did not hike rates this week, but the market views future hikes as a near certainty. The expectation of future Fed rate hikes and increased borrowing by the U.S. Treasury is putting upward pressure on interest rates. The 30-year fixed rate mortgage is up over a quarter of a percentage point (27 basis points) from the first week of the year. 30-year fixed mortgage rates have increased for four consecutive weeks and are now slightly above where they were last year at this time.